Question: PLEASE HELP ME SOLVE THIS!! Santinit new contract for 2022 indicates the following compensation and benefits: Santini is 54 years old at the end of

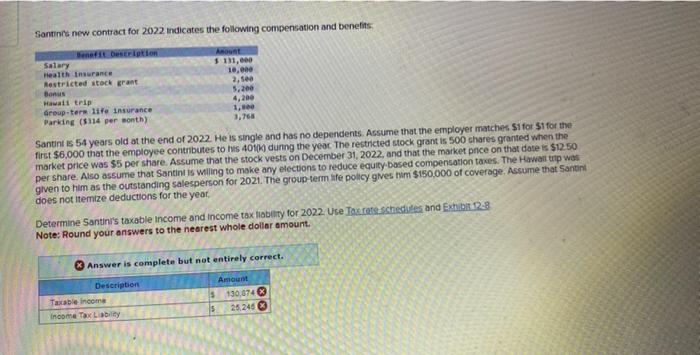

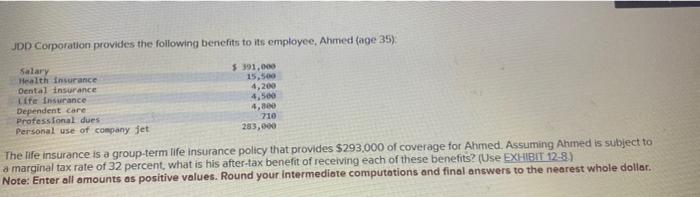

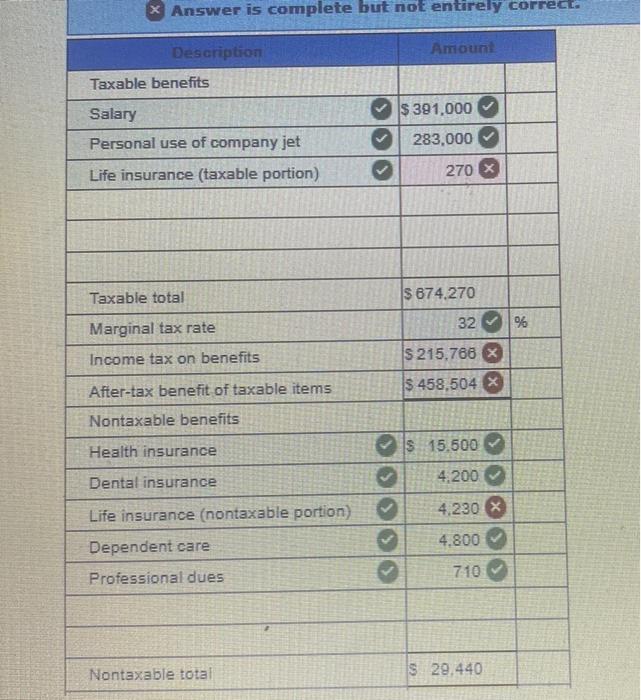

Santinit new contract for 2022 indicates the following compensation and benefits: Santini is 54 years old at the end of 2022 . He is single and has no dependents. Acsume that the employer matches $1 for $1 for the first $6.000 that the employee contributes to his 401k durng the year. The restricted stock grant is 500 shares granted when the market price was $5 per share. Assume that the stock vests on December 31, 2022, and that the market pnce on that date is $12.50 per share. Also assume that Santint is wiling to make any electons to reduce equity.based compensation taxes. The Hawall tip was given to him as the outstanding salesperson for 2021. The group-erm lle pollcy gives him $150,000 of coverage. Assume that 5an init does not itemize deductions for the yeat, Note: Round your answers to the nearest whole dollar amount. Q Answer is complete but not entirely correct. JDD Corporation provides the following benefits to its employee, Ahmed (age 35): The life insurance is a group-term life insurance policy that provides $293,000 of coverage for Ahmed. Assuming Ahmed is subject to a marginal tax rate of 32 percent, what is his after-tax benefit of receiving each of these benefits? (Use EXFHIBIT 12-8) Note: Enter all amounts as positive values. Round your intermediate computations and final answers to the nearest whole dollor. x Answer is complete but not entirely correct. Santinit new contract for 2022 indicates the following compensation and benefits: Santini is 54 years old at the end of 2022 . He is single and has no dependents. Acsume that the employer matches $1 for $1 for the first $6.000 that the employee contributes to his 401k durng the year. The restricted stock grant is 500 shares granted when the market price was $5 per share. Assume that the stock vests on December 31, 2022, and that the market pnce on that date is $12.50 per share. Also assume that Santint is wiling to make any electons to reduce equity.based compensation taxes. The Hawall tip was given to him as the outstanding salesperson for 2021. The group-erm lle pollcy gives him $150,000 of coverage. Assume that 5an init does not itemize deductions for the yeat, Note: Round your answers to the nearest whole dollar amount. Q Answer is complete but not entirely correct. JDD Corporation provides the following benefits to its employee, Ahmed (age 35): The life insurance is a group-term life insurance policy that provides $293,000 of coverage for Ahmed. Assuming Ahmed is subject to a marginal tax rate of 32 percent, what is his after-tax benefit of receiving each of these benefits? (Use EXFHIBIT 12-8) Note: Enter all amounts as positive values. Round your intermediate computations and final answers to the nearest whole dollor. x Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts