Question: please help me solve this !!!! thank you Problem 3 : Payroll Problem Background: M&D Contractors has numerous employees who are paid on a weekly

please help me solve this !!!! thank you

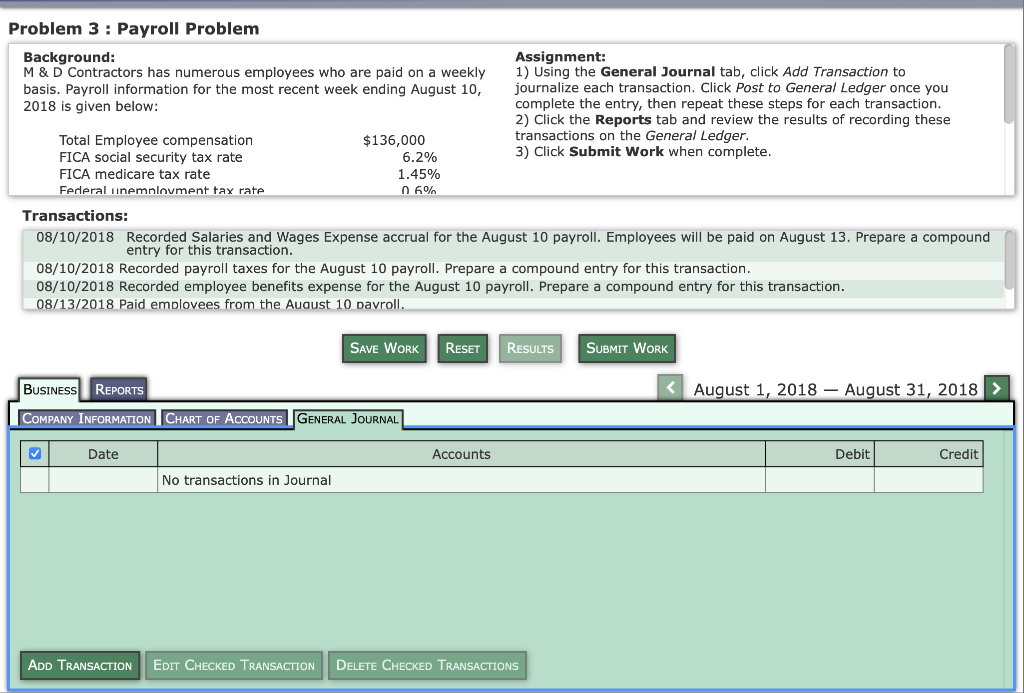

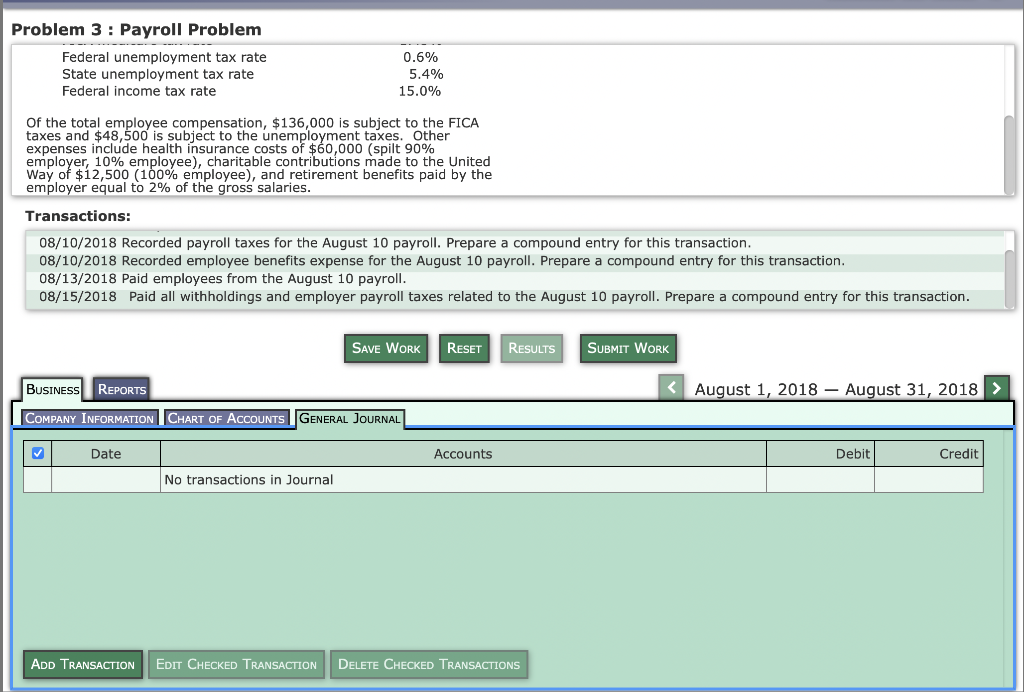

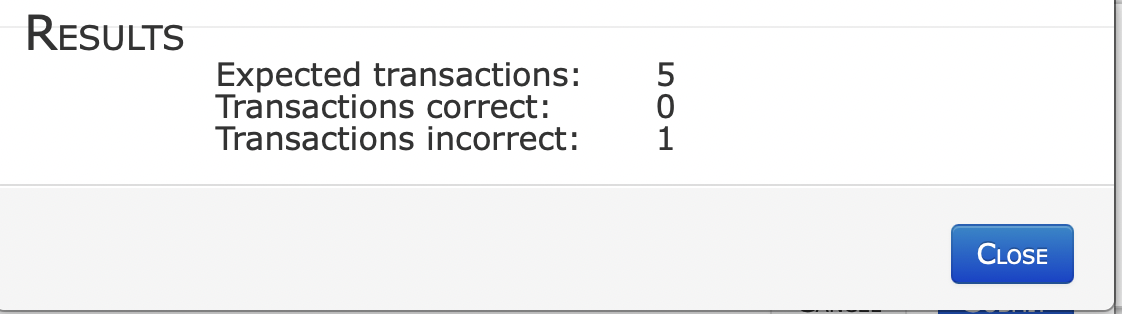

Problem 3 : Payroll Problem Background: M&D Contractors has numerous employees who are paid on a weekly basis. Payroll information for the most recent week ending August 10, 2018 is given below: Assignment: 1) Using the General Journal tab, click Add Transaction to journalize each transaction. Click Post to General Ledger once you complete the entry, then repeat these steps for each transaction. 2) Click the Reports tab and review the results of recording these transactions on the General Ledger. 3) Click Submit Work when complete. Total Employee compensation FICA social security tax rate FICA medicare tax rate Federal unemployment tay rate $136,000 6.2% 1.45% 0.6% Transactions: 08/10/2018 Recorded Salaries and Wages Expense accrual for the August 10 payroll. Employees will be paid on August 13. Prepare a compound entry for this transaction. 08/10/2018 Recorded payroll taxes for the August 10 payroll. Prepare a compound entry for this transaction. 08/10/2018 Recorded employee benefits expense for the August 10 payroll. Prepare a compound entry for this transaction. 08/13/2018 Paid emplovees from the August 10 dayroll. SAVE WORK RESET RESULTS SUBMIT WORK BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Date Accounts Debit Credit No transactions in Journal ADD TRANSACTION EDIT CHECKED TRANSACTION DELETE CHECKED TRANSACTIONS Problem 3 : Payroll Problem Federal unemployment tax rate State unemployment tax rate Federal income tax rate 0.6% 5.4% 15.0% Of the total employee compensation, $136,000 is subject to the FICA taxes and $48,500 is subject to the unemployment taxes. Other expenses include health insurance costs of $60,000 (spilt 90% employer, 10% employee), charitable contributions made to the United Way of $12,500 (100% employee), and retirement benefits paid by the employer equal to 2% of the gross salaries. Transactions: 08/10/2018 Recorded payroll taxes for the August 10 payroll. Prepare a compound entry for this transaction. 08/10/2018 Recorded employee benefits expense for the August 10 payroll. Prepare a compound entry for this transaction. 08/13/2018 Paid employees from the August 10 payroll. 08/15/2018 Paid all withholdings and employer payroll taxes related to the August 10 payroll. Prepare a compound entry for this transaction. SAVE WORK RESET RESULTS SUBMIT WORK BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Date Accounts Debit Credit No transactions in Journal ADD TRANSACTION EDIT CHECKED TRANSACTION DELETE CHECKED TRANSACTIONS RESULTS 5 Expected transactions: Transactions correct: Transactions incorrect: O- 1 CLOSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts