Question: Please help me solve this, the formula I have been trying is not working. What are the correct answers for all 3 questions? (Related to

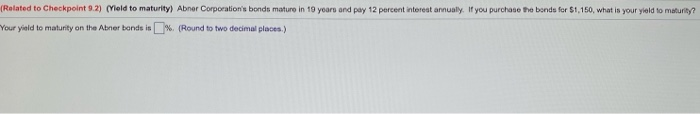

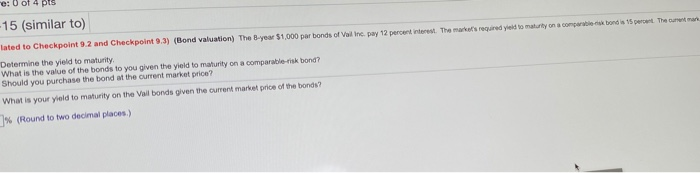

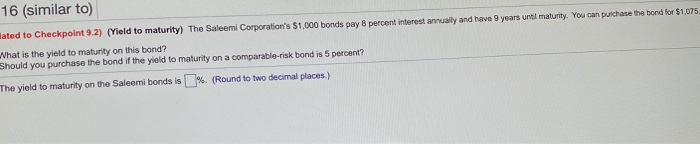

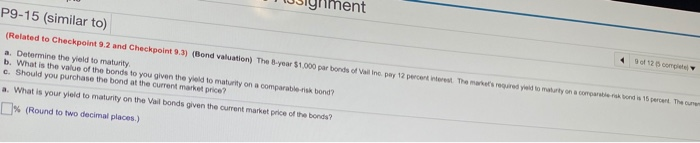

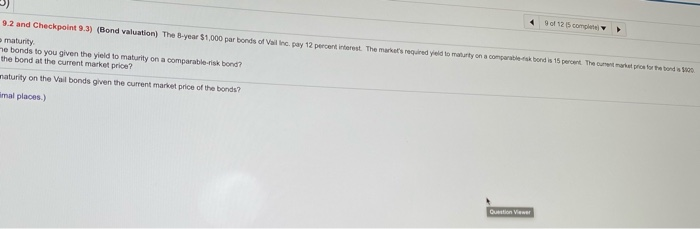

(Related to Checkpoint 9.2) (eld to maturity) Abner Corporation's bonds mature in 19 years and pay 12 percent interest annualy. If you purchase the bonds for $1,150, what is your yield to maturity? Your yield to maturity on the Abner bonds is % (Round to two decimal places) 15 (similar to) lated to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) The B-year $1,000 par bonds of Vallin, pay 12 percent interest. The more required to makty on a com b ond is 15 percent. The com Determine the yield to maturity What is the value of the bonds to you given the yield la maturity on a comparable-risk bond? Should you purchase the bond at the current market price? What is your yield to maturity on the Vallbonds given the current market price of the bonds? % (Round to two decimal places) TUJIU lated to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 8 percent interest annually and have 9 years until maturity. You can purchase the bond for $1,075 What is the yield to maturity on this bond? Should you purchase the bond if the yield to maturity on a comparable-risk bond is 5 percent? The yield to maturity on the Saleemi bonds is % (Round to two decimal places.) - warynment 4 1125 corrie 9-15 (similar to) (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) The Bear $1.000 par bonds of Valline pay 12 percen t Thema's roured to many on a comentar i s 15 percent The a. Determine the yield to maturity What is the value of the bonds to you given the yield to maturity on a comparable-risk bond? c. Should you purchase the bond at the current market price? a. What is your old to malunity on the Vallbonds given the current market price of the bonds? (Round to two decimal places.) 4 125 2 and Checkpoint 9.3) (Bond valuation) The B-year $1,000 par bonds of Ville pay 12 petites Thema 's required yeld to maturty on a comparables bond is 15 percent. The current pros for the bord 1100 matunity bonds to you given the yield to maturity on a comparable-risk bond? he bond at the current market price? maturity on the Vallbonds given the current market price of the bonds? mal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts