Question: Please help me solve!! Will thumbs up! Your company currently has $1,000 par, 6.5% coupon bonds with 10 years to maturity and a price of

Please help me solve!! Will thumbs up!

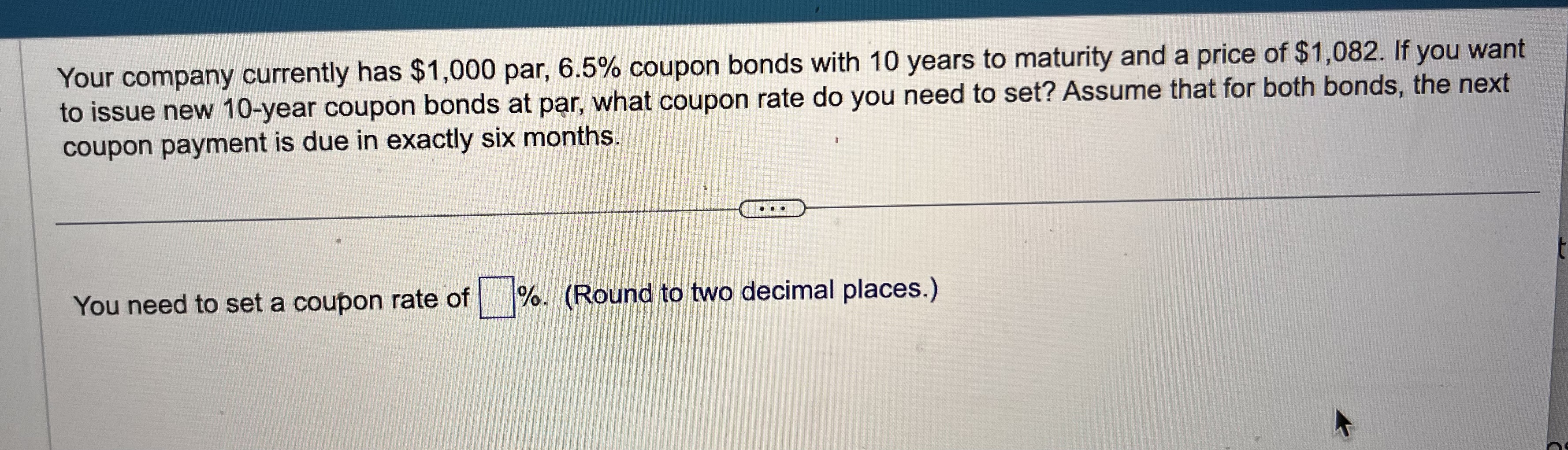

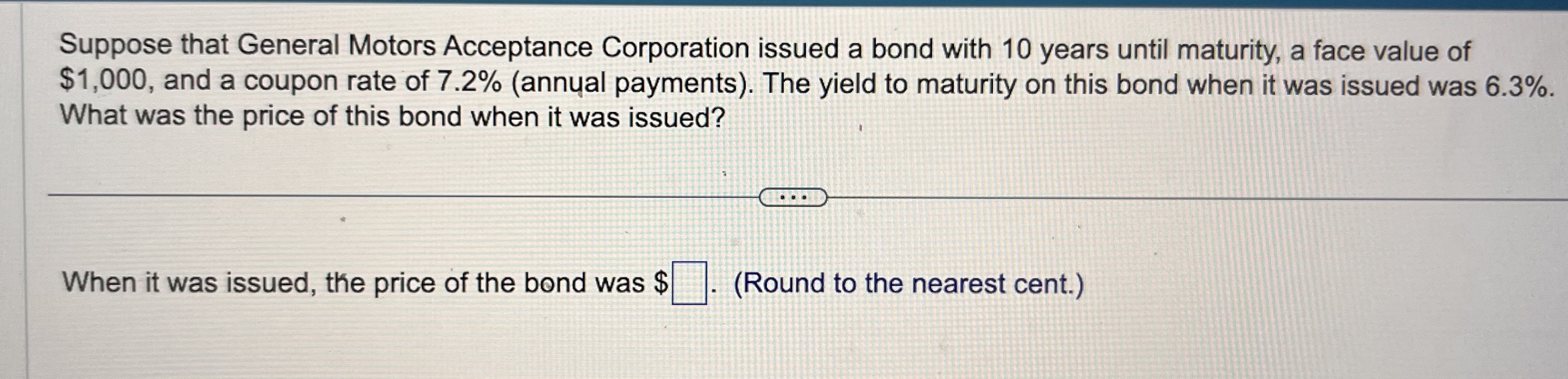

Your company currently has $1,000 par, 6.5% coupon bonds with 10 years to maturity and a price of $1,082. If you want to issue new 10-year coupon bonds at par, what coupon rate do you need to set? Assume that for both bonds, the next coupon payment is due in exactly six months. You need to set a coupon rate of \%. (Round to two decimal places.) Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1,000, and a coupon rate of 7.2% (annual payments). The yield to maturity on this bond when it was issued was 6.3%. What was the price of this bond when it was issued? When it was issued, the price of the bond was $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts