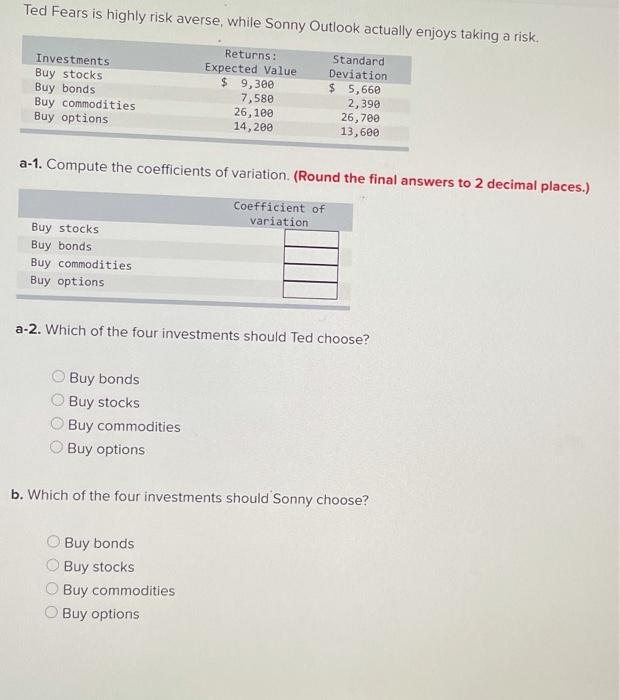

Question: please help me Ted Fears is highly risk averse, while Sonny Outlook actually enjoys taking a risk. Investments Buy stocks Buy bonds Buy commodities Buy

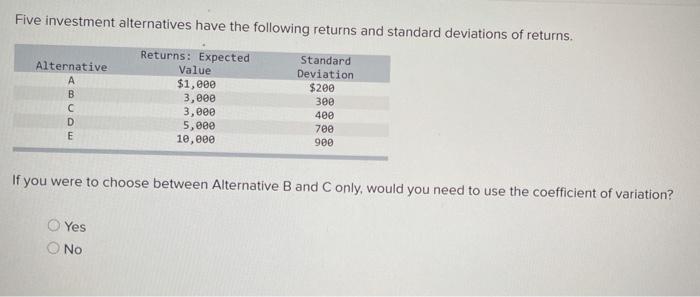

Ted Fears is highly risk averse, while Sonny Outlook actually enjoys taking a risk. Investments Buy stocks Buy bonds Buy commodities Buy options Returns: Expected Value $ 9,300 7,580 26,100 14,200 Standard Deviation $ 5,660 2,390 26,700 13,600 a-1. Compute the coefficients of variation (Round the final answers to 2 decimal places.) Coefficient of variation Buy stocks Buy bonds Buy commodities Buy options a-2. Which of the four investments should Ted choose? Buy bonds Buy stocks Buy commodities Buy options b. Which of the four investments should Sonny choose? Buy bonds Buy stocks Buy commodities Buy options Five investment alternatives have the following returns and standard deviations of returns. Alternative B monov Returns: Expected Value $1,000 3,000 3 , 5,800 10,000 Standard Deviation $200 300 400 700 900 If you were to choose between Alternative B and Conly, would you need to use the coefficient of variation? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts