Question: please help me the below question, it seems easy but still need help 2 Lunar Company uses a perpetual inventory system. The company's accounting records

please help me the below question, it seems easy but still need help

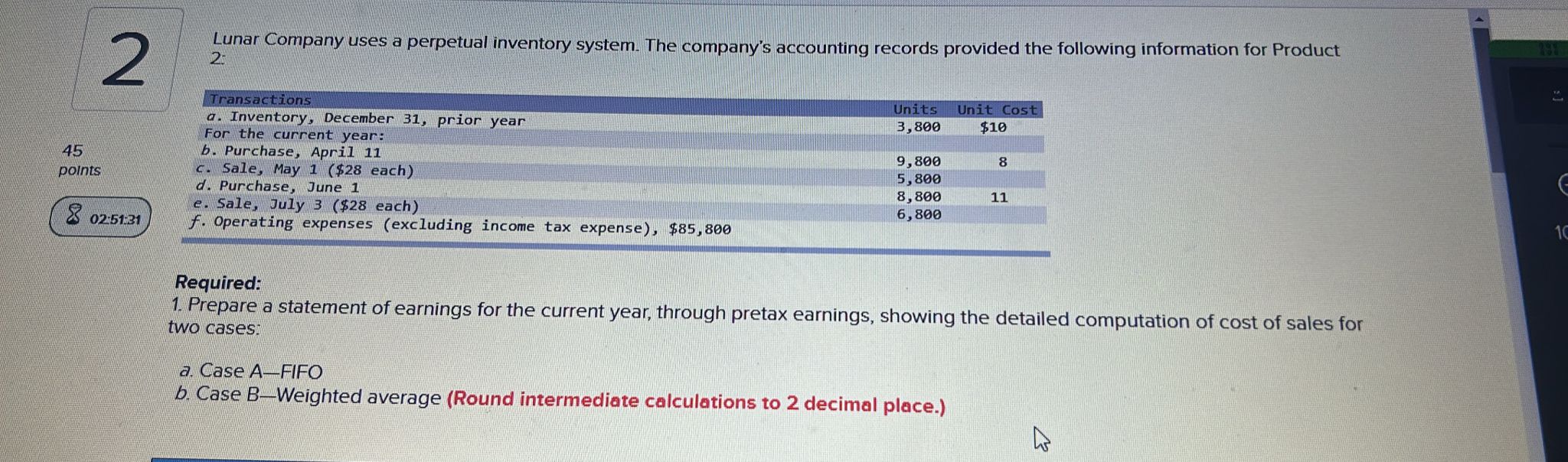

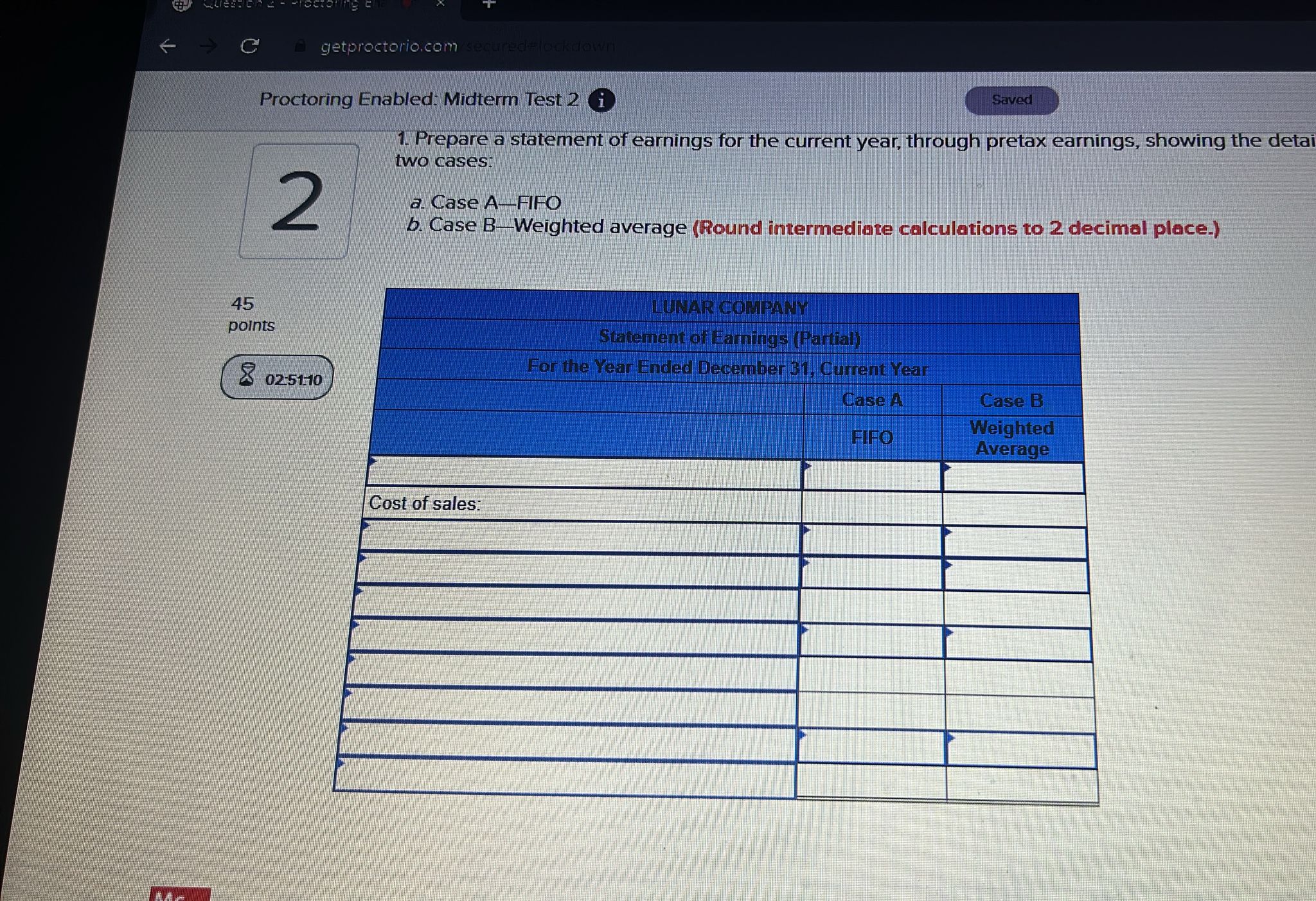

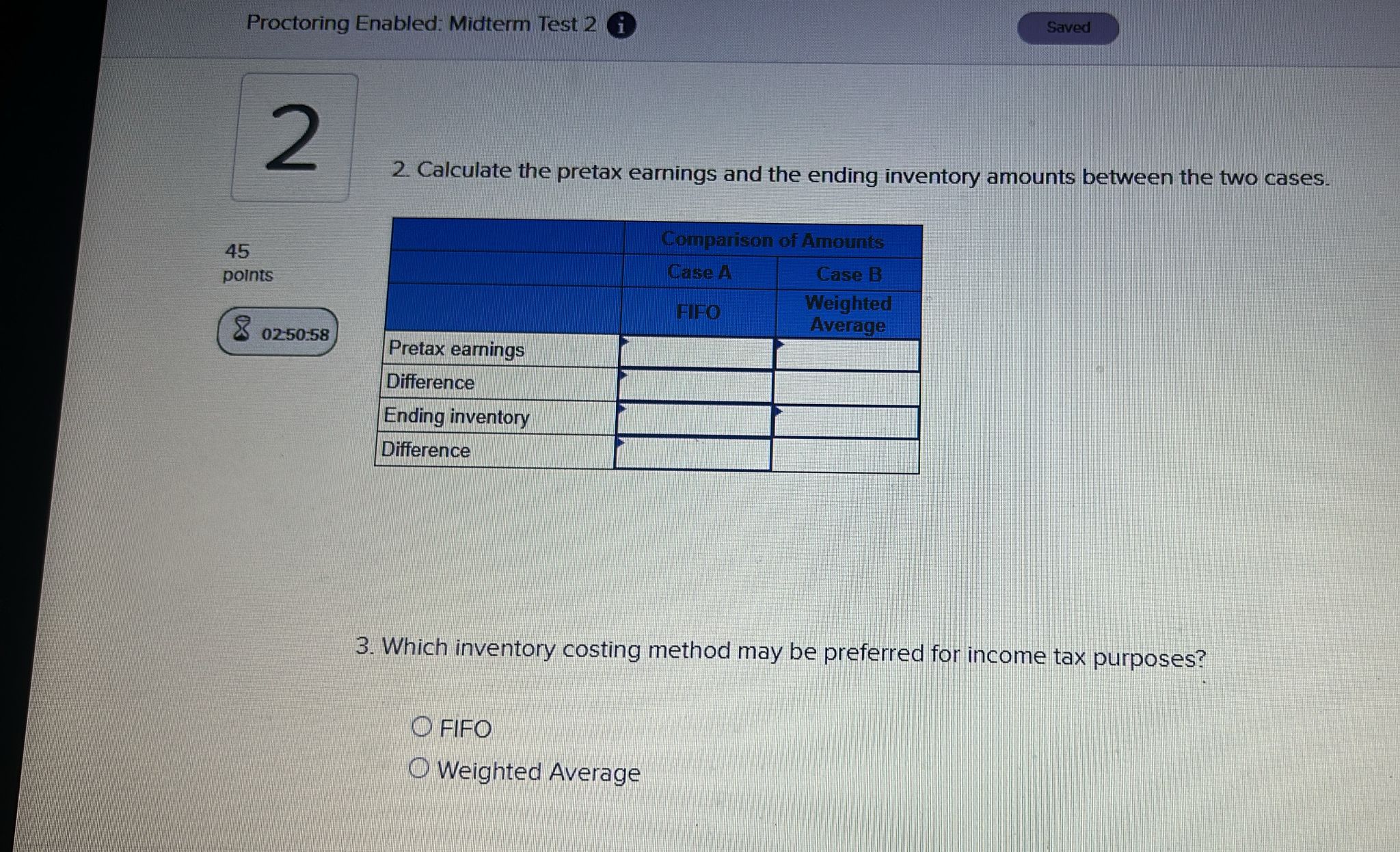

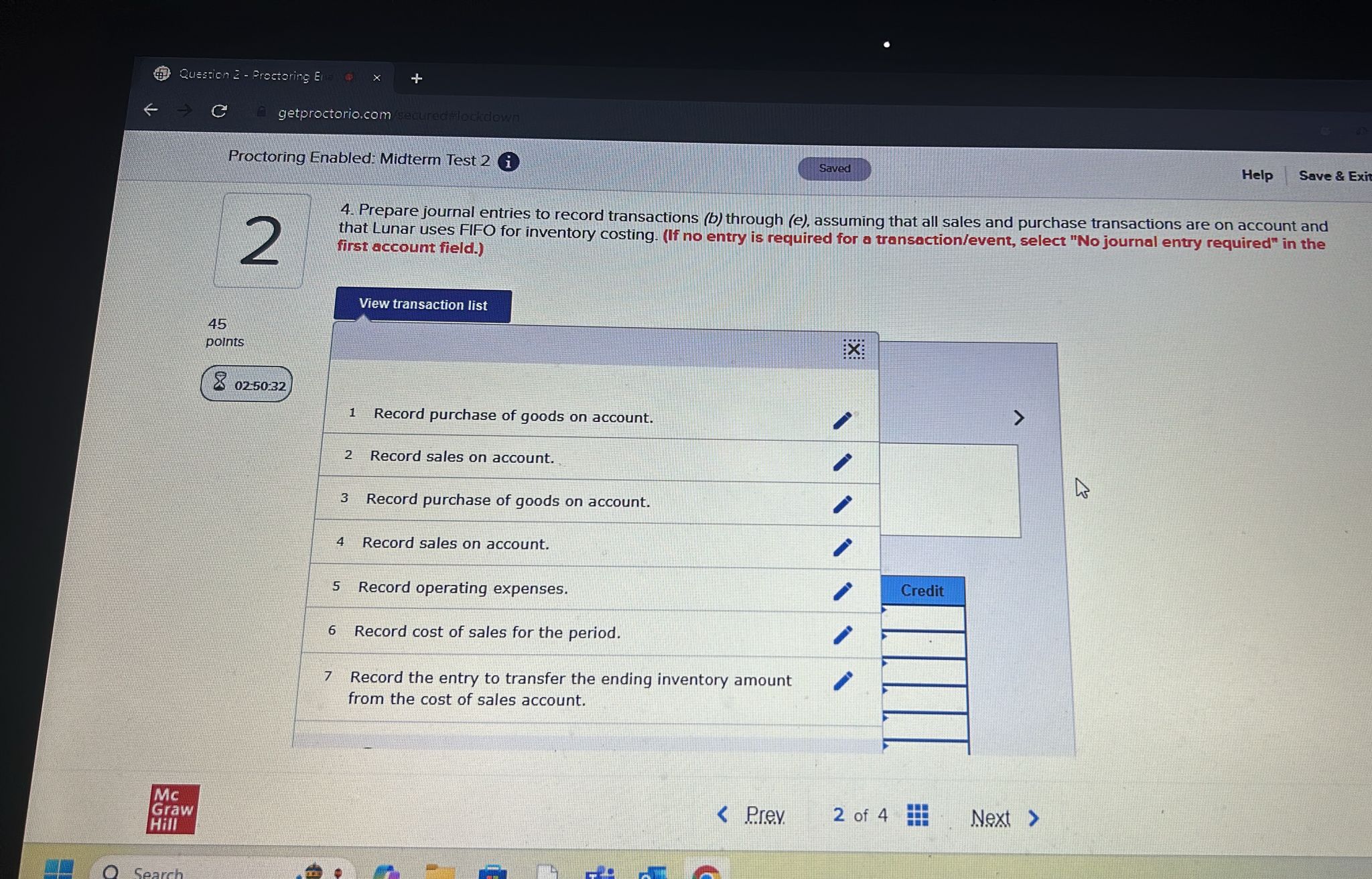

2 Lunar Company uses a perpetual inventory system. The company's accounting records provided the following information for Product Transactions Units Unit Cost a. Inventory, December 31, prior year 3, 800 $10 For the current year: 45 b. Purchase, April 11 9, 800 8 points c. Sale, May 1 ($28 each) 5, 800 d. Purchase, June 1 8, 800 11 e. Sale, July 3 ($28 each) 6, 800 8 02:51:31 f. Operating expenses (excluding income tax expense), $85,800 Required: 1. Prepare a statement of earnings for the current year, through pretax earnings, showing the detailed computation of cost of sales for two cases: a. Case A-FIFO b. Case B-Weighted average (Round intermediate calculations to 2 decimal place.)C getproctorio.com secured=lockdown Proctoring Enabled: Midterm Test 2 Saved 1. Prepare a statement of earnings for the current year, through pretax earnings, showing the deta two cases: 2 a. Case A-FIFO b. Case B-Weighted average (Round intermediate calculations to 2 decimal place.) 45 LUNAR COMPANY points Statement of Earnings (Partial) 02:51-10 For the Year Ended December 31, Current Year Case A Case B FIFO Weighted Average Cost of sales:Proctoring Enabled: Midterm Test 2 Saved 2 2. Calculate the pretax earnings and the ending inventory amounts between the two cases. Comparison of Amounts 45 Case A Case B points FIFO Weighted Average 8 02:50:58 Pretax earnings Difference Ending inventory Difference 3. Which inventory costing method may be preferred for income tax purposes? O FIFO O Weighted Average4. Prepare journal entries to record transactions (b) through (e), assuming that all sales and purchase tansactions are on account and that Lunar uses FIFO for Inventory costing (lino entry is required for a mansactionfevent, select \"No journal envy required\" in the I 2 f rst account eld.) i View transaction "5' 45 norm: 1 Record purchase of goods on account. Record sales on account. 3 Record purchase of goods on account. I Record sales on account. \" ,. m, J 5 Record operating expenses. l i 6 Record cost of sales for the period. 7 Record the entry to transfer the ending inventory amount from the cost of sales account. 20M 55% Next > .30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts