Question: PLEASE HELP ME The table below contains the monthly closing prices for U.S. Steel and the S&P 500 Index for the past five years. Use

PLEASE HELP ME

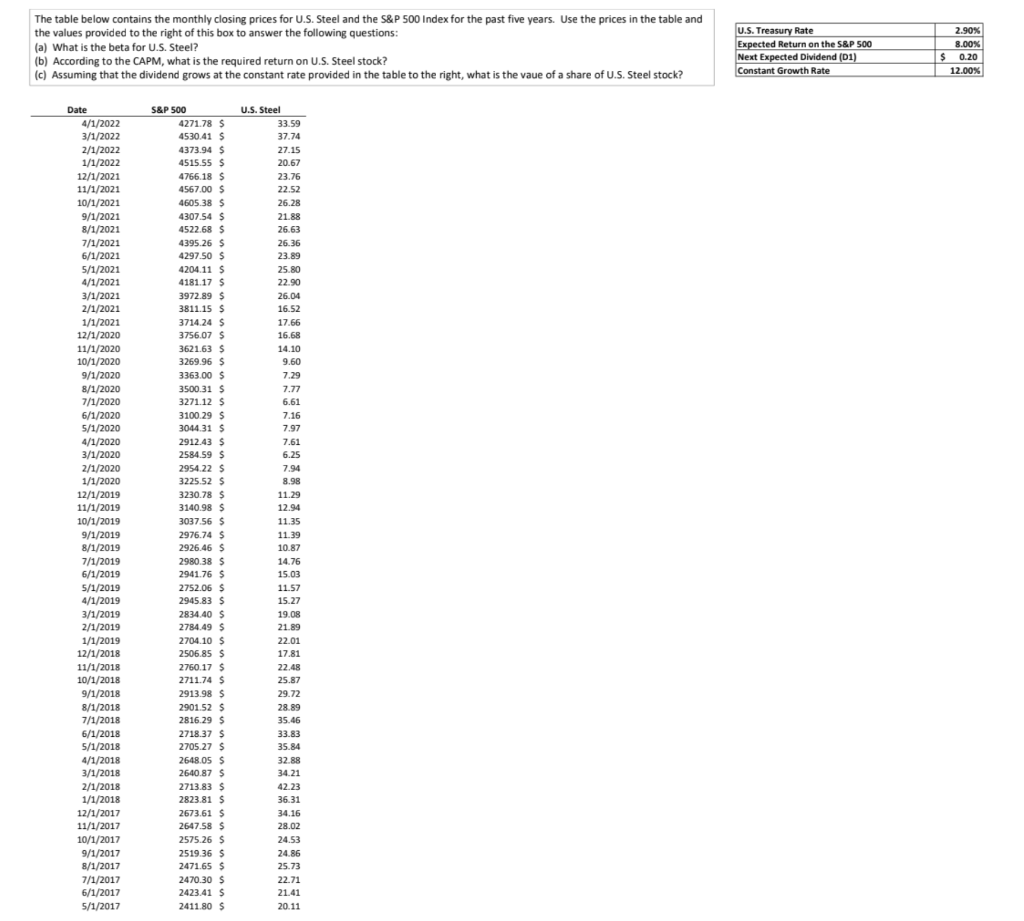

The table below contains the monthly closing prices for U.S. Steel and the S&P 500 Index for the past five years. Use the prices in the table and the values provided to the right of this box to answer the following questions: (a) What is the beta for U.S. Steel? (b) According to the CAPM, what is the required return on U.S. Steel stock? (c) Assuming that the dividend grows at the constant rate provided in the table to the right, what is the vaue of a share of U.S. Steel stock? U.S. Treasury Rate Expected Return on the S&P 500 Next Expected Dividend (D1) Constant Growth Rate 2.90% 8.00% 0.20 12.00% $ Date 4/1/2022 3/1/2022 2/1/2022 1/1/2022 12/1/2021 11/1/2021 10/1/2021 9/1/2021 8/1/2021 7/1/2021 6/1/2021 5/1/2021 4/1/2021 3/1/2021 2/1/2021 1/1/2021 12/1/2020 11/1/2020 10/1/2020 9/1/2020 8/1/2020 7/1/2020 6/1/2020 5/1/2020 4/1/2020 3/1/2020 2/1/2020 1/1/2020 12/1/2019 11/1/2019 S&P 500 4271.785 4530.41 $ 4373.94 $ 4515.55 $ 4766.18 $ 4567.00 S 4605.38 S 4307.54 $ 4522.68 $ 4395.26 $ S 4297.50 $ $ 4204.11 S 4181.17 $ S 3972.89 $ 3811.15 $ 3714.24 $ 3756.07 $ 362163 S 3269.96 $ 3363.00 $ 3500.31 $ 3271 125 3100.29 $ 3044.31 $ 2912.43 $ 2584.59 $ 2954.22 $ 3225.52 $ 3230.78 $ 3140.98 3037.56 $ 2976.74 S 2926.46 $ 2980.38 $ 2941 76 S 2752.06 $ 2945.83 S 2834.40 $ 2784.49 $ 2704.10 $ $ 2506.85 S 2760.17 $ 2711.74 $ 2913.98 S 2901.52 S 2816.29 $ 2718.37 $ 2705.27 $ 2648.05 S 2640.87 $ 2713.83 $ 2823.81 $ 2673.61 $ 2647.58 $ 2575.26 $ 2519.36 $ 2471.65 $ 2470.30 $ 2423.41 $ 2411.80 $ U.S. Steel 33.59 37.74 27.15 20.67 23.76 22.52 26.28 21.88 26.63 26.36 23.89 25.80 22.90 26.04 16.52 17.66 16.68 14.10 9.60 7.29 7.77 6.61 7.16 7.97 7.61 6.25 7.94 8.98 11.29 12.94 11.35 11.39 10.87 14.76 15.03 11.57 15.27 19.08 21.89 22.01 17.81 22.48 25.87 29.72 28.89 35.46 33.83 35.84 32.88 34.21 42.23 36.31 34.16 28.02 24.53 24.86 25.73 22.71 21.41 20.11 10/1/2019 9/1/2019 8/1/2019 7/1/2019 6/1/2019 5/1/2019 4/1/2019 3/1/2019 2/1/2019 1/1/2019 12/1/2018 11/1/2018 10/1/2018 9/1/2018 8/1/2018 7/1/2018 6/1/2018 5/1/2018 4/1/2018 3/1/2018 2/1/2018 1/1/2018 12/1/2017 11/1/2017 10/1/2017 9/1/2017 8/1/2017 7/1/2017 6/1/2017 5/1/2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts