Question: please help me! this is the data THIS IS AN EXAMPLE ON HOW TO SOLVE THE PROBLEM! Score: 0 of 1 pt 5 of 6

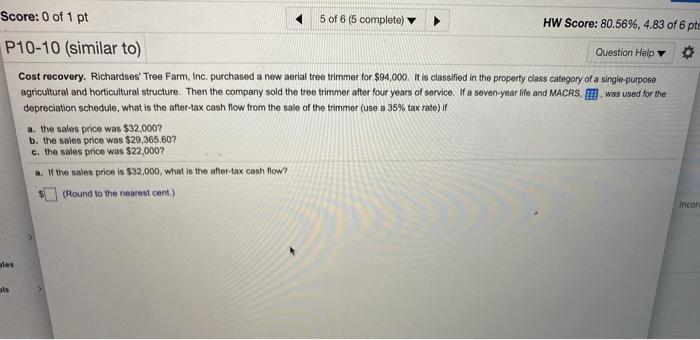

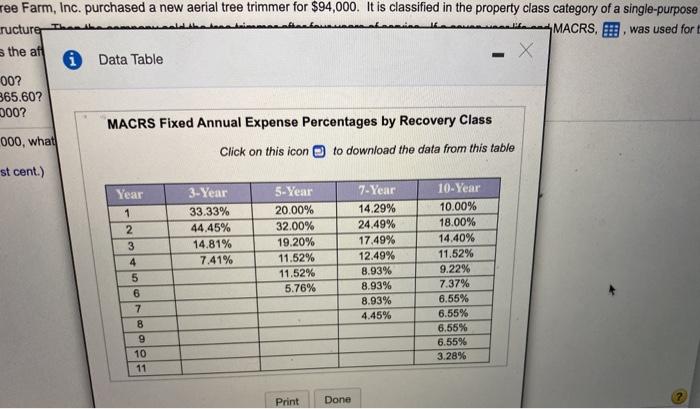

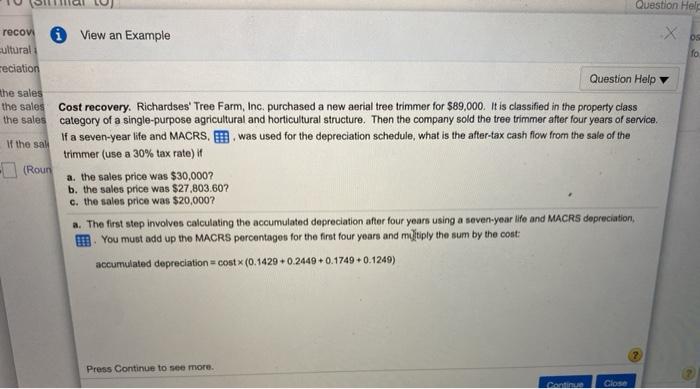

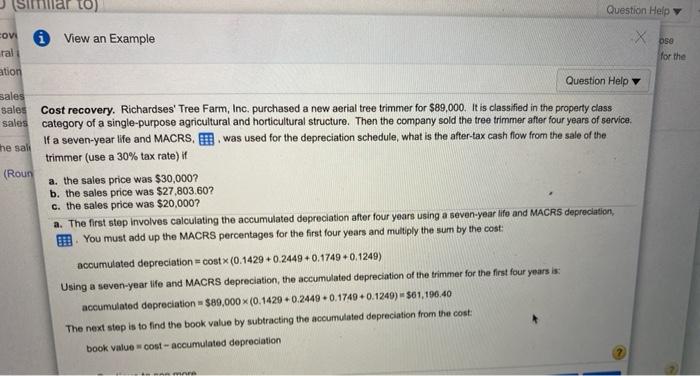

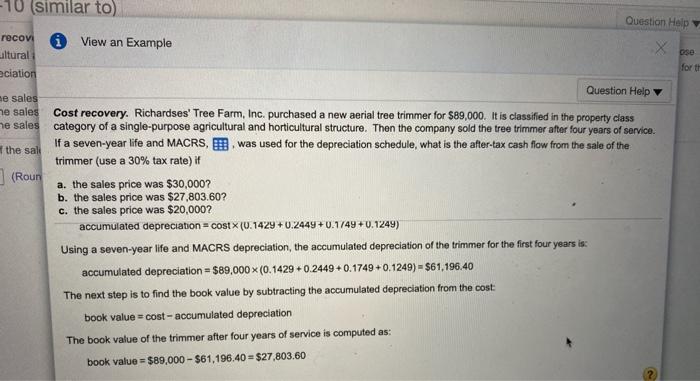

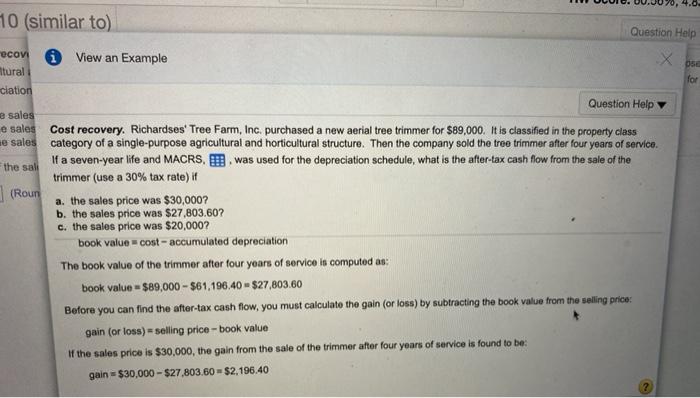

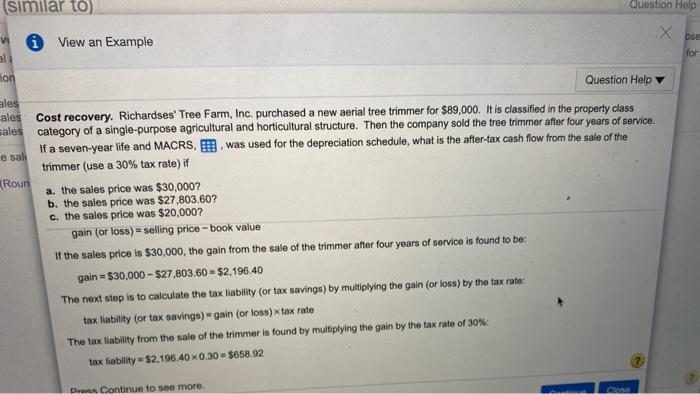

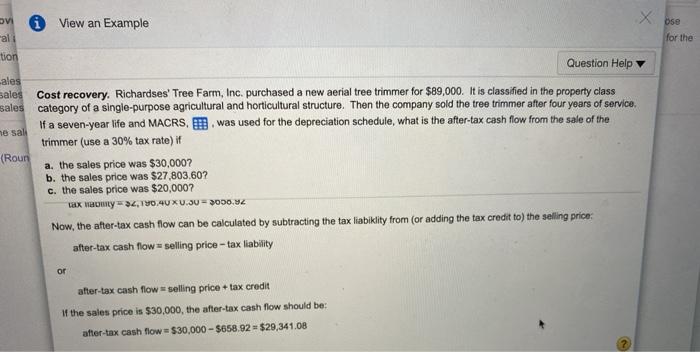

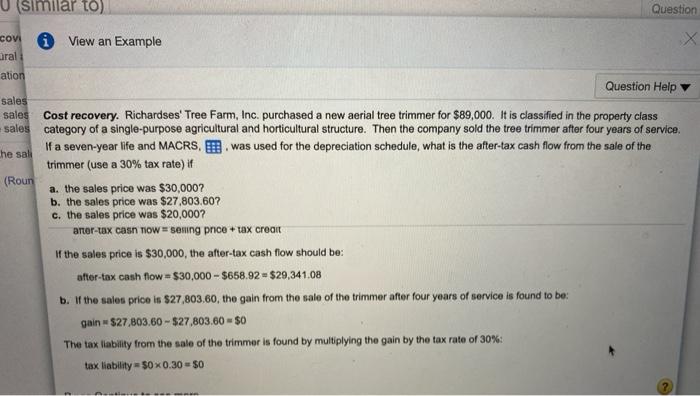

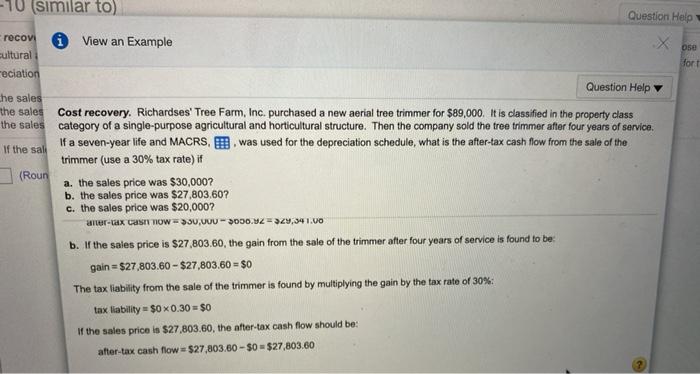

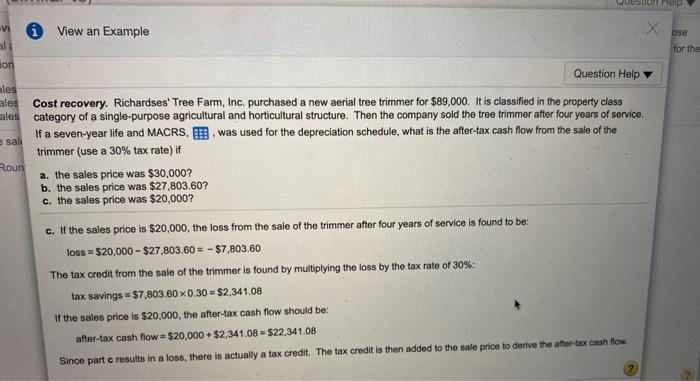

Score: 0 of 1 pt 5 of 6 (5 complete) HW Score: 80.56%, 4.83 of 6 pts P10-10 (similar to) Question Help Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $94,000. It is classified in the property class category of a single purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service. If a seven-year life and MACRS, I was used for the depreciation schedule, what is the after-tax cash flow from the sale of the trimmer (use a 35% tax rate) if a. the sales price was $32,000? b. the sales price was $29,365,60? c. the sales price was $22,000? a. W the sale price is $32,000, what in the after tax canh flow? (Round to the nearest cent.) Incor les els ree Farm, Inc. purchased a new aerial tree trimmer for $94,000. It is classified in the property class category of a single-purpose ructure MACRS,!!!. was used for the af Data Table 00? 365.60? 000? MACRS Fixed Annual Expense Percentages by Recovery Class 000, what Click on this icon to download the data from this table st cent.) Year 3-Year 5-Year 7-Year 10-Year 33.33% 20.00% 14.29% 10.00% 2 44.45% 32.00% 24.49% 18.00% 3 14,81% 19.20% 17.49% 14.40% 4 7.41% 11.52% 12.49% 11.52% 11.52% 8.93% 9.22% 5.76% 8.93% 7.37% 8.93% 6.55% 8 4.45% 6.55% 6.55% 6.55% 3.28% 11 1 von 9 10 Print Done Question Help OS fo recov 0 View an Example cultural reciation Question Help the sales the sales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class the sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service, If a seven-year life and MACRS, I was used for the depreciation schedule, what is the after-tax cash flow from the sale of the If the sal trimmer (use a 30% tax rate) (Roun a. the sales price was $30,000? b. the sales price was $27.803,60? c. the sales price was $20,000? a. The first step involves calculating the accumulated depreciation after four years using a seven-year life and MACRS depreciation, IB. You must add up the MACRS percentages for the first four years and multiply the sum by the cost: accumulated depreciation=cost(0.1429 +0.2449+0.1749+0.1249) Press Continue to see more. Continue Close Similar to) Question Help COV ral View an Example Xose for the ation Question Help sales sales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service, If a seven-year life and MACRS, . was used for the depreciation schedule, what is the after-tax cash flow from the sale of the the salt trimmer (use a 30% tax rate) if (Roun a. the sales price was $30,000? b. the sales price was $27,803.60? c. the sales price was $20,000? a. The first step involves calculating the accumulated depreciation after four years using a seven-year life and MACRS depreciation, You must add up the MACRS percentages for the first four years and multiply the sum by the cost accumulated depreciation=costx (0.1429 +0.2449+0.1749+0.1249) Using a seven-year life and MACRS depreciation, the accumulated depreciation of the trimmer for the first four years is accumulated depreciation - $80,000 X (0.1429 +0.2449.0.1749+0.1249) $61,190.40 The next step is to find the book value by subtracting the accumulated depreciation from the cost: book value oost-accumulated depreciation gge -10 (similar to) Question Help recov View an Example ultural fort ociation Question Help ne sales he sales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class me sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service If a seven-year life and MACRS, E was used for the depreciation schedule, what is the after-tax cash flow from the sale of the the sali trimmer (use a 30% tax rate) if (Roun a. the sales price was $30,000? b. the sales price was $27,803.60? c. the sales price was $20,000? accumulated depreciation=costx (0.1429 +0.2449 +0.1749+0.1249) Using a seven-year life and MACRS depreciation, the accumulated depreciation of the trimmer for the first four years is: accumulated depreciation = $89.000(0.1429 +0.2449+0.1749+0.1249) = $61,196.40 The next step is to find the book value by subtracting the accumulated depreciation from the cost: book value = cost-accumulated depreciation The book value of the trimmer after four years of service is computed as: book value = $89,000 - $61,196,40 = $27,803.60 10 (similar to) Question Help econ i View an Example OSE Atural for ciation Question Help sales e sales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class e sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service. If a seven-year life and MACRS, was used for the depreciation schedule, what is the after-tax cash flow from the sale of the the sali trimmer (use a 30% tax rate) if (Roun a. the sales price was $30,000? b. the sales price was $27.803,60? c. the sales price was $20,000? book value-cost-accumulated depreciation The book value of the trimmer after four years of service is computed as: book value = $89,000 - $61,196,40 - $27,803.60 Before you can find the after-tax cash flow, you must calculate the gain (or loss) by subtracting the book value from the selling price: gain (or loss) = selling price - book value of the sales price is $30,000, the gain from the sale of the trimmer after four years of service is found to be gain = $30,000 - $27.803.60 $2,196.40 (similar to) Question Help View an Example OSE for hon Question Help ales ales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service. If a seven-year life and MACRS, was used for the depreciation schedule, what is the after-tax cash flow from the sale of the e sal trimmer (use a 30% tax rate) if Roun a. the sales price was $30,000? b. the sales price was $27.803.60? c. the sales price was $20,000? gain (or loss) = selling price - book value If the sales price is $30,000, the gain from the sale of the trimmer after four years of service is found to be: gain = $30,000 - $27,803,60 = $2,196.40 The next step is to calculate the tax liability for tax savings) by multiplying the gain (or loss) by the tax rate: tax liability (or tax savings) gain (or loss) x tax rate The tax liability from the sale of the trimmer is found by multiplying the gain by the tax rate of 30% tax liability - $2,196.40 x 0.30 - $658.92 Der Continue to see more View an Example Ose for the al tion Question Help ales sales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service. If a seven-year life and MACRS. E. was used for the depreciation schedule, what is the after-tax cash flow from the sale of the ne sal trimmer (use a 30% tax rate) if (Roun a. the sales price was $30,000? b. the sales price was $27,803.60? c. the sales price was $20,000? tax winy-2,190.4UXU.30 - 00.42 Now, the after-tax cash flow can be calculated by subtracting the tax liabiklity from (or adding the tax credit to) the selling price: after-tax cash flow = selling price - tax liability or after-tax cash flow selling price + tax credit If the sales price is $30,000, the after-tax cash flow should be: after-tax cash flow = $30,000 - $658.92 $29,341.08 U (similar to) Question COV View an Example arali ation Question Help sales sales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service If a seven-year life and MACRS, I was used for the depreciation schedule, what is the after-tax cash flow from the sale of the he sal trimmer (use a 30% tax rate) if (Roun a. the sales price was $30,000? b. the sales price was $27,803.60? c. the sales price was $20,000? arter-tax cash Tow = selling price + tax crean If the sales price is $30,000, the after-tax cash flow should be: after-tax cash flow = $30,000 - $658.92 $29,341.08 b. If the sales price is $27,803,60, tho gain from the sale of the trimmer after four years of service is found to be: gain $27,803.60 - $27,803.60 - $0 The tax liability from the sale of the trimmer is found by multiplying the gain by the tax rate of 30%. tax liability = $0x0.30 - 50 -10 (similar to) Question Help -recov cultural i View an Example ose fort reciation Question Help he sales the sales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class the sales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service. If a seven-year life and MACRS, B. was used for the depreciation schedule, what is the after-tax cash flow from the sale of the If the sal trimmer (use a 30% tax rate) if (Roun a. the sales price was $30,000? b. the sales price was $27.803,60? c. the sales price was $20,000? era a NOW $30,000000.2329,341.00 b. If the sales price is $27,803,60, the gain from the sale of the trimmer after four years of service is found to be gain = $27,803.60 - $27,803,60 = $0 The tax liability from the sale of the trimmer is found by multiplying the gain by the tax rate of 30% tax liability = $0 0.30 = $0 If the sales price is $27.803.60, the after-tax cash flow should be: after-tax cash flow = $27,803,60 - $0 $27,803.60 estone ose for the View an Example al son Question Help ales ales Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $89,000. It is classified in the property class ales category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service, If a seven-year life and MACRS, was used for the depreciation schedule, what is the after-tax cash flow from the sale of the e sal trimmer (use a 30% tax rate) if Roun a. the sales price was $30,000? b. the sales price was $27,803.60? c. the sales price was $20,000? c. If the sales price is $20,000, the loss from the sale of the trimmer after four years of service is found to be: loss = $20,000 - $27,803,60 = - $7,803.60 The tax credit from the sale of the trimmer is found by multiplying the loss by the tax rate of 30%: tax savings = $7,803.60 x0.30 - $2,341.08 of the sales price is $20,000, the after-tax cash flow should be: after-tax cash flow = $20,000 $2,341.08 - $22,341.08 Since part c results in a loss, there is actually a tax credit. The tax credit is then added to the sale price to derive the after-tax cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts