Question: please help me to answer all a. . Download stock prices for any two companies from different industries, (preferably same economy) 5 years of monthly

please help me to answer all

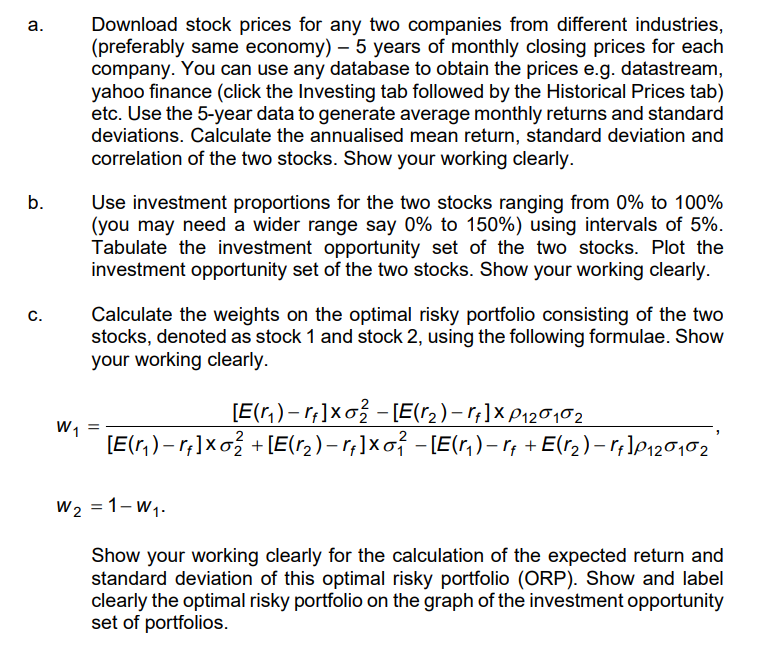

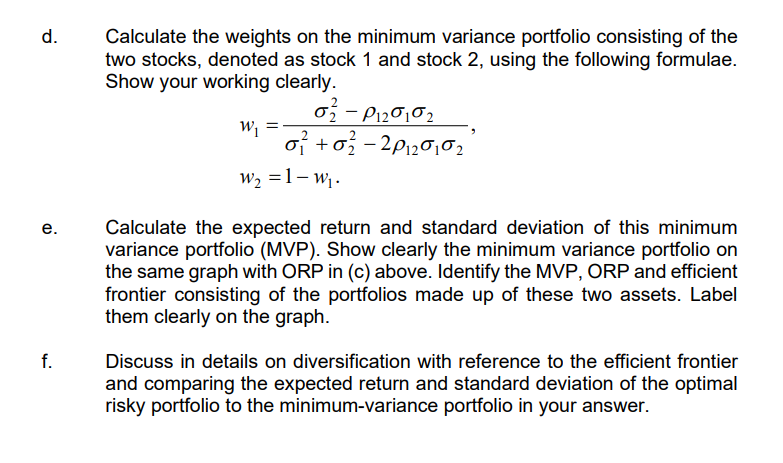

a. . Download stock prices for any two companies from different industries, (preferably same economy) 5 years of monthly closing prices for each company. You can use any database to obtain the prices e.g. datastream, yahoo finance (click the Investing tab followed by the Historical Prices tab) etc. Use the 5-year data to generate average monthly returns and standard deviations. Calculate the annualised mean return, standard deviation and correlation of the two stocks. Show your working clearly. b. Use investment proportions for the two stocks ranging from 0% to 100% (you may need a wider range say 0% to 150%) using intervals of 5%. Tabulate the investment opportunity set of the two stocks. Plot the investment opportunity set of the two stocks. Show your working clearly. c. Calculate the weights on the optimal risky portfolio consisting of the two stocks, denoted as stock 1 and stock 2, using the following formulae. Show your working clearly. W1 [E(11) r*]xo [E(12) r4]XP120102 [E(17) ry]xo + [E(r2) rf]xo? - [E(ra) r4 +E(ra) r410120102 W2 = 1-W1 Show your working clearly for the calculation of the expected return and standard deviation of this optimal risky portfolio (ORP). Show and label clearly the optimal risky portfolio on the graph of the investment opportunity set of portfolios. d. Calculate the weights on the minimum variance portfolio consisting of the two stocks, denoted as stock 1 and stock 2, using the following formulae. Show your working clearly. o P120,02 o +o 28120102 W2 = 1- wi. W1 = e. e Calculate the expected return and standard deviation of this minimum variance portfolio (MVP). Show clearly the minimum variance portfolio on the same graph with ORP in (c) above. Identify the MVP, ORP and efficient frontier consisting of the portfolios made up of these two assets. Label them clearly on the graph. f. Discuss in details on diversification with reference to the efficient frontier and comparing the expected return and standard deviation of the optimal risky portfolio to the minimum-variance portfolio in your answer. a. . Download stock prices for any two companies from different industries, (preferably same economy) 5 years of monthly closing prices for each company. You can use any database to obtain the prices e.g. datastream, yahoo finance (click the Investing tab followed by the Historical Prices tab) etc. Use the 5-year data to generate average monthly returns and standard deviations. Calculate the annualised mean return, standard deviation and correlation of the two stocks. Show your working clearly. b. Use investment proportions for the two stocks ranging from 0% to 100% (you may need a wider range say 0% to 150%) using intervals of 5%. Tabulate the investment opportunity set of the two stocks. Plot the investment opportunity set of the two stocks. Show your working clearly. c. Calculate the weights on the optimal risky portfolio consisting of the two stocks, denoted as stock 1 and stock 2, using the following formulae. Show your working clearly. W1 [E(11) r*]xo [E(12) r4]XP120102 [E(17) ry]xo + [E(r2) rf]xo? - [E(ra) r4 +E(ra) r410120102 W2 = 1-W1 Show your working clearly for the calculation of the expected return and standard deviation of this optimal risky portfolio (ORP). Show and label clearly the optimal risky portfolio on the graph of the investment opportunity set of portfolios. d. Calculate the weights on the minimum variance portfolio consisting of the two stocks, denoted as stock 1 and stock 2, using the following formulae. Show your working clearly. o P120,02 o +o 28120102 W2 = 1- wi. W1 = e. e Calculate the expected return and standard deviation of this minimum variance portfolio (MVP). Show clearly the minimum variance portfolio on the same graph with ORP in (c) above. Identify the MVP, ORP and efficient frontier consisting of the portfolios made up of these two assets. Label them clearly on the graph. f. Discuss in details on diversification with reference to the efficient frontier and comparing the expected return and standard deviation of the optimal risky portfolio to the minimum-variance portfolio in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts