Question: Please help me to answer this i have limited time SITUATION 6 On January 1, 2015, Burgos Co. sold goods to Carasi Co. Jane signed

Please help me to answer this i have limited time

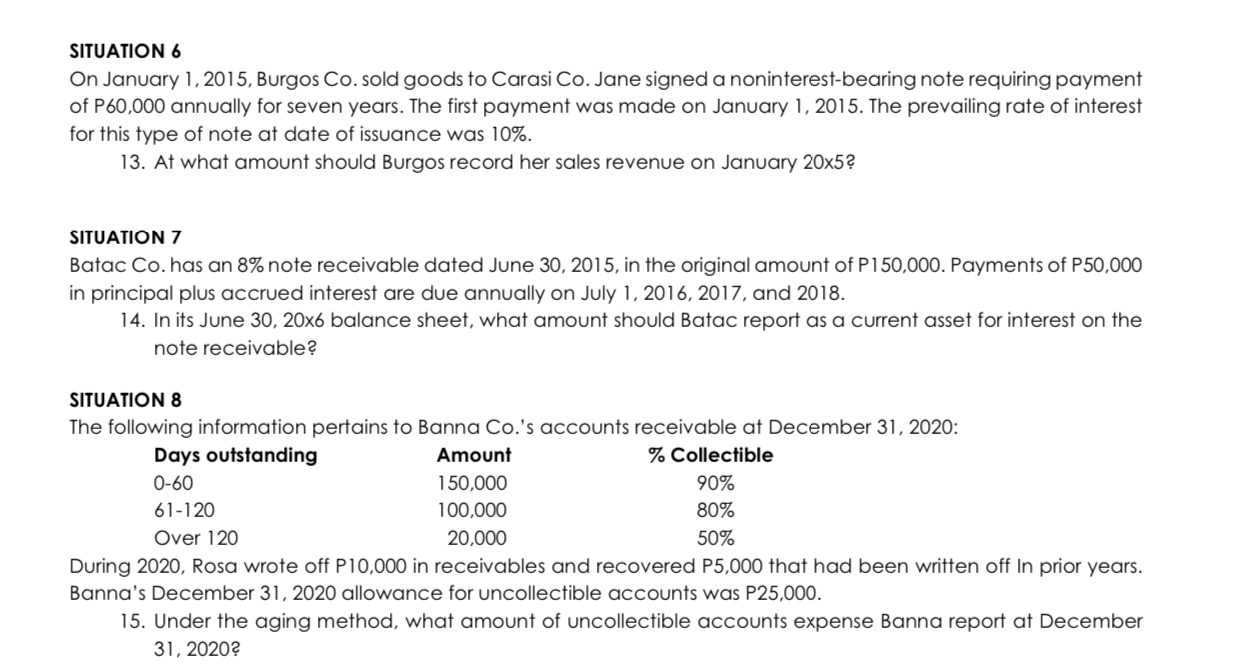

SITUATION 6 On January 1, 2015, Burgos Co. sold goods to Carasi Co. Jane signed a noninterest-bearing note requiring payment of P60,000 annually for seven years. The first payment was made on January 1, 2015. The prevailing rate of interest for this type of note at date of issuance was 10%. 13. At what amount should Burgos record her sales revenue on January 20x5? SITUATION 7 Batac Co. has an 8% note receivable dated June 30, 2015, in the original amount of P150,000. Payments of P50,000 in principal plus accrued interest are due annually on July 1, 2016, 2017, and 2018. 14. In its June 30, 20x6 balance sheet, what amount should Batac report as a current asset for interest on the note receivable? SITUATION 8 The following information pertains to Banna Co.'s accounts receivable at December 31, 2020: Days outstanding Amount %% Collectible 0-60 150,000 90% 61-120 100,000 80% Over 120 20,000 50% During 2020, Rosa wrote off P10,000 in receivables and recovered P5,000 that had been written off In prior years. Banna's December 31, 2020 allowance for uncollectible accounts was P25,000. 15. Under the aging method, what amount of uncollectible accounts expense Banna report at December 31, 20202

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts