Question: Please help me to answer this in details: Question 2: 20 marks You are planning to invest RM18 million in one of two short-term portfolios.

Please help me to answer this in details:

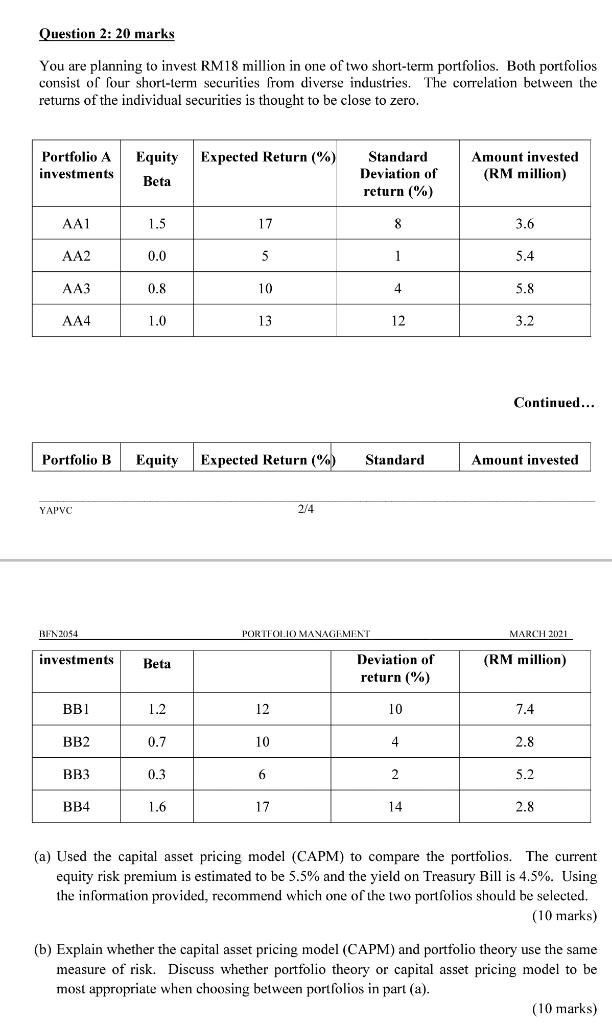

Question 2: 20 marks You are planning to invest RM18 million in one of two short-term portfolios. Both portfolios consist of four short-term securities from diverse industries. The correlation between the returns of the individual securities is thought to be close to zero. Portfolio A investments Expected Return (%) Equity Beta Standard Deviation of return (%) Amount invested (RM million) AA1 1.5 17 8 3.6 AA2 0.0 5 1 5.4 AA3 0.8 10 4 5.8 AA4 1.0 13 12 3.2 Continued... Portfolio B Equity Expected Return (%) Standard Amount invested YAPVC 2/4 BFN 2054 PORTFOLIO MANAGEMENT MARCH 2021 investments Beta (RM million) Deviation of return (%) BB1 1.2 12 10 7.4 BB2 0.7 10 4 2.8 BB3 0.3 6 2 5.2 BB4 1.6 17 14 2.8 (a) Used the capital asset pricing model (CAPM) to compare the portfolios. The current equity risk premium is estimated to be 5.5% and the yield on Treasury Bill is 4.5%. Using the information provided, recommend which one of the two portfolios should be selected. (10 marks) (b) Explain whether the capital asset pricing model (CAPM) and portfolio theory use the same measure of risk. Discuss whether portfolio theory or capital asset pricing model to be most appropriate when choosing between portfolios in part (a). (10 marks) Question 2: 20 marks You are planning to invest RM18 million in one of two short-term portfolios. Both portfolios consist of four short-term securities from diverse industries. The correlation between the returns of the individual securities is thought to be close to zero. Portfolio A investments Expected Return (%) Equity Beta Standard Deviation of return (%) Amount invested (RM million) AA1 1.5 17 8 3.6 AA2 0.0 5 1 5.4 AA3 0.8 10 4 5.8 AA4 1.0 13 12 3.2 Continued... Portfolio B Equity Expected Return (%) Standard Amount invested YAPVC 2/4 BFN 2054 PORTFOLIO MANAGEMENT MARCH 2021 investments Beta (RM million) Deviation of return (%) BB1 1.2 12 10 7.4 BB2 0.7 10 4 2.8 BB3 0.3 6 2 5.2 BB4 1.6 17 14 2.8 (a) Used the capital asset pricing model (CAPM) to compare the portfolios. The current equity risk premium is estimated to be 5.5% and the yield on Treasury Bill is 4.5%. Using the information provided, recommend which one of the two portfolios should be selected. (10 marks) (b) Explain whether the capital asset pricing model (CAPM) and portfolio theory use the same measure of risk. Discuss whether portfolio theory or capital asset pricing model to be most appropriate when choosing between portfolios in part (a). (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts