Question: Please help me to answer this question 1. Conditionl: If you and your friend contribute $ 50,000 respectively to register a consulting office, what type

Please help me to answer this question

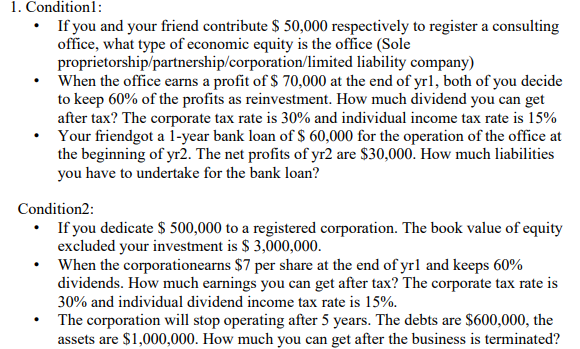

1. Conditionl: If you and your friend contribute $ 50,000 respectively to register a consulting office, what type of economic equity is the office (Sole proprietorship/partnership/corporation/limited liability company) When the office earns a profit of $ 70,000 at the end of yrl, both of you decide to keep 60% of the profits as reinvestment. How much dividend you can get after tax? The corporate tax rate is 30% and individual income tax rate is 15% Your friendgot a 1-year bank loan of $ 60,000 for the operation of the office at the beginning of yr2. The net profits of yr2 are $30,000. How much liabilities you have to undertake for the bank loan? Condition2: If you dedicate $ 500,000 to a registered corporation. The book value of equity excluded your investment is $ 3,000,000. When the corporationearns $7 per share at the end of yrl and keeps 60% dividends. How much earnings you can get after tax? The corporate tax rate is 30% and individual dividend income tax rate is 15%. The corporation will stop operating after 5 years. The debts are $600,000, the assets are $1,000,000. How much you can get after the business is terminated? 1. Conditionl: If you and your friend contribute $ 50,000 respectively to register a consulting office, what type of economic equity is the office (Sole proprietorship/partnership/corporation/limited liability company) When the office earns a profit of $ 70,000 at the end of yrl, both of you decide to keep 60% of the profits as reinvestment. How much dividend you can get after tax? The corporate tax rate is 30% and individual income tax rate is 15% Your friendgot a 1-year bank loan of $ 60,000 for the operation of the office at the beginning of yr2. The net profits of yr2 are $30,000. How much liabilities you have to undertake for the bank loan? Condition2: If you dedicate $ 500,000 to a registered corporation. The book value of equity excluded your investment is $ 3,000,000. When the corporationearns $7 per share at the end of yrl and keeps 60% dividends. How much earnings you can get after tax? The corporate tax rate is 30% and individual dividend income tax rate is 15%. The corporation will stop operating after 5 years. The debts are $600,000, the assets are $1,000,000. How much you can get after the business is terminated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts