Question: Please help me to answer this question. I already know the correct answer is a, but I wnat to know why. And I hope someone

Please help me to answer this question. I already know the correct answer is a, but I wnat to know why. And I hope someone can show how to calculate it. Thanks.

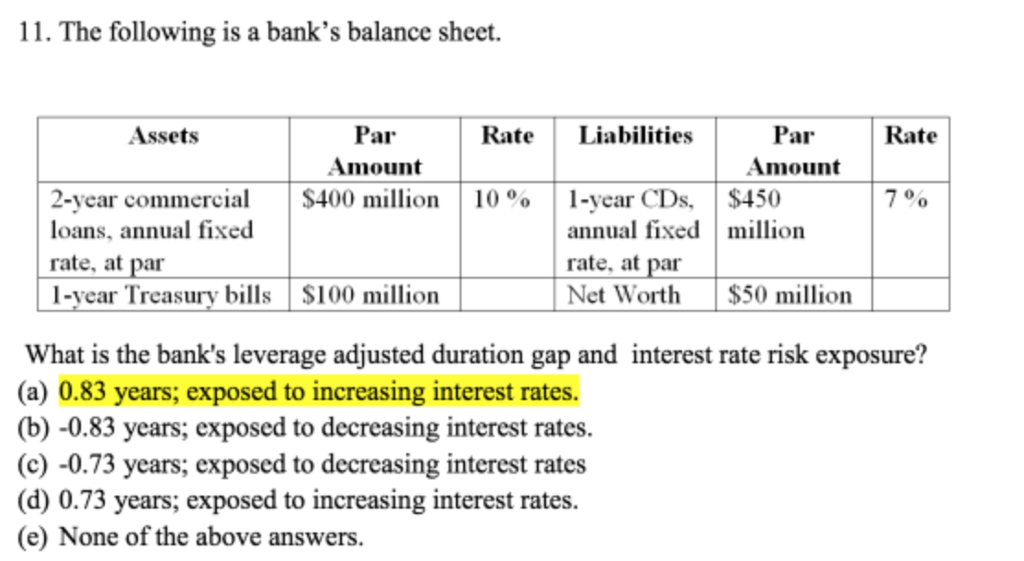

11. The following is a bank's balance sheet. Par Amount $400 million RateLiabilities Par Amount Assets Rate | 1-year CDs. annual fixed million rate, at par Net Worth $50 million 2-year commercial 10 % | $450 0 0 loans, annual fixed rate, at par I-year Treasury bills $100 million What is the bank's leverage adjusted duration gap and interest rate risk exposure? (a) 0.83 years; exposed to increasing interest rates. (b) -0.83 years; exposed to decreasing interest rates. (c) -0.73 years; exposed to decreasing interest rates (d) 0.73 years; exposed to increasing interest rates. (e) None of the above answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts