Question: Please help me to answer this question in full details. Much appreciate. Required: Outline the international and Australian tax implications resulting lrom each of the

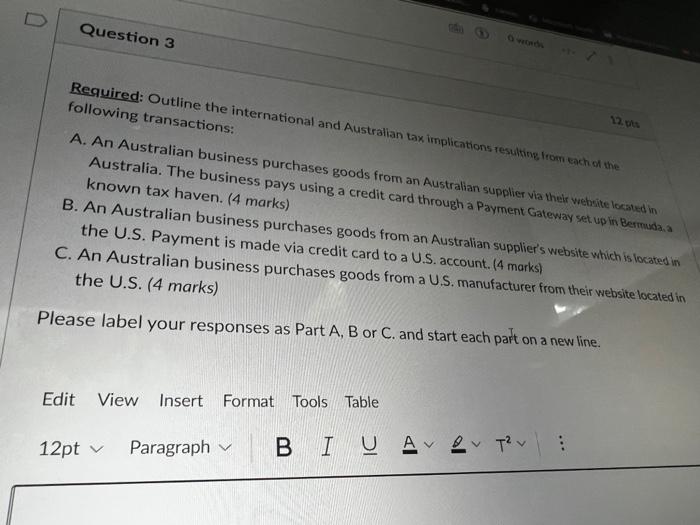

Required: Outline the international and Australian tax implications resulting lrom each of the following transactions: A. An Australian business purchases goods from an Australian supplier via their website locsued in Australia. The business pays using a credit card through a Payment Gateway set up lir Bermuda.a known tax haven. (4 marks) B. An Australian business purchases goods from an Australian supplier's website which is located in the U.S. Payment is made via credit card to a U.S. account. (4 marks) C. An Australian business purchases goods from a U.S. manufacturer from their website localed in the U.S. (4 marks) Please label your responses as Part A, B or C. and start each part on a new line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts