Question: Please help me to answer this question, my professor does not explained well :( Thank you for your support Presented below is an amortization schedule

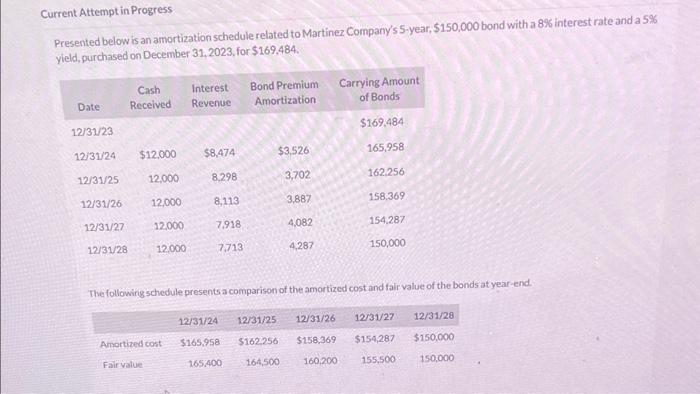

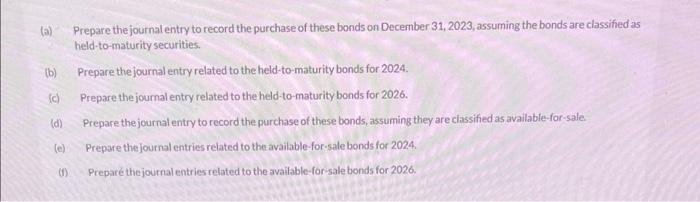

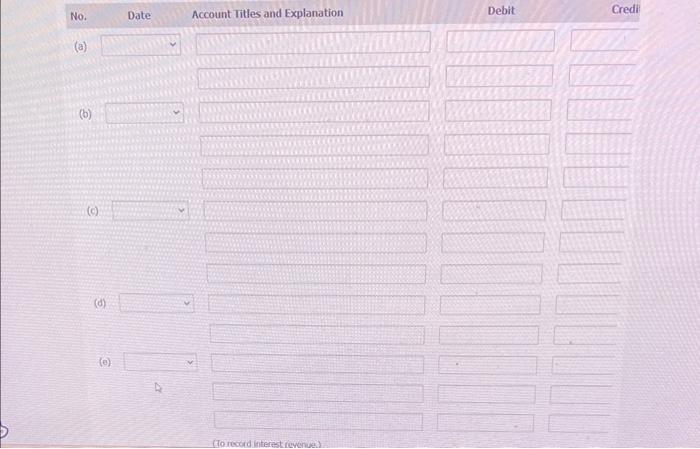

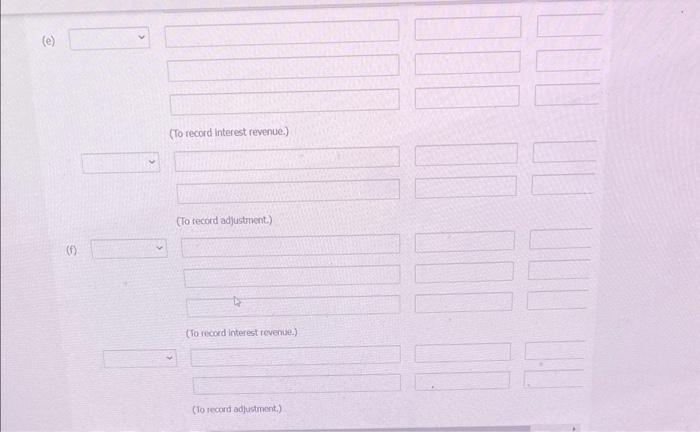

Presented below is an amortization schedule related to Martinez. Company/55-year, $150,000 bond with a 8% interest rate and a 5% yield, purchased on December 31, 2023, for $169,484. The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end. (a) Prepare the journal entry to record the purchase of these bonds on December 31,2023 , assuming the bonds are classified as held-to-maturity securities. (b) Prepare the journal entry related to the held-to-maturity bonds for 2024. (c) Prepare the journal entry related to the held-to-maturity bonds for 2026. (d) Prepare the journal entry to record the purchase of these bonds, assuming they are ciassified as available-for-sale. (e) Prepare the journal entries related to the available-for-sale bonds for 202,4. (f) Prepare the journal entries related to the available-for-sale bonds for 2026. No. Date Account Titles and Explanation Debit Credi (a) (b) (c) (d) (b) (e) (To record interest revenue) (To record adjustment) (f) (So rocord interest ievenue.) (To record adlustment.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts