Question: Please help me to answer this question. Polytech Inc. calculated its Net Income for its Dec. 31st, 2022, year-end as follows: Other Information: A. Other

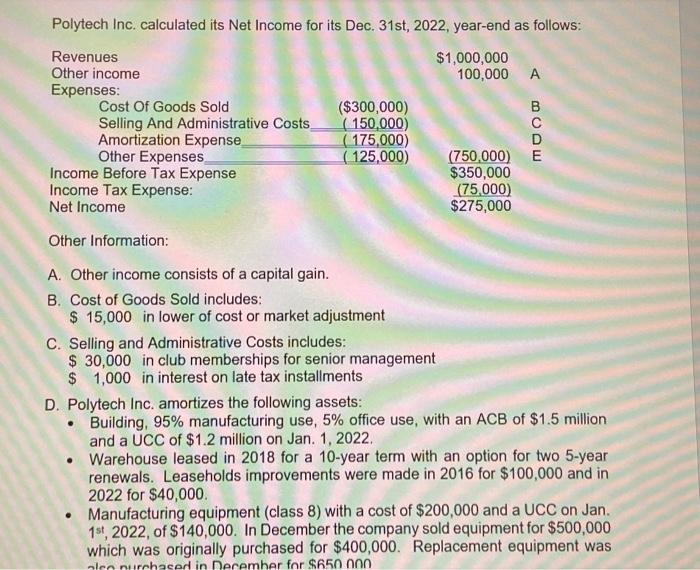

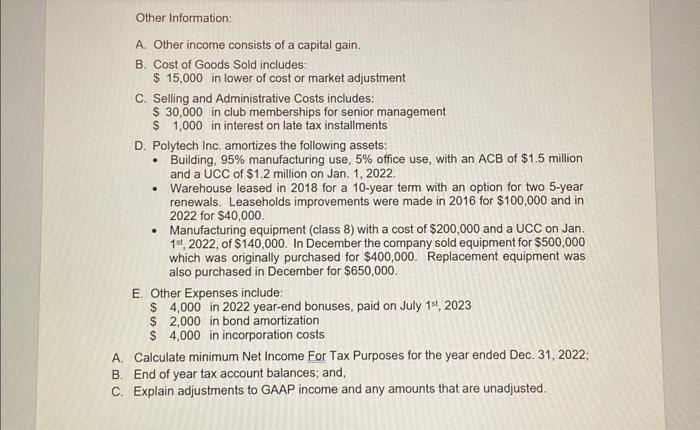

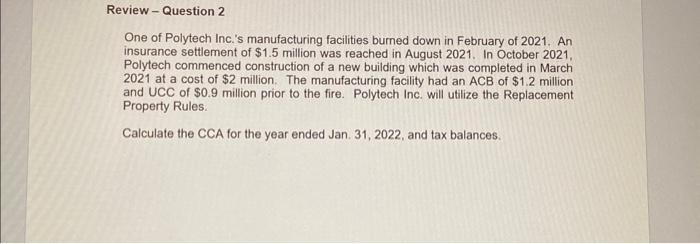

Polytech Inc. calculated its Net Income for its Dec. 31st, 2022, year-end as follows: Other Information: A. Other income consists of a capital gain. B. Cost of Goods Sold includes: $15,000 in lower of cost or market adjustment C. Selling and Administrative Costs includes: $30,000 in club memberships for senior management $1,000 in interest on late tax installments D. Polytech Inc. amortizes the following assets: - Building, 95% manufacturing use, 5% office use, with an ACB of $1.5 million and a UCC of \$1.2 million on Jan. 1, 2022. - Warehouse leased in 2018 for a 10 -year term with an option for two 5-year renewals. Leaseholds improvements were made in 2016 for $100,000 and in 2022 for $40,000. - Manufacturing equipment (class 8) with a cost of $200,000 and a UCC on Jan. 1st,2022, of $140,000. In December the company sold equipment for $500,000 which was originally purchased for $400,000. Replacement equipment was B. Cost of Goods Sold includes: $15,000 in lower of cost or market adjustment C. Selling and Administrative Costs includes: $30,000 in club memberships for senior management \$ 1,000 in interest on late tax installments D. Polytech Inc. amortizes the following assets: - Building, 95% manufacturing use, 5% office use, with an ACB of $1.5 million and a UCC of \$1.2 million on Jan. 1, 2022. - Warehouse leased in 2018 for a 10-year term with an option for two 5-year renewals. Leaseholds improvements were made in 2016 for $100,000 and in 2022 for $40,000. - Manufacturing equipment (class 8) with a cost of $200,000 and a UCC on Jan. 1st,2022, of $140,000. In December the company sold equipment for $500,000 which was originally purchased for $400,000. Replacement equipment was also purchased in December for $650,000. E. Other Expenses include: $4,000 in 2022 year-end bonuses, paid on July 1st,2023 $2,000 in bond amortization $4,000 in incorporation costs A. Calculate minimum Net Income For Tax Purposes for the year ended Dec. 31, 2022; Explanation of adjustments and unadjusted amounts. Calculations and end of or year tax balances Review - Question 2 One of Polytech Inc.'s manufacturing facilities burned down in February of 2021. An insurance settlement of $1.5 million was reached in August 2021. In October 2021, Polytech commenced construction of a new building which was completed in March 2021 at a cost of $2 million. The manufacturing facility had an ACB of $1.2 million and UCC of $0.9 million prior to the fire. Polytech Inc. will utilize the Replacement Property Rules. Calculate the CCA for the year ended Jan. 31, 2022, and tax balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts