Question: Please help me to answer this question, thanks a lot~ Bob owns 100% of a business that is an LLC. You do business with Bob

Please help me to answer this question, thanks a lot~

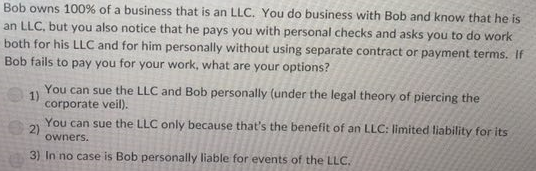

Bob owns 100% of a business that is an LLC. You do business with Bob and know that he is an LLC, but you also notice that he pays you with personal checks and asks you to do work both for his LLC and for him personally without using separate contract or payment terms. If Bob fails to pay you for your work, what are your options? You can sue the LLC and Bob personally (under the legal theory of piercing the corporate veil). You can sue the LLC only because that's the benefit of an LLC: limited liability for its 2) owners. 3) In no case is Bob personally liable for events of the LLC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts