Question: please help me to answer tq please show step by step please show step by step Shenhua Group Corporation Limited is a holding company that

please help me to answer tq please show step by step please show step by step

Shenhua Group Corporation Limited is a holding company that owns China Shenhua Energy. China Shenhua Energy is one of the worlds biggest coal producers and the largest coal mining state-owned enterprise in China. Its main business is coal mining and producing, railway and port transportation of its coal as well as power generation. It takes up to 10 years to acquire property, obtain the necessary permits, design the plant, arrange the financing, and complete the construction of a large generating plant. Moreover, utilities like China Shenhua Energy are required by law to have electricity available when it is demanded-when people turn on the switch, the utility must have the energy its customers expect or suffer severe fines and other penalties. Thus, China Shenhua must have the energy its customers expect or suffer severe fines and penalties. Also, for China Shenhuas coal business, demand is cyclical. In an economic recession demand for raw materials like coal falls and China Shenhua would suffer from falling coal prices as well. If China Shenhua had invested heavily in mines and had an oversupply during the recession, it would not bode well for company. Making a 10-year forecast is always difficult, but the 2008-2009 recession increased this difficulty tremendously. India and China, two very large sources of demand for China Shenhua Energys products cut back on coal consumption during the financial crisis. As many businesses in Mainland China reduced production during this time, demand for power also went down. No one could know when these two industries, power generation and coal would recover. Hence, no one could accurately forecast world demand for coal and local demand for power or thus, the need for new generation capacity. In the aftermath of the massive earthquake in Japan in 2011, several nuclear reactors risked a nuclear meltdown. The event highlights the high risk of the use of nuclear energy leading governments around the world to put on hold their future plants to deploy nuclear energy. This results in the increase in demand for coal and energy source. The China Shenhua Energy story is typical, and it illustrates that capital budgeting is critically important booth to companies and to the economy. The principles set forth will help you make the right choices regarding which projects to accept and which to reject for the two recent proposals: Project ABC and Project XYZ. All figures are presented in thousands of US dollars:

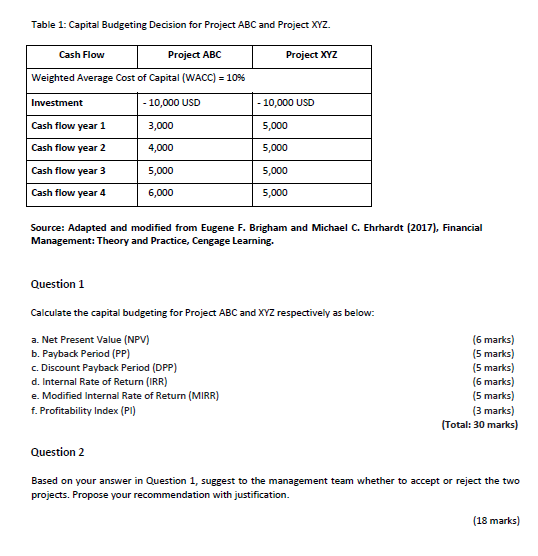

Table 1: Capital Budgeting Decision for Project ABC and Project XYZ. Source: Adapted and modified from Eugene F. Brigham and Michael C. Ehrhardt (2017), Financial Management: Theory and Practice, Cengage Learning. Question 1 Calculate the capital budgeting for Project ABC and XYZ respectively as below: a. Net Present Value (NPV) b. Payback Period (PP) c. Discount Payback Period (DPP) d. Internal Rate of Return (IRR) e. Modified Internal Rate of Return (MIRR) f. Profitability Index (PI) (6 marks) (5 marks) (5 marks) (6 marks) (5 marks) (3 marks) (Total: 30 marks) Question 2 Based on your answer in Question 1, suggest to the management team whether to accept or reject the two projects. Propose your recommendation with justification

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts