Question: Please help me to calculate the operating cash inflow, operating cash outflow, investing cash inflow, investing cash outflow, financing cash inflow and financing cash outflow?

Please help me to calculate the operating cash inflow, operating cash outflow, investing cash inflow, investing cash outflow, financing cash inflow and financing cash outflow? (based on cash flow statement above). thanks

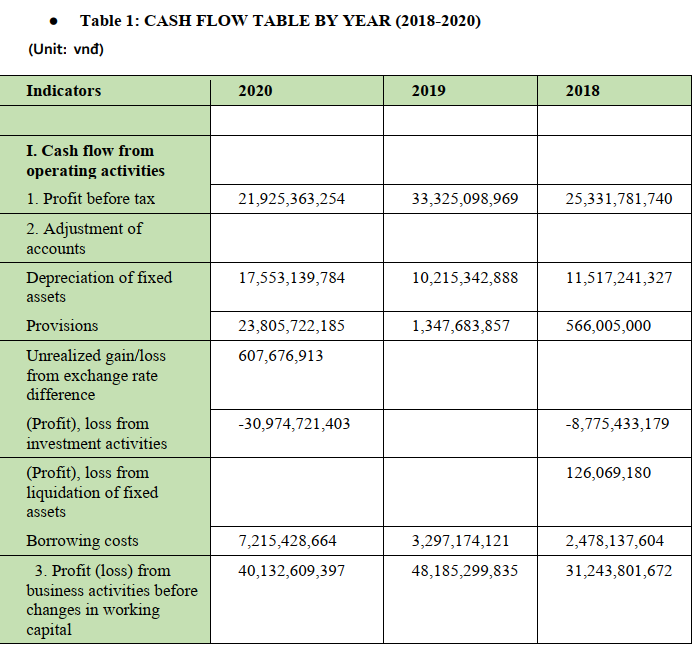

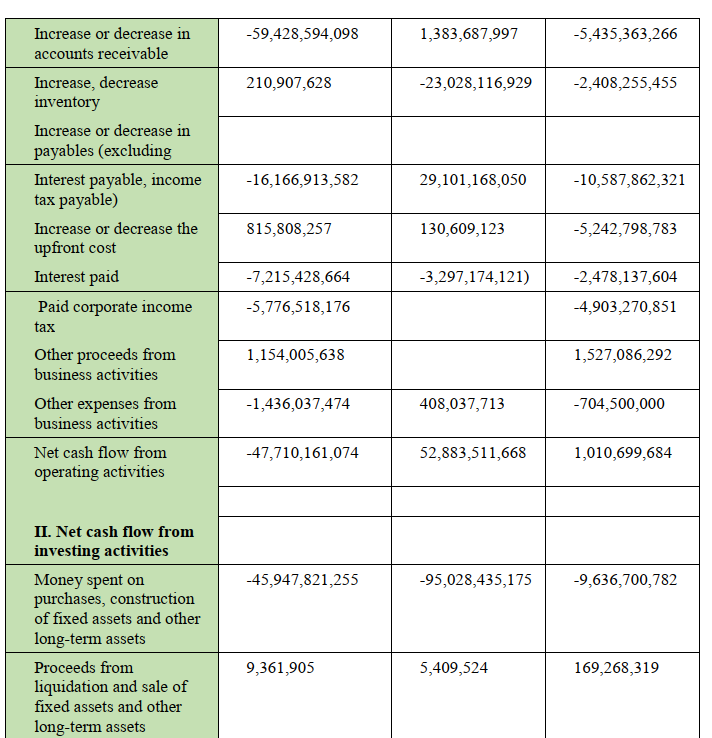

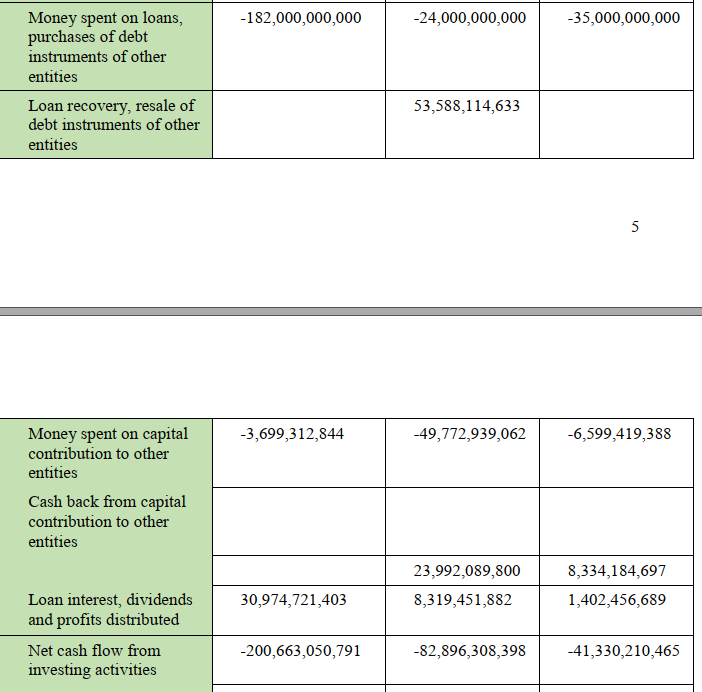

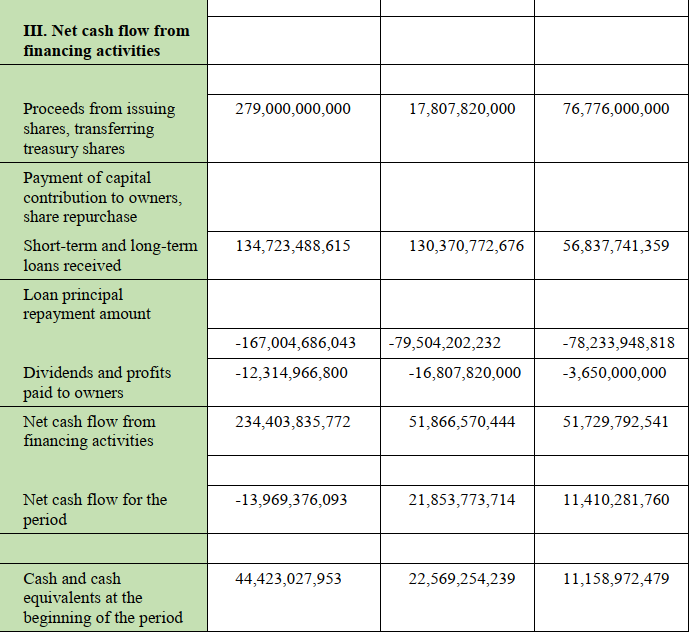

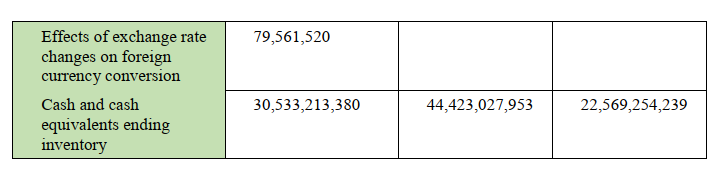

- Table 1: CASH FLOW TABLE BY YEAR (2018-2020) \begin{tabular}{|l|l|l|l|} \hline Moneyspentonloans,purchasesofdebtinstrumentsofotherentities & 182,000,000,000 & 24,000,000,000 & 35,000,000,000 \\ \hline Loanrecovery,resaleofdebtinstrumentsofotherentities & & 53,588,114,633 & \\ \hline \end{tabular} 5 \begin{tabular}{l|c|c|c|} \hline Moneyspentoncapitalcontributiontootherentities & 3,699,312,844 & 49,772,939,062 & 6,599,419,388 \\ \cline { 2 - 4 } Cashbackfromcapitalcontributiontootherentities & & & \\ \cline { 2 - 4 } & & 23,992,089,800 & 8,334,184,697 \\ \cline { 2 - 4 } & 30,974,721,403 & 8,319,451,882 & 1,402,456,689 \\ \hline Loaninterest,dividendsandprofitsdistributed & 200,663,050,791 & 82,896,308,398 & 41,330,210,465 \\ \hline Netcashflowfrominvestingactivities & & & \\ \cline { 2 - 4 } & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Effectsofexchangeratechangesonforeigncurrencyconversion & 79,561,520 & & \\ \cline { 2 - 4 } Cashandcashequivalentsendinginventory & 30,533,213,380 & 44,423,027,953 & 22,569,254,239 \\ \hline \end{tabular} - Table 1: CASH FLOW TABLE BY YEAR (2018-2020) \begin{tabular}{|l|l|l|l|} \hline Moneyspentonloans,purchasesofdebtinstrumentsofotherentities & 182,000,000,000 & 24,000,000,000 & 35,000,000,000 \\ \hline Loanrecovery,resaleofdebtinstrumentsofotherentities & & 53,588,114,633 & \\ \hline \end{tabular} 5 \begin{tabular}{l|c|c|c|} \hline Moneyspentoncapitalcontributiontootherentities & 3,699,312,844 & 49,772,939,062 & 6,599,419,388 \\ \cline { 2 - 4 } Cashbackfromcapitalcontributiontootherentities & & & \\ \cline { 2 - 4 } & & 23,992,089,800 & 8,334,184,697 \\ \cline { 2 - 4 } & 30,974,721,403 & 8,319,451,882 & 1,402,456,689 \\ \hline Loaninterest,dividendsandprofitsdistributed & 200,663,050,791 & 82,896,308,398 & 41,330,210,465 \\ \hline Netcashflowfrominvestingactivities & & & \\ \cline { 2 - 4 } & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Effectsofexchangeratechangesonforeigncurrencyconversion & 79,561,520 & & \\ \cline { 2 - 4 } Cashandcashequivalentsendinginventory & 30,533,213,380 & 44,423,027,953 & 22,569,254,239 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts