Question: Please help me to check it and provide your process. Thank you. Problem 4-18 Two-stage DCF model Consider the following three stocks: a. Stock A

Please help me to check it and provide your process. Thank you.

Please help me to check it and provide your process. Thank you.

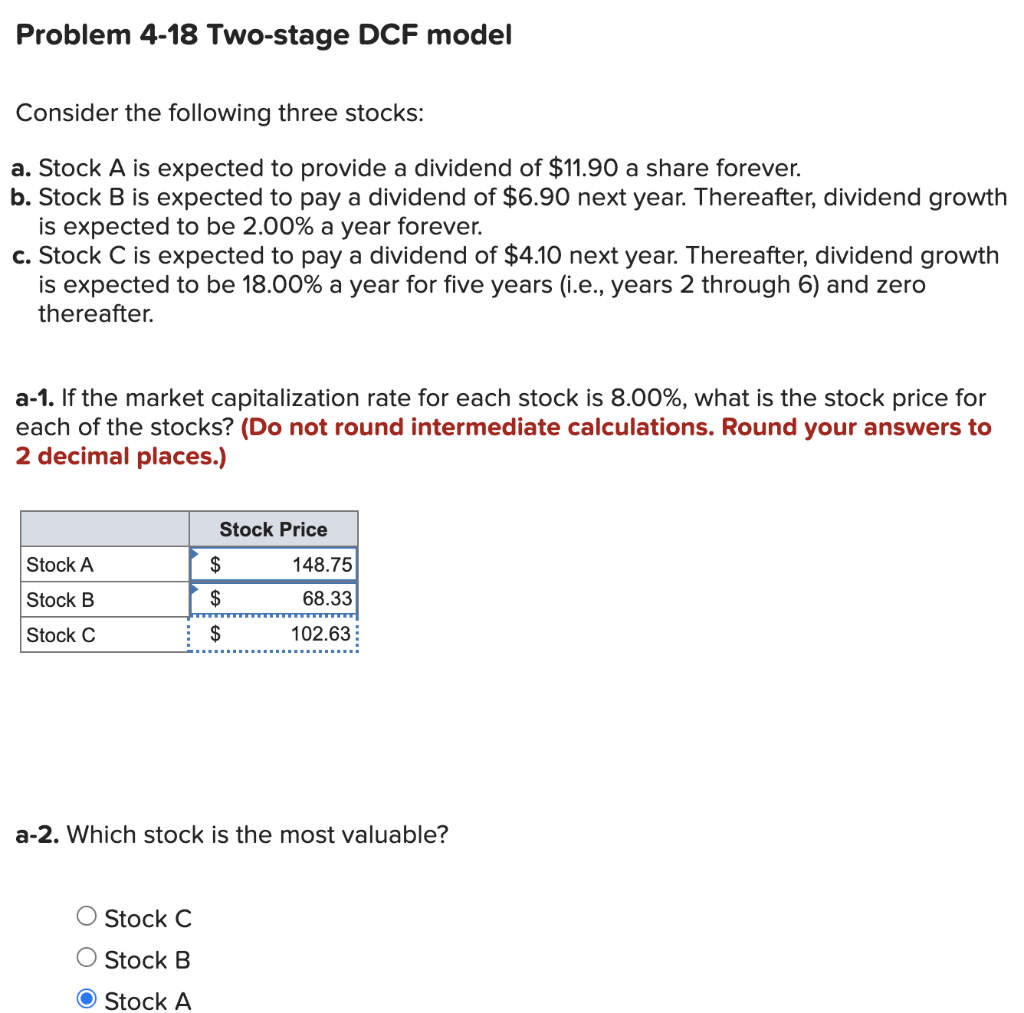

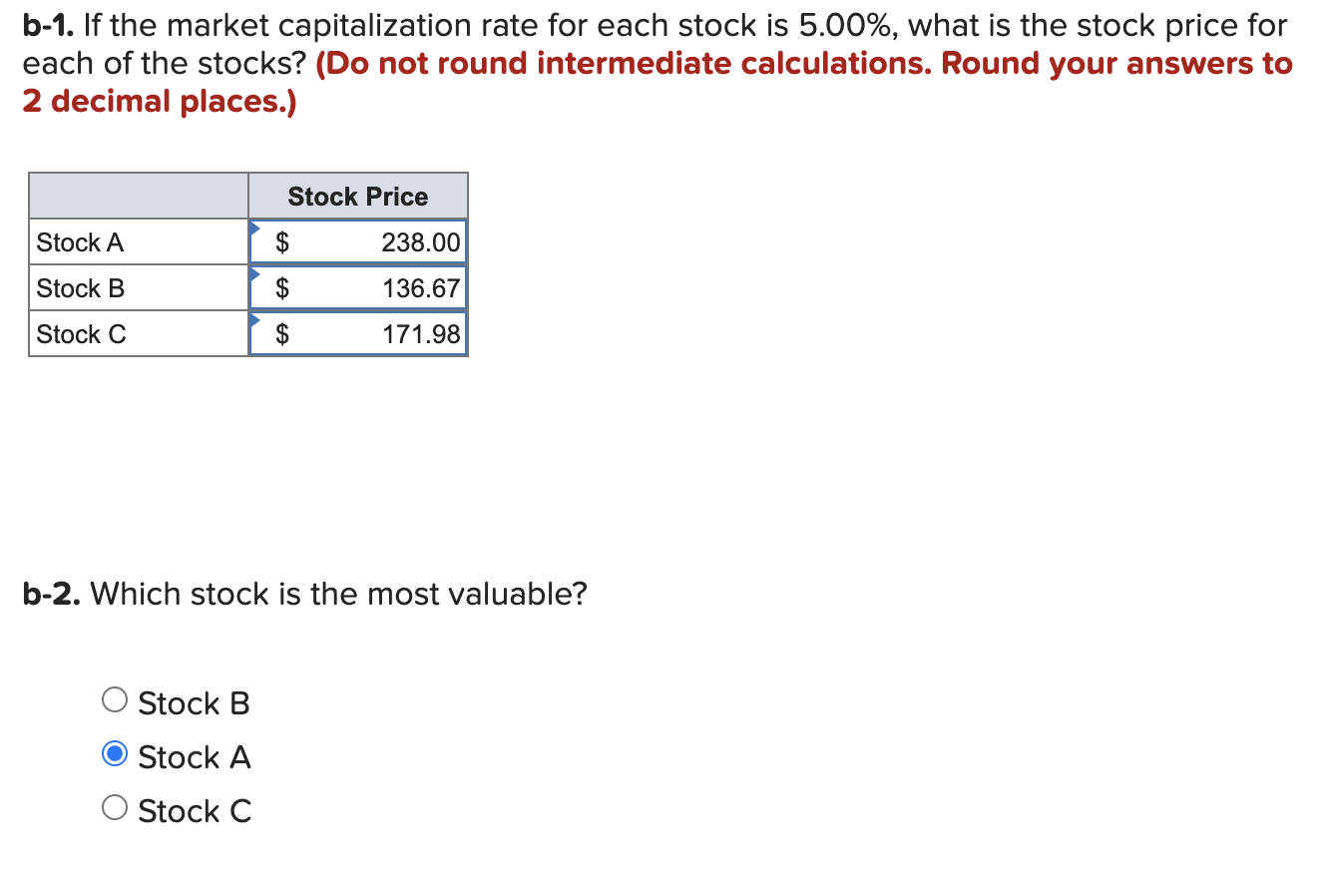

Problem 4-18 Two-stage DCF model Consider the following three stocks: a. Stock A is expected to provide a dividend of $11.90 a share forever. b. Stock B is expected to pay a dividend of $6.90 next year. Thereafter, dividend growth is expected to be 2.00% a year forever. c. Stock C is expected to pay a dividend of $4.10 next year. Thereafter, dividend growth is expected to be 18.00% a year for five years (i.e., years 2 through 6) and zero thereafter. a-1. If the market capitalization rate for each stock is 8.00%, what is the stock price for each of the stocks? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock Price Stock A $ 148.75 68.33 Stock B $ Stock C $ 102.63 : a-2. Which stock is the most valuable? O Stock C O Stock B O Stock A b-1. If the market capitalization rate for each stock is 5.00%, what is the stock price for each of the stocks? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock Price Stock A $ 238.00 Stock B $ 136.67 Stock C $ 171.98 b-2. Which stock is the most valuable? Stock B Stock A O Stock C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts