Question: Please help me to complete question 1aand 1bfor this . Thank you so much Case Studies 1a. Journalize the following entries. Refer to the chart

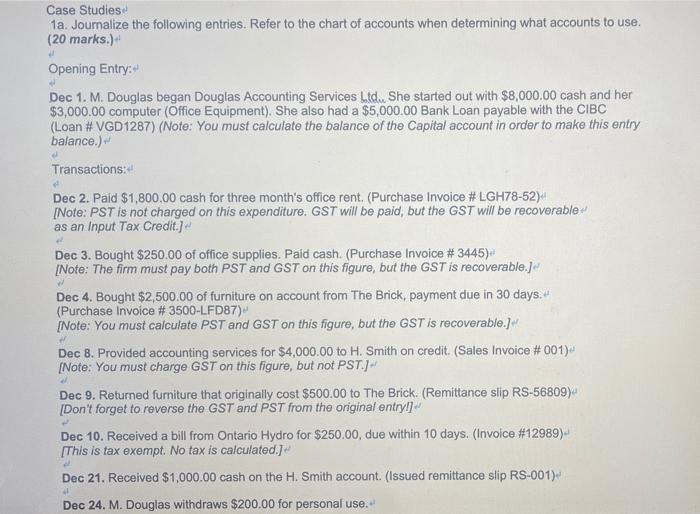

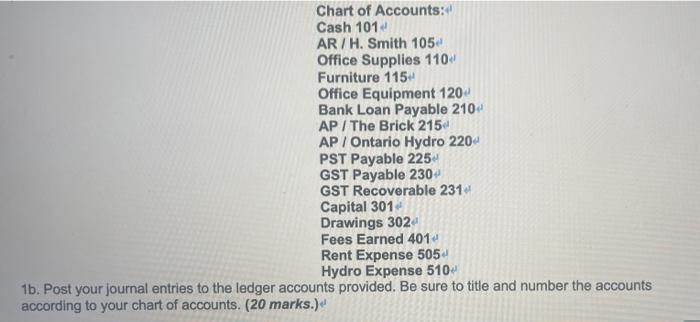

Case Studies 1a. Journalize the following entries. Refer to the chart of accounts when determining what accounts to use. (20 marks.) Opening Entry:- Dec 1. M. Douglas began Douglas Accounting Services Ltd. She started out with $8,000.00 cash and her $3,000.00 computer (Office Equipment). She also had a $5,000.00 Bank Loan payable with the CIBC (Loan # VGD1287) (Note: You must calculate the balance of the Capital account in order to make this entry balance.) Transactions: Dec 2. Paid $1,800.00 cash for three month's office rent. (Purchase Invoice # LGH78-52) [Note: PST is not charged on this expenditure. GST will be paid, but the GST will be recoverable! as an Input Tax Credit.) Dec 3. Bought $250.00 of office supplies. Paid cash. (Purchase Invoice # 3445) [Note: The firm must pay both PST and GST on this figure, but the GST is recoverable.) Dec 4. Bought $2,500.00 of furniture on account from The Brick, payment due in 30 days. (Purchase Invoice # 3500-LFD87) [Note: You must calculate PST and GST on this figure, but the GST is recoverable.) Dec 8. Provided accounting services for $4,000.00 to H. Smith on credit. (Sales Invoice # 001) [Note: You must charge GST on this figure, but not PST.) Dec 9. Returned furniture that originally cost $500.00 to The Brick. (Remittance slip RS-56809) [Don't forget to reverse the GST and PST from the original entry!] Dec 10. Received a bill from Ontario Hydro for $250.00, due within 10 days. (Invoice #12989) [This is tax exempt. No tax is calculated.] Dec 21. Received $1,000.00 cash on the H. Smith account. (Issued remittance slip RS-001) Dec 24. M. Douglas withdraws $200.00 for personal use. Chart of Accounts: Cash 101 AR/H. Smith 105 Office Supplies 110 Furniture 115 Office Equipment 120 Bank Loan Payable 210 AP/ The Brick 215 AP / Ontario Hydro 220 PST Payable 225 GST Payable 230 GST Recoverable 231 Capital 301 Drawings 302 Fees Earned 401 Rent Expense 505 Hydro Expense 510 1b. Post your journal entries to the ledger accounts provided. Be sure to title and number the accounts according to your chart of accounts. (20 marks.) Case Studies 1a. Journalize the following entries. Refer to the chart of accounts when determining what accounts to use. (20 marks.) Opening Entry:- Dec 1. M. Douglas began Douglas Accounting Services Ltd. She started out with $8,000.00 cash and her $3,000.00 computer (Office Equipment). She also had a $5,000.00 Bank Loan payable with the CIBC (Loan # VGD1287) (Note: You must calculate the balance of the Capital account in order to make this entry balance.) Transactions: Dec 2. Paid $1,800.00 cash for three month's office rent. (Purchase Invoice # LGH78-52) [Note: PST is not charged on this expenditure. GST will be paid, but the GST will be recoverable! as an Input Tax Credit.) Dec 3. Bought $250.00 of office supplies. Paid cash. (Purchase Invoice # 3445) [Note: The firm must pay both PST and GST on this figure, but the GST is recoverable.) Dec 4. Bought $2,500.00 of furniture on account from The Brick, payment due in 30 days. (Purchase Invoice # 3500-LFD87) [Note: You must calculate PST and GST on this figure, but the GST is recoverable.) Dec 8. Provided accounting services for $4,000.00 to H. Smith on credit. (Sales Invoice # 001) [Note: You must charge GST on this figure, but not PST.) Dec 9. Returned furniture that originally cost $500.00 to The Brick. (Remittance slip RS-56809) [Don't forget to reverse the GST and PST from the original entry!] Dec 10. Received a bill from Ontario Hydro for $250.00, due within 10 days. (Invoice #12989) [This is tax exempt. No tax is calculated.] Dec 21. Received $1,000.00 cash on the H. Smith account. (Issued remittance slip RS-001) Dec 24. M. Douglas withdraws $200.00 for personal use. Chart of Accounts: Cash 101 AR/H. Smith 105 Office Supplies 110 Furniture 115 Office Equipment 120 Bank Loan Payable 210 AP/ The Brick 215 AP / Ontario Hydro 220 PST Payable 225 GST Payable 230 GST Recoverable 231 Capital 301 Drawings 302 Fees Earned 401 Rent Expense 505 Hydro Expense 510 1b. Post your journal entries to the ledger accounts provided. Be sure to title and number the accounts according to your chart of accounts. (20 marks.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts