Question: PLEASE HELP ME TO DO THESE HW ASAP, PLEASE DO THEM ALL CORRECTLY ASAP. I WOULD LOVE IT IF YOU ADDED ALL THE STEPS IF

PLEASE HELP ME TO DO THESE HW ASAP, PLEASE DO THEM ALL CORRECTLY ASAP. I WOULD LOVE IT IF YOU ADDED ALL THE STEPS IF NOT THEN PLEASE PUT THE RIGHT ANSWER FOR EACH PART AND MAKE SURE TO PUT THE NUMBER OF THE QUESTION/PART BESIDE ITS ANSWER TO MAKE IT CLEAR TO ME. ANSWER ALL QUESTIONS CORRECTLY TO GET A LIKE. THANK U:)

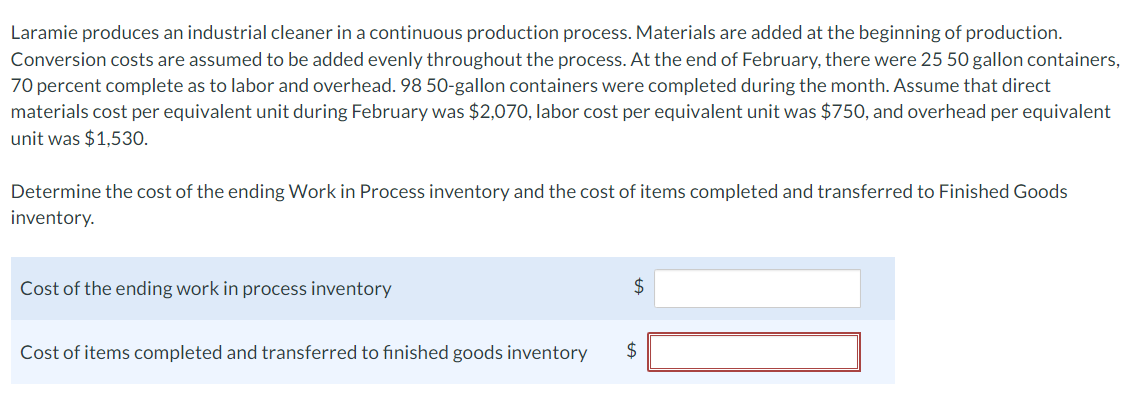

QUESTION 1)

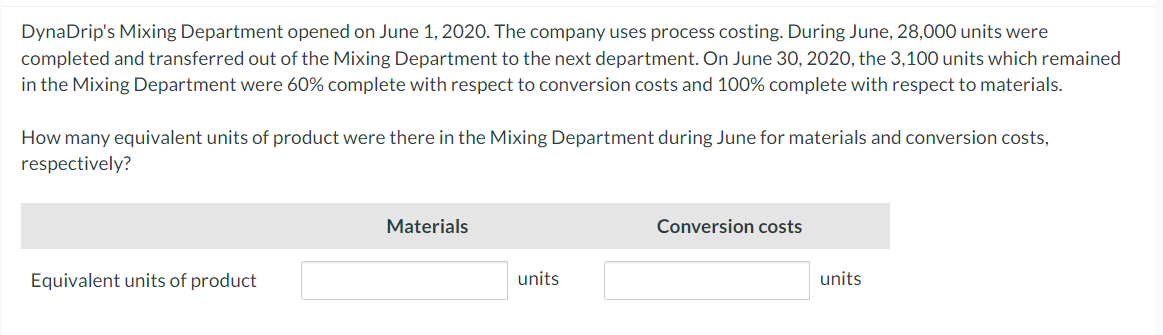

QUESTION 2)

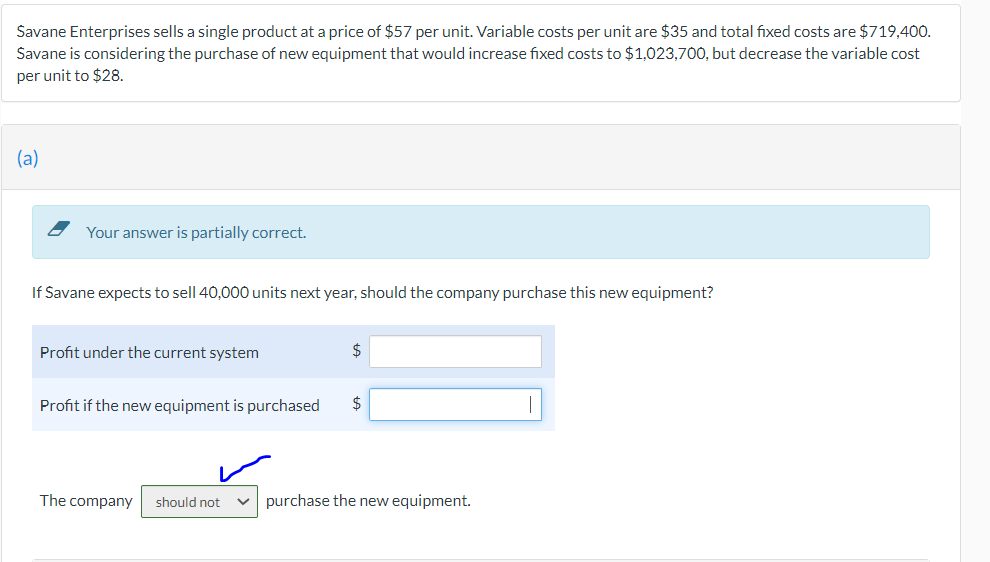

QUESTION 3)

QUESTION 3)

PLEASE HELP ME TO DO THESE HW ASAP, PLEASE DO THEM ALL CORRECTLY ASAP. I WOULD LOVE IT IF YOU ADDED ALL THE STEPS IF NOT THEN PLEASE PUT THE RIGHT ANSWER FOR EACH PART AND MAKE SURE TO PUT THE NUMBER OF THE QUESTION/PART BESIDE ITS ANSWER TO MAKE IT CLEAR TO ME. ANSWER ALL QUESTIONS CORRECTLY TO GET A LIKE. THANK U:)

Laramie produces an industrial cleaner in a continuous production process. Materials are added at the beginning of production. Conversion costs are assumed to be added evenly throughout the process. At the end of February, there were 250 gallon containers, 70 percent complete as to labor and overhead. 98 50-gallon containers were completed during the month. Assume that direct materials cost per equivalent unit during February was $2,070, labor cost per equivalent unit was $750, and overhead per equivalent unit was $1,530. Determine the cost of the ending Work in Process inventory and the cost of items completed and transferred to Finished Goods inventory. Cost of the ending work in process inventory Cost of items completed and transferred to finished goods inventory DynaDrip's Mixing Department opened on June 1, 2020. The company uses process costing. During June, 28,000 units were completed and transferred out of the Mixing Department to the next department. On June 30,2020 , the 3,100 units which remained in the Mixing Department were 60% complete with respect to conversion costs and 100% complete with respect to materials. How many equivalent units of product were there in the Mixing Department during June for materials and conversion costs, respectively? Savane Enterprises sells a single product at a price of $57 per unit. Variable costs per unit are $35 and total fixed costs are $719,400. Savane is considering the purchase of new equipment that would increase fixed costs to $1,023,700, but decrease the variable cost per unit to $28. (a) Your answer is partially correct. If Savane expects to sell 40,000 units next year, should the company purchase this new equipment? Profit under the current system The company purchase the new equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts