please help me to do this calculations..

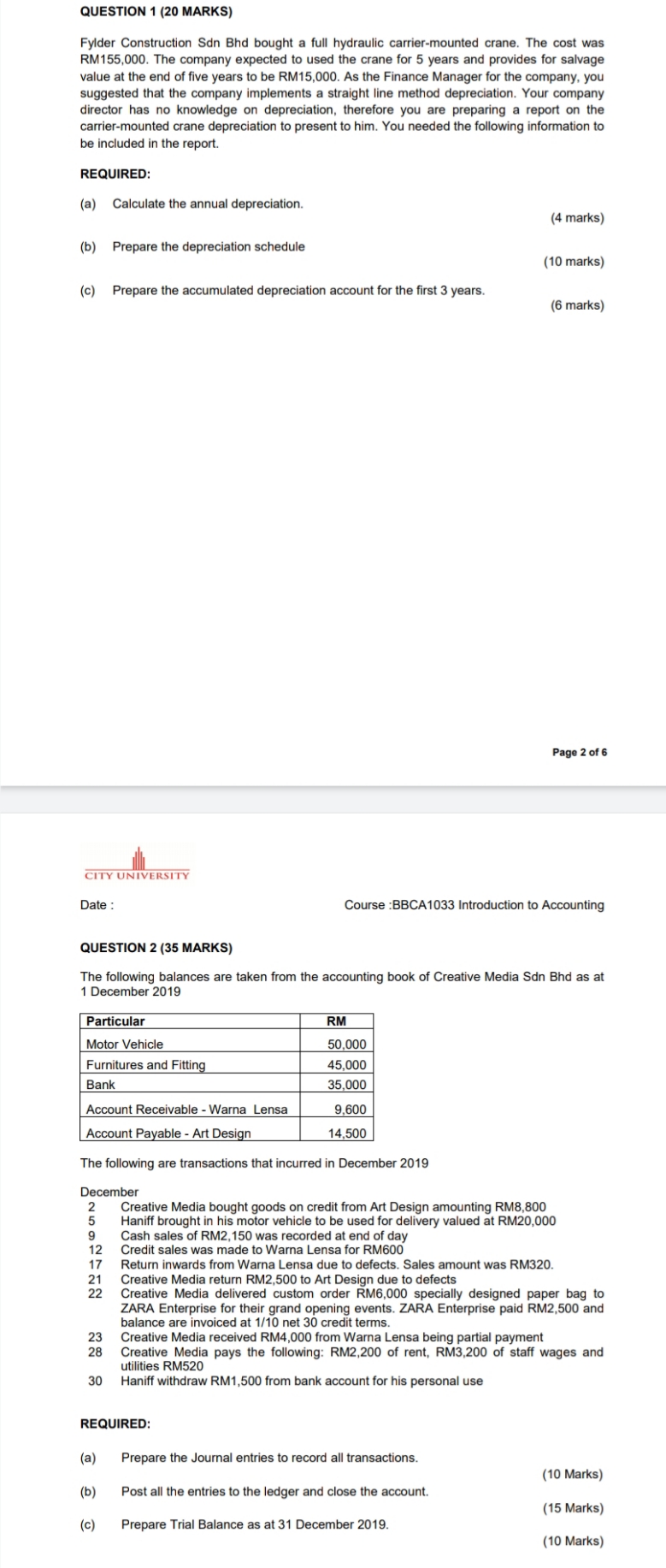

QUESTION 1 (20 MARKS) Fylder Construction Sdn Bhd bought a full hydraulic carrier-mounted crane. The cost was RM155,000. The company expected to used the crane for 5 years and provides for salvage value at the end of five years to be RM15,000. As the Finance Manager for the company, you suggested that the company implements a straight line method depreciation. Your company director has no knowledge on depreciation, therefore you are preparing a report on the carrier-mounted crane depreciation to present to him. You needed the following information to be included in the report. REQUIRED: (a) Calculate the annual depreciation. (4 marks) (b) Prepare the depreciation schedule (10 marks) (c) Prepare the accumulated depreciation account for the first 3 years. (6 marks) Page 2 of 6 CITY UNIVERSITY Date : Course :BBCA1033 Introduction to Accounting QUESTION 2 (35 MARKS) The following balances are taken from the accounting book of Creative Media Sdn Bhd as at 1 December 2019 Particular RM Motor Vehicle 50,000 Furnitures and Fitting 45,000 Bank 35,000 Account Receivable - Warna Lensa 9,600 Account Payable - Art Design 14,500 The following are transactions that incurred in December 2019 December Creative Media bought goods on credit from Art Design amounting RM8,800 Haniff brought in his motor vehicle to be used for delivery valued at RM20,000 Cash sales of RM2,150 was recorded at end of day Credit sales was made to Warna Lensa for RM600 Return inwards from Warna Lensa due to defects. Sales amount was RM320. 21 Creative Media return RM2,500 to Art Design due to defects 22 Creative Media delivered custom order RM6,000 specially designed paper bag to ZARA Enterprise for their grand opening events. ZARA Enterprise paid RM2,500 and balance are invoiced at 1/10 net 30 credit terms. 23 Creative Media received RM4,000 from Warna Lensa being partial payment 28 Creative Media pays the following: RM2,200 of rent, RM3,200 of staff wages and utilities RM520 30 Haniff withdraw RM1,500 from bank account for his personal use REQUIRED: (a) Prepare the Journal entries to record all transactions. (10 Marks) (b) Post all the entries to the ledger and close the account. (15 Marks) (c) Prepare Trial Balance as at 31 December 2019. (10 Marks)