Question: Please help me to do this quickly... Your company has purchased equipment worth $25,000 and would like to compare the impact of straight line depreciation

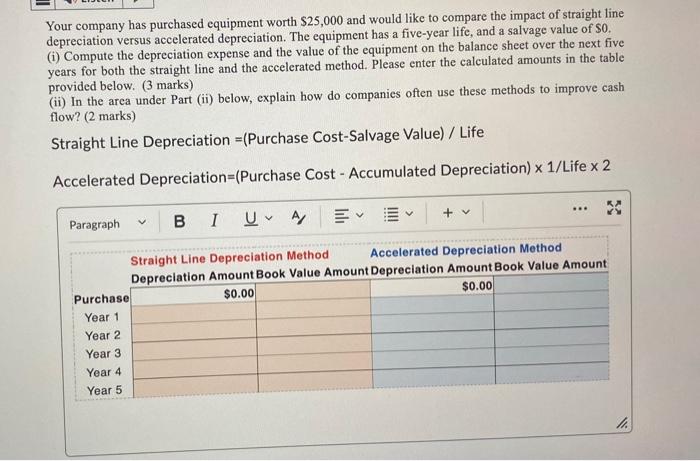

Your company has purchased equipment worth $25,000 and would like to compare the impact of straight line depreciation versus accelerated depreciation. The equipment has a five-year life, and a salvage value of $0. (i) Compute the depreciation expense and the value of the equipment on the balance sheet over the next five years for both the straight line and the accelerated method. Please enter the calculated amounts in the table provided below. ( 3 marks) (ii) In the area under Part (ii) below, explain how do companies often use these methods to improve cash flow? ( 2 marks) Straight Line Depreciation =( Purchase Cost-Salvage Value )/ Life Accelerated Depreciation=(Purchase Cost - Accumulated Depreciation) 1/ Life 2 Part (ii) Explain how do companies often use these methods to improve cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts