Question: please help me to get the correct answer for the one that is incorrect. this is the third time I've asked this question so PLEASE

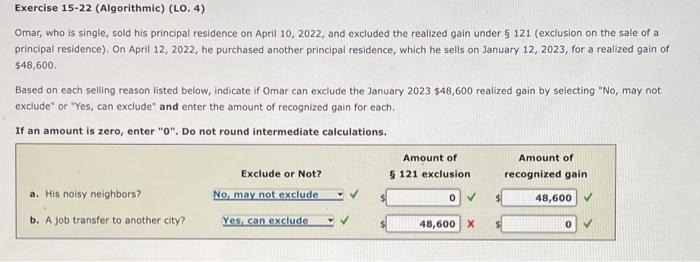

Omar, who is single, sold his principal residence on April 10, 2022, and excluded the realized gain under 121 (exclusion on the sale of a principal residence), On April 12, 2022, he purchased another principal residence, which he sells on January 12,2023 , for a realized gain of 548,600. Based on each selling reason listed below, indicate if Omar can exclude the January 2023$48,600 realized gain by selecting "No, may not exclude" or "Yes, can exclude" and enter the amount of recognized gain for each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts