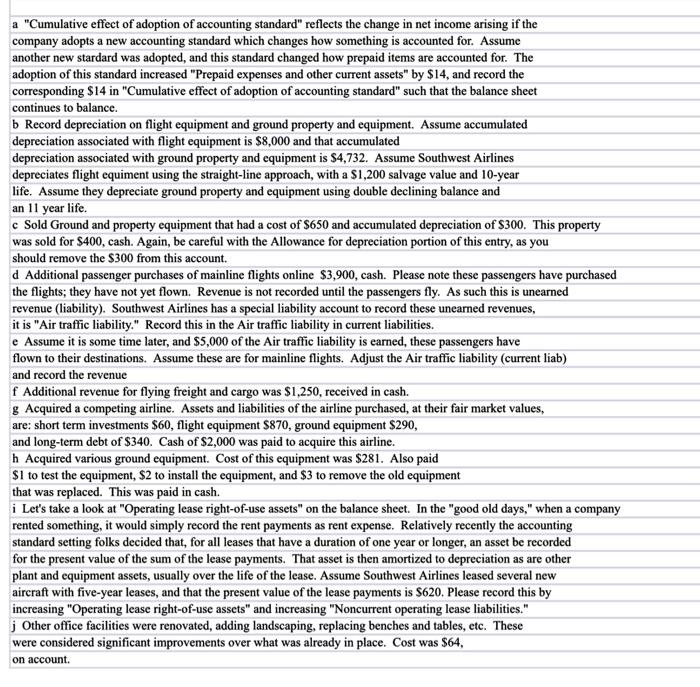

Question: Please help me to record the transactions a Cumulative effect of adoption of accounting standard reflects the change in net income arising if the company

a "Cumulative effect of adoption of accounting standard" reflects the change in net income arising if the company adopts a new accounting standard which changes how something is accounted for. Assume another new stardard was adopted, and this standard changed how prepaid items are accounted for. The adoption of this standard increased "Prepaid expenses and other current assets" by $14, and record the corresponding $14 in "Cumulative effect of adoption of accounting standard" such that the balance sheet continues to balance. b Record depreciation on flight equipment and ground property and equipment. Assume accumulated depreciation associated with flight equipment is $8,000 and that accumulated depreciation associated with ground property and equipment is $4,732. Assume Southwest Airlines depreciates flight equiment using the straight-line approach, with a $1,200 salvage value and 10 -year life. Assume they depreciate ground property and equipment using double declining balance and an 11 year life. c Sold Ground and property equipment that had a cost of $650 and accumulated depreciation of $300. This property was sold for $400, cash. Again, be careful with the Allowance for depreciation portion of this entry, as you should remove the $300 from this account. d Additional passenger purchases of mainline flights online $3,900, cash. Please note these passengers have purchased the flights; they have not yet flown. Revenue is not recorded until the passengers fly. As such this is unearned revenue (liability). Southwest Airlines has a special liability account to record these unearned revenues, it is "Air traffic liability." Record this in the Air traffic liability in current liabilities. e Assume it is some time later, and $5,000 of the Air traffic liability is earned, these passengers have flown to their destinations. Assume these are for mainline flights. Adjust the Air traffic liability (current liab) and record the revenue f Additional revenue for flying freight and cargo was $1,250, received in cash. g Acquired a competing airline. Assets and liabilities of the airline purchased, at their fair market values, are: short term investments $60, flight equipment $870, ground equipment $290, and long-term debt of $340. Cash of $2,000 was paid to acquire this airline. h Acquired various ground equipment. Cost of this equipment was \$281. Also paid $1 to test the equipment, $2 to install the equipment, and $3 to remove the old equipment that was replaced. This was paid in cash. i Let's take a look at "Operating lease right-of-use assets" on the balance sheet. In the "good old days," when a company rented something, it would simply record the rent payments as rent expense. Relatively recently the accounting standard setting folks decided that, for all leases that have a duration of one year or longer, an asset be recorded for the present value of the sum of the lease payments. That asset is then amortized to depreciation as are other plant and equipment assets, usually over the life of the lease. Assume Southwest Airlines leased several new aircraft with five-year leases, and that the present value of the lease payments is $620. Please record this by increasing "Operating lease right-of-use assets" and increasing "Noncurrent operating lease liabilities." j Other office facilities were renovated, adding landscaping, replacing benches and tables, etc. These were considered significant improvements over what was already in place. Cost was $64, on account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts