Question: Please help me to solve it by using Excel Sheet, really confused. Thank you Lingenburger Cheese Corporation has 6.4 million shares of common stock outstanding,

Please help me to solve it by using Excel Sheet, really confused. Thank you

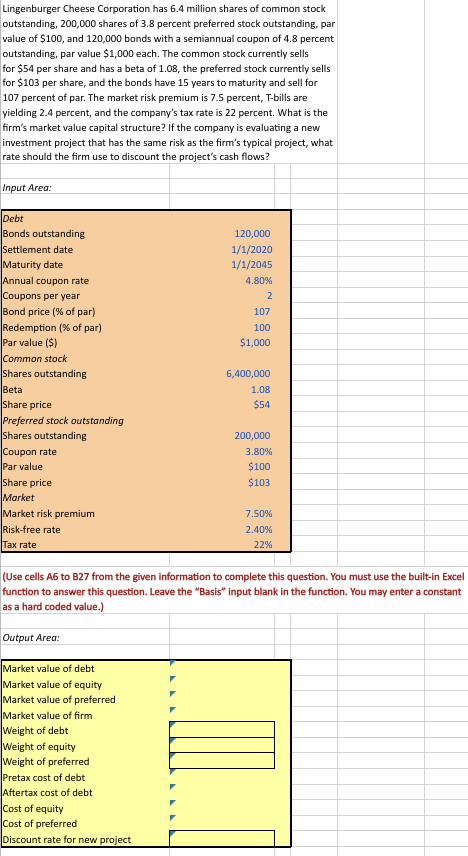

Lingenburger Cheese Corporation has 6.4 million shares of common stock outstanding, 200,000 shares of 3.8 percent preferred stock outstanding, par value of $100, and 120,000 bonds with a semiannual coupon of 4.8 percent outstanding, par value $1,000 each. The common stock currently sells for $54 per share and has a beta of 1.08 , the preferred stock currently sells for $103 per share, and the bonds have 15 years to maturity and sell for 107 percent of par. The market risk premium is 7.5 percent, T-bills are yielding 2.4 percent, and the company's tax rate is 22 percent. What is the firm's market value capital structure? If the company is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? (Use cells A6 to B27 from the given information to complete this question. You must use the built-in Excel function to answer this question. Leave the "Basis" input blank in the function. You may enter a constant as a hard coded value.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts