Question: Please help me to solve it. It's urgent. Drepare the entry to record income tax expense for the year. (Credit account titles are automatically indented

Please help me to solve it. It's urgent.

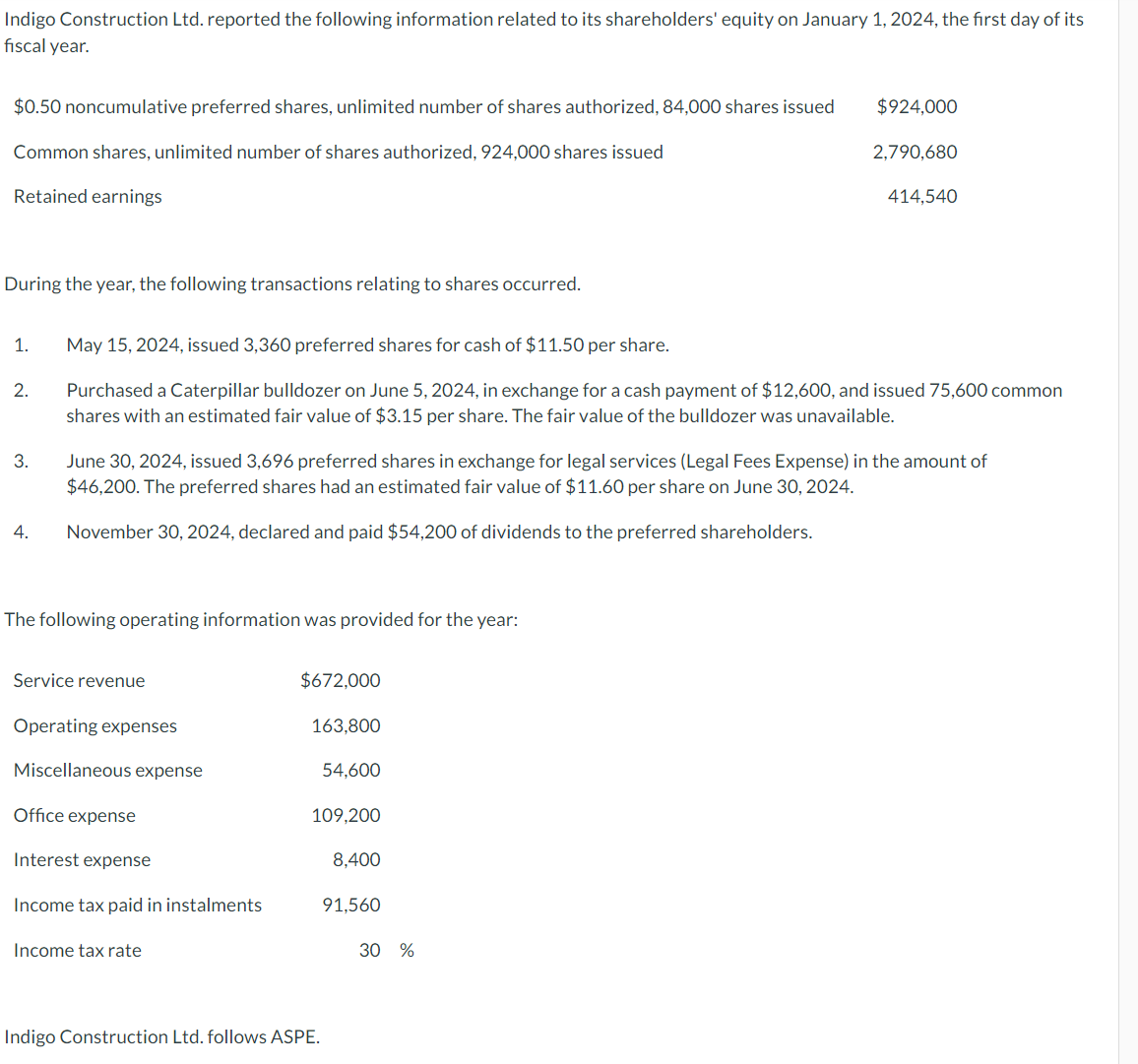

Drepare the entry to record income tax expense for the year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Indigo Construction Ltd. reported the following information related to its shareholders' equity on January 1,2024 , the first day of its fiscal year. During the year, the following transactions relating to shares occurred. 1. May 15,2024 , issued 3,360 preferred shares for cash of $11.50 per share. 2. Purchased a Caterpillar bulldozer on June 5,2024 , in exchange for a cash payment of $12,600, and issued 75,600 common shares with an estimated fair value of $3.15 per share. The fair value of the bulldozer was unavailable. 3. June 30, 2024, issued 3,696 preferred shares in exchange for legal services (Legal Fees Expense) in the amount of $46,200. The preferred shares had an estimated fair value of $11.60 per share on June 30,2024 . 4. November 30,2024 , declared and paid $54,200 of dividends to the preferred shareholders. The following operating information was provided for the year: Indigo Construction Ltd. follows ASPE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts