Question: Please help me to solve it. Question 1: Stan has a $490,000 mortgage and is anxious to get it paid off before his retirement in

Please help me to solve it.

Question 1:

Stan has a $490,000 mortgage and is anxious to get it paid off before his retirement in 16 years. How much does he need to pay monthly to get it paid off by his retirement? Assume his mortgage interest rate remains at 3.3% semi-annual interest. Input your answer to the nearest dollar.

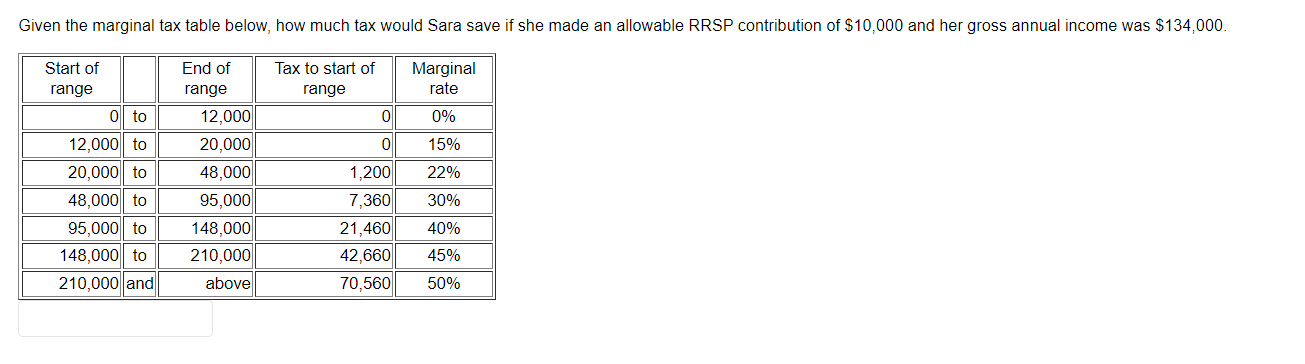

Question 2:

Given the marginal tax table below, how much tax would Sara save if she made an allowable RRSP contribution of $10,000 and her gross annual income was $134,000. Start of range Tax to start of range Marginal rate 0% 0 15% End of range 12,000 20,000 48,000 95,000 148,000 210,000 above ol to 12,000 to 20,000 to 48,000 to 95,000 to 148,000 to 210,000 and 22% 30% 1,200 7,360 21,460 42,660 70,560 40% 45% 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts