Question: Please help me to solve these problems. I need them solved by Sunday 2pm. P5-52. Non-GAAP Disclosures General Electric (GE) disclosed the following non-GAAP reconciliation

Please help me to solve these problems. I need them solved by Sunday 2pm.

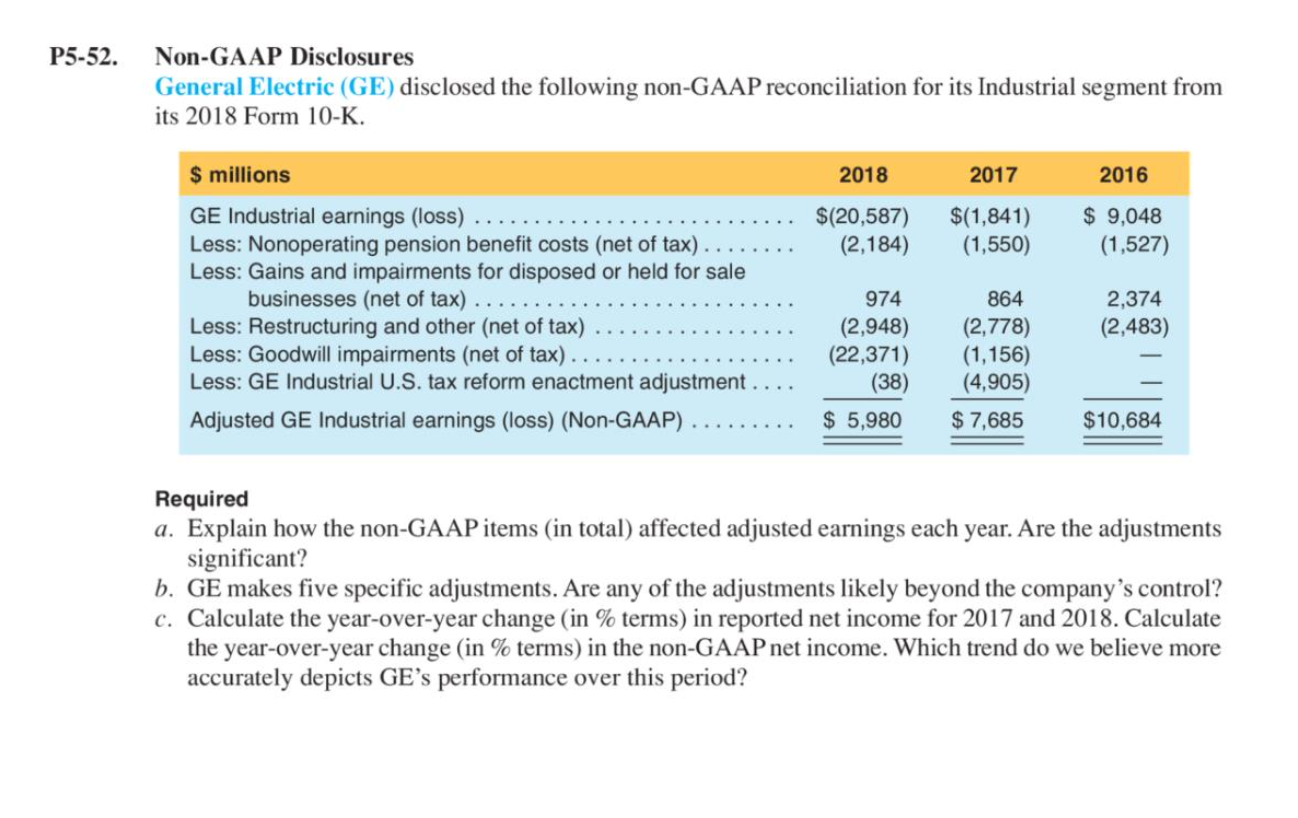

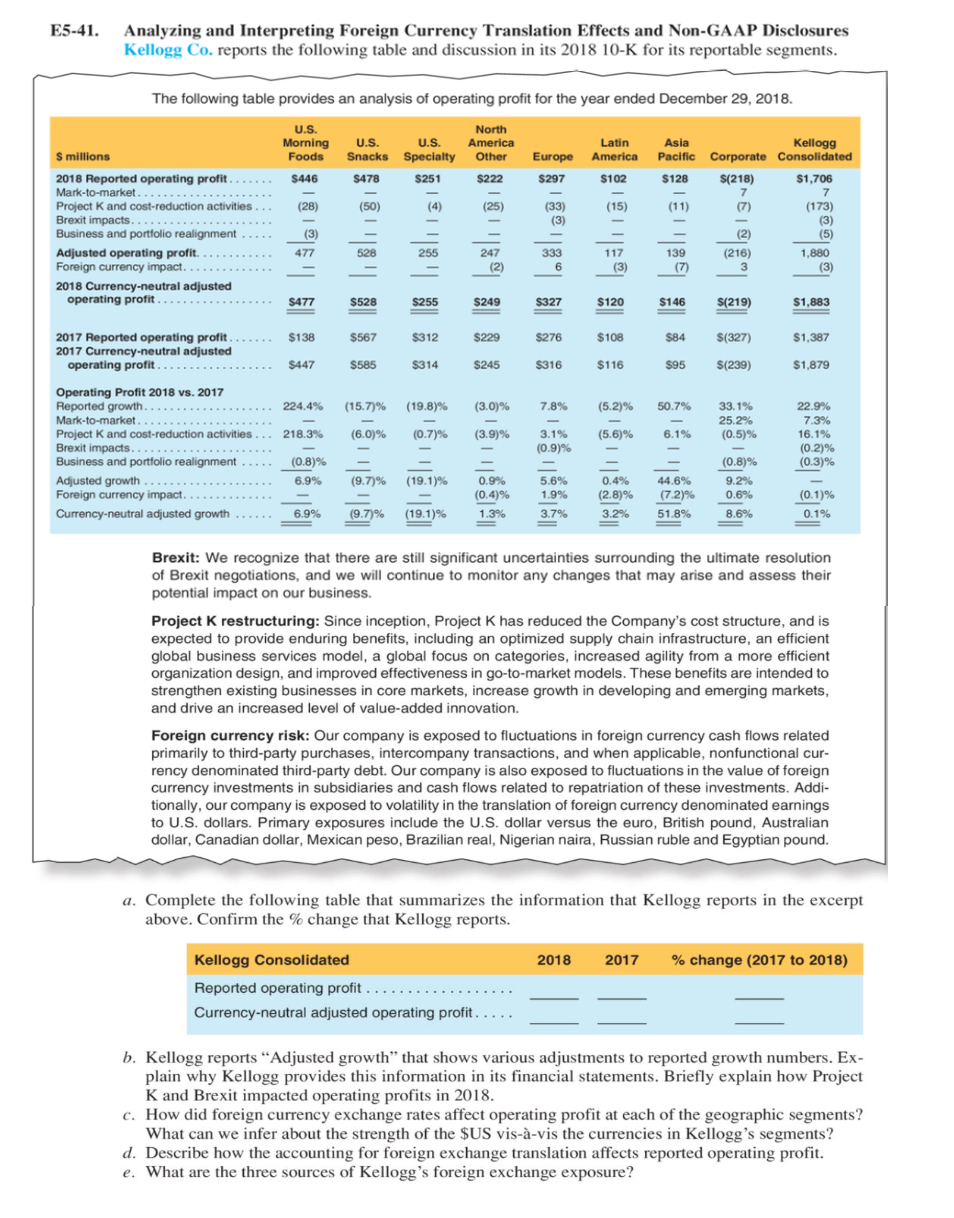

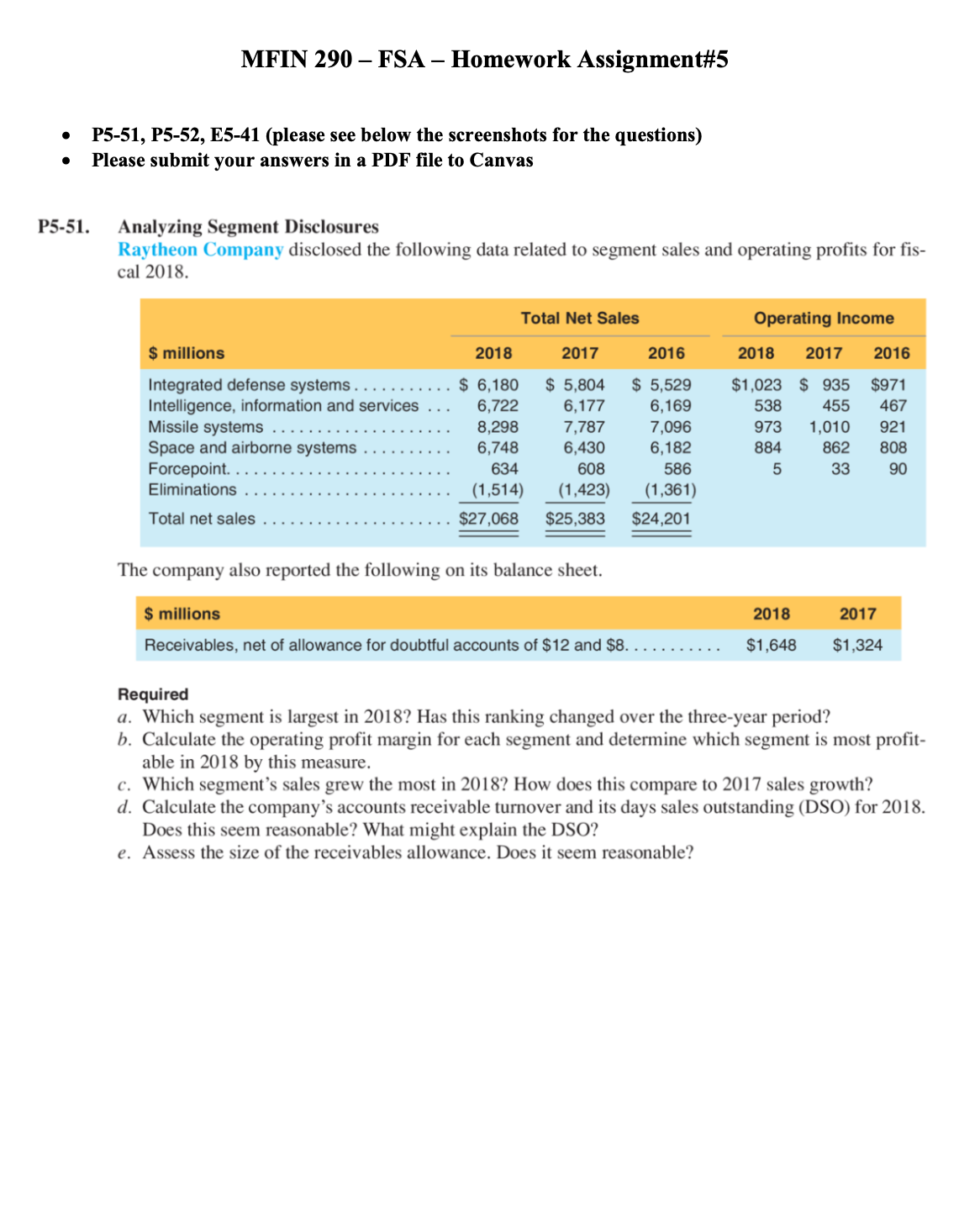

P5-52. Non-GAAP Disclosures General Electric (GE) disclosed the following non-GAAP reconciliation for its Industrial segment from its 2018 Form 10-K. $ millions 2018 2017 2016 GE Industrial earnings (loss) . ...... $(20,587) $(1,841) $ 9,048 Less: Nonoperating pension benefit costs (net of tax) . . . . .... (2,184) (1,550) (1,527) Less: Gains and impairments for disposed or held for sale businesses (net of tax) .. ..... 974 864 2,374 Less: Restructuring and other (net of tax) . (2,948) (2,778) (2,483) Less: Goodwill impairments (net of tax) . . . ... (22,371) (1, 156) Less: GE Industrial U.S. tax reform enactment adjustment . . . . (38 (4,905) Adjusted GE Industrial earnings (loss) (Non-GAAP) . .. ... .. $ 5,980 $ 7,685 $10,684 Required a. Explain how the non-GAAP items (in total) affected adjusted earnings each year. Are the adjustments significant? b. GE makes five specific adjustments. Are any of the adjustments likely beyond the company's control? c. Calculate the year-over-year change (in % terms) in reported net income for 2017 and 2018. Calculate the year-over-year change (in % terms) in the non-GAAP net income. Which trend do we believe more accurately depicts GE's performance over this period?E5-41. Analyzing and Interpreting Foreign Currency Translation Effects and Non-GAAP Disclosures Kellogg Co. reports the following table and discussion in its 2018 10-K for its reportable segments. The following table provides an analysis of operating profit for the year ended December 29, 2018. U.S. North Morning U.S. U.S. America Latin Asia Kellogg S millions Foods Snacks Specialty Other Europe America Pacific Corporate Consolidated 2018 Reported operating profit . . .. . .. $446 $478 $251 $222 $297 $102 $128 S(218 $1,706 Mark-to-market . .. Project K and cost-reduction activities (28) (50) (3:3) (173) Brexit impacts. . .. (3) Business and portfolio realignment . . . . . (3 ) (2) (5) Adjusted operating profit. . 477 247 333 117 139 (216) 1.880 Foreign currency impact. (2) 6 (3) (3) 2018 Currency-neutral adjusted operating profit . ... . . . . . . . . . ..... $528 $255 $249 $327 $120 $146 S(219) $1,883 2017 Reported operating profit . . . . . . . $138 $567 $312 $229 276 $108 $84 $(327) $1,387 2017 Currency-neutral adjusted operating profit ....... . ... . .. .. .. $447 $585 $314 $245 $316 $116 $95 $(239) $1,879 Operating Profit 2018 vs. 2017 Reported growth . . . . . " . . . . . . .. 224.4% (15.7)% (19.8)% (3.0)% 7.8% (5.2)% 50.7% 33.1% 22.9% Mark-to-market .......... ....... .. . 25.2% 7.3% Project K and cost-reduction activities 218.3% (6.0)% (0.7)% (3.9)% 3.1% (5.6)% 6.19% (0.5)% 16.1% Brexit impacts. . (0.9)% (0.2)% Business and portfolio realignment . (0.8)% (0.8)% (0.3)% Adjusted growth . . . . .. 6.9% (9.7)% (19.1)% 0.9% 5.6% 0.4% 44.6% 9.2% Foreign currency impact (0.4)% 1.9% (2.8)% (7.2)% 0.6% (0.1)% Currency-neutral adjusted growth . 6.9% (9.7)% (19.1)% 1.3% 3.7% 3.2% 51.8% 8.6% 0.1% Brexit: We recognize that there are still significant uncertainties surrounding the ultimate resolution of Brexit negotiations, and we will continue to monitor any changes that may arise and assess their potential impact on our business. Project K restructuring: Since inception, Project K has reduced the Company's cost structure, and is expected to provide enduring benefits, including an optimized supply chain infrastructure, an efficient global business services model, a global focus on categories, increased agility from a more efficient organization design, and improved effectiveness in go-to-market models. These benefits are intended to strengthen existing businesses in core markets, increase growth in developing and emerging markets, and drive an increased level of value-added innovation. Foreign currency risk: Our company is exposed to fluctuations in foreign currency cash flows related primarily to third-party purchases, intercompany transactions, and when applicable, nonfunctional cur- rency denominated third-party debt. Our company is also exposed to fluctuations in the value of foreign currency investments in subsidiaries and cash flows related to repatriation of these investments. Addi- tionally, our company is exposed to volatility in the translation of foreign currency denominated earnings to U.S. dollars. Primary exposures include the U.S. dollar versus the euro, British pound, Australian dollar, Canadian dollar, Mexican peso, Brazilian real, Nigerian naira, Russian ruble and Egyptian pound. a. Complete the following table that summarizes the information that Kellogg reports in the excerpt above. Confirm the % change that Kellogg reports. Kellogg Consolidated 2018 2017 % change (2017 to 2018) Reported operating profit . .... . . . . . ... Currency-neutral adjusted operating profit . . ... b. Kellogg reports "Adjusted growth" that shows various adjustments to reported growth numbers. Ex- plain why Kellogg provides this information in its financial statements. Briefly explain how Project K and Brexit impacted operating profits in 2018. c. How did foreign currency exchange rates affect operating profit at each of the geographic segments? What can we infer about the strength of the $US vis-a-vis the currencies in Kellogg's segments? d. Describe how the accounting for foreign exchange translation affects reported operating profit. e. What are the three sources of Kellogg's foreign exchange exposure?MFIN 290 - FSA - Homework Assignment#5 P5-51, P5-52, E5-41 (please see below the screenshots for the questions) . Please submit your answers in a PDF file to Canvas P5-51. Analyzing Segment Disclosures Raytheon Company disclosed the following data related to segment sales and operating profits for fis- cal 2018. Total Net Sales Operating Income $ millions 2018 2017 2016 2018 2017 2016 Integrated defense systems . . . . . . ..... $ 6,180 $ 5,804 $ 5,529 $1,023 $ 935 $971 Intelligence, information and services . . . 6,722 6,177 6,169 538 455 467 Missile systems . . . . . . . . . . 8,298 7,787 7,096 973 1,010 921 Space and airborne systems . . . . . . . . . . 6,748 6,430 6,182 884 862 808 Forcepoint. .... 634 608 586 5 33 90 Eliminations . ... (1,514) (1,423) (1,361) Total net sales $27,068 $25,383 $24,201 The company also reported the following on its balance sheet. $ millions 2018 2017 Receivables, net of allowance for doubtful accounts of $12 and $8. . $1,648 $1,324 Required a. Which segment is largest in 2018? Has this ranking changed over the three-year period? b. Calculate the operating profit margin for each segment and determine which segment is most profit- able in 2018 by this measure. c. Which segment's sales grew the most in 2018? How does this compare to 2017 sales growth? d. Calculate the company's accounts receivable turnover and its days sales outstanding (DSO) for 2018. Does this seem reasonable? What might explain the DSO? e. Assess the size of the receivables allowance. Does it seem reasonable