Question: Please help me to solve this finance question. = = 3. Consider three investors A, B, and C. Investor A's risk aversion coefficient A =

Please help me to solve this finance question.

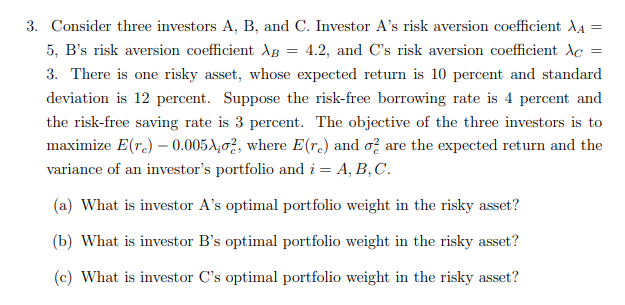

= = 3. Consider three investors A, B, and C. Investor A's risk aversion coefficient A = 5, B's risk aversion coefficient AB 4.2, and C's risk aversion coefficient lc 3. There is one risky asset, whose expected return is 10 percent and standard deviation is 12 percent. Suppose the risk-free borrowing rate is 4 percent and the risk-free saving rate is 3 percent. The objective of the three investors is to maximize E(r.) - 0.0052;o, where E(rc) and o are the expected return and the variance of an investor's portfolio and i = A,B,C. (a) What is investor A's optimal portfolio weight in the risky asset? (b) What is investor B's optimal portfolio weight in the risky asset? (C) What is investor C's optimal portfolio weight in the risky asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts