Question: Please help me to solve this one 2 Firm has sales of 100 000 units at RM4.00 per unit, variable operating costs of RM2.70 per

Please help me to solve this one

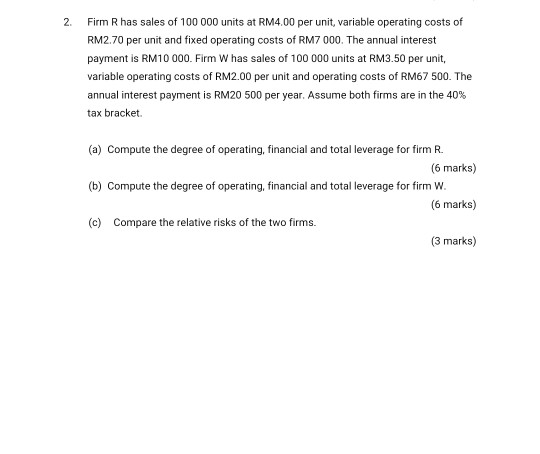

2 Firm has sales of 100 000 units at RM4.00 per unit, variable operating costs of RM2.70 per unit and fixed operating costs of RM7 000. The annual interest payment is RM10 000. Firm W has sales of 100 000 units at RM3.50 per unit, variable operating costs of RM2.00 per unit and operating costs of RM67 500. The annual interest payment is RM20 500 per year. Assume both firms are in the 40% tax bracket (a) Compute the degree of operating, financial and totalleverage for firm R. (6 marks) (b) Compute the degree of operating, financial and total leverage for firm W. (6 marks) (c) Compare the relative risks of the two firms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts