Question: Please help me to solve this problem, I need to use Excel to solve the process You need to borrow $200,000 to buy a house

Please help me to solve this problem, I need to use Excel to solve the process

Please help me to solve this problem, I need to use Excel to solve the process

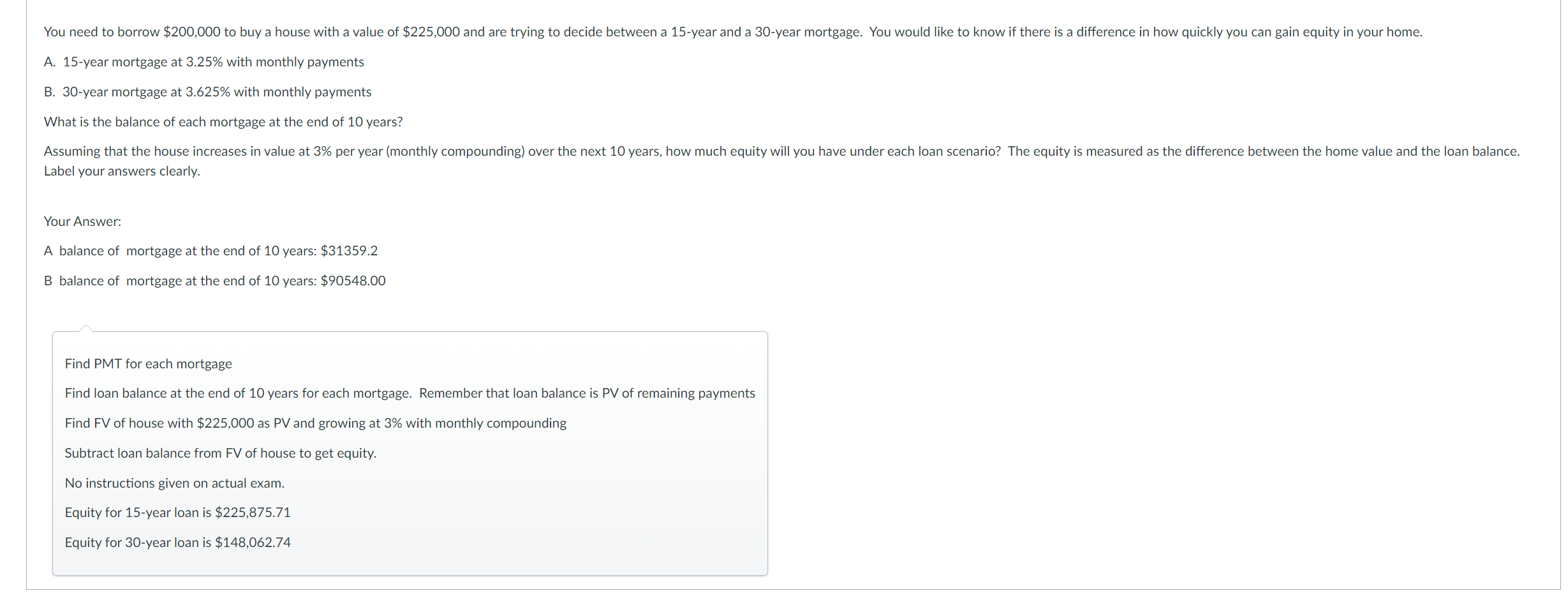

You need to borrow $200,000 to buy a house with a value of $225,000 and are trying to decide between a 15-year and a 30-year mortgage. You would like to know if there is a difference in how quickly you can gain equity in your home. A. 15-year mortgage at 3.25% with monthly payments B. 30-year mortgage at 3.625% with monthly payments What is the balance of each mortgage at the end of 10 years? Assuming that the house increases in value at 3% per year (monthly compounding) over the next 10 years, how much equity will you have under each loan scenario? The equity is measured as the difference between the home value and the loan balance. Label your answers clearly. Your Answer: A balance of mortgage at the end of 10 years: $31359.2 B balance of mortgage at the end of 10 years: $90548.00 Find PMT for each mortgage Find loan balance at the end of 10 years for each mortgage. Remember that loan balance is PV of remaining payments Find FV of house with $225,000 as PV and growing at 3% with monthly compounding Subtract loan balance from FV of house to get equity. No instructions given on actual exam. Equity for 15-year loan is $225,875.71 Equity for 30-year loan is $148,062.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts