Question: please help me to solve this question . QUESTION 3 Billie Eilish Son Bhd manufactures artificial baby's breath flower. The production of an artificial baby's

please help me to solve this question .

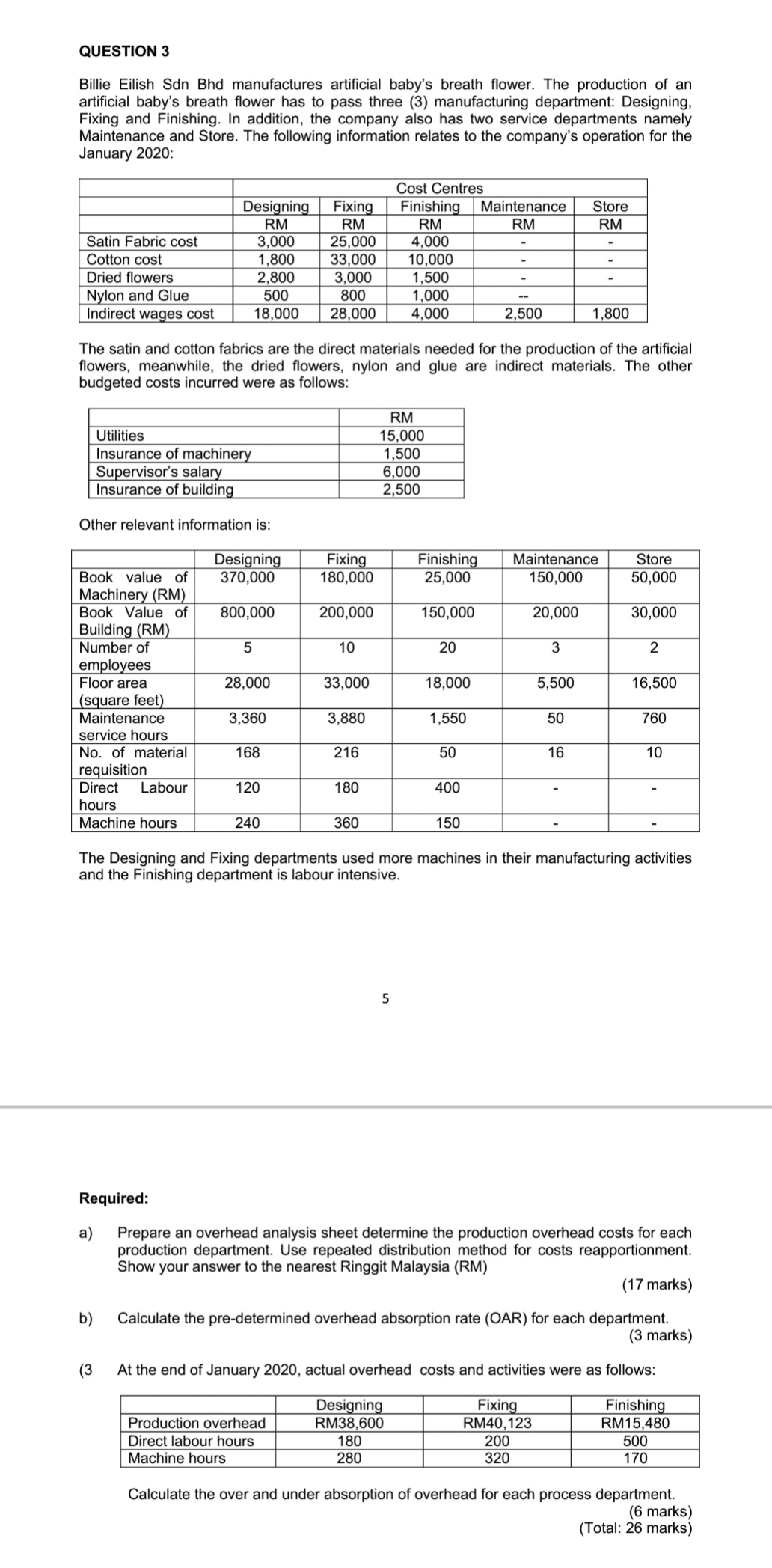

QUESTION 3 Billie Eilish Son Bhd manufactures artificial baby's breath flower. The production of an artificial baby's breath flower has to pass three (3) manufacturing department: Designing, Fixing and Finishing. In addition, the company also has two service departments namely Maintenance and Store. The following information relates to the company's operation for the January 2020: Cost Centres Designing Fixing Finishing Maintenance Store RM RM RM RM RM Satin Fabric cost 3,000 25,000 4,000 Cotton cost 1,800 33,000 10,000 Dried flowers 2,800 3,000 1,500 Nylon and Glue 500 800 1,000 Indirect wages cost 18,000 28,000 4,000 2,500 1,800 The satin and cotton fabrics are the direct materials needed for the production of the artificial flowers, meanwhile, the dried flowers, nylon and glue are indirect materials. The other budgeted costs incurred were as follows: RM Utilities 15,000 Insurance of machinery 1,500 Supervisor's salary 6,000 Insurance of building 2,500 Other relevant information is: Designing Fixing Finishing Maintenance Store Book value of 370,000 180,000 25,000 150,000 50,000 Machinery (RM) Book Value of 800,000 200,000 150,000 20,000 30,000 Building (RM) Number of 5 10 20 3 2 employees Floor area 28,000 33,000 18,000 5,500 16,500 (square feet) Maintenance 3,360 3,880 1,550 50 760 service hours No. of material 168 216 50 16 10 requisition Direct Labour 120 180 400 hours Machine hours 240 360 150 The Designing and Fixing departments used more machines in their manufacturing activities and the Finishing department is labour intensive. UT Required: a) Prepare an overhead analysis sheet determine the production overhead costs for each production department. Use repeated distribution method for costs reapportionment. Show your answer to the nearest Ringgit Malaysia (RM) (17 marks) b) Calculate the pre-determined overhead absorption rate (OAR) for each department. (3 marks) (3 At the end of January 2020, actual overhead costs and activities were as follows: Designing Fixing Finishing Production overhead RM38,600 RM40, 123 RM15,480 Direct labour hours 180 200 500 Machine hours 280 320 170 Calculate the over and under absorption of overhead for each process department (6 marks) (Total: 26 marks)