Question: Please help me to solve this question. Thank you :) 1,300 PROBLEM 9-6. Choosing Among Alternative Investments Bright Spot tion, a chain of dry cleaning

Please help me to solve this question. Thank you :)

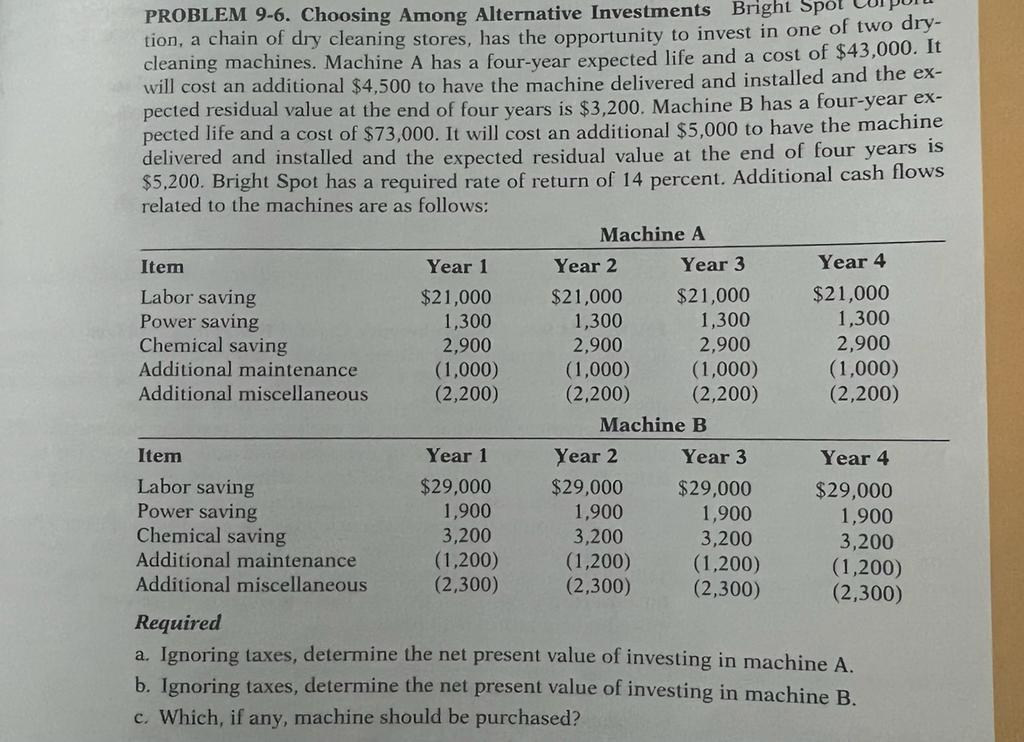

1,300 PROBLEM 9-6. Choosing Among Alternative Investments Bright Spot tion, a chain of dry cleaning stores, has the opportunity to invest in one of two dry- cleaning machines. Machine A has a four-year expected life and a cost of $43,000. It will cost an additional $4,500 to have the machine delivered and installed and the ex- pected residual value at the end of four years is $3,200. Machine B has a four-year ex- pected life and a cost of $73,000. It will cost an additional $5,000 to have the machine delivered and installed and the expected residual value at the end of four years is $5,200. Bright Spot has a required rate of return of 14 percent. Additional cash flows related to the machines are as follows: Machine A Item Year 1 Year 2 Year 3 Year 4 Labor saving $21,000 $21,000 $21,000 $21,000 Power saving 1,300 1,300 1,300 Chemical saving 2,900 2,900 2,900 2,900 Additional maintenance (1,000) (1,000) (1,000) (1,000) Additional miscellaneous (2,200) (2,200) (2,200) (2,200) Machine B Item Year 1 Year 2 Year 3 Year 4 Labor saving $29,000 $29,000 $29,000 $29,000 Power saving 1,900 1,900 1,900 1,900 Chemical saving 3,200 3,200 3,200 3,200 Additional maintenance (1,200) (1,200) (1,200) (1,200) Additional miscellaneous (2,300) (2,300) (2,300) (2,300) Required a. Ignoring taxes, determine the net present value of investing in machine A. b. Ignoring taxes, determine the net present value of investing in machine B. c. Which, if any, machine should be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts