Question: Please help me to solve this question. Thank you :) PROBLEM 5-3. Variable and Full Costing: Income Effect of Clearing Excess In- ventory The following

Please help me to solve this question. Thank you :)

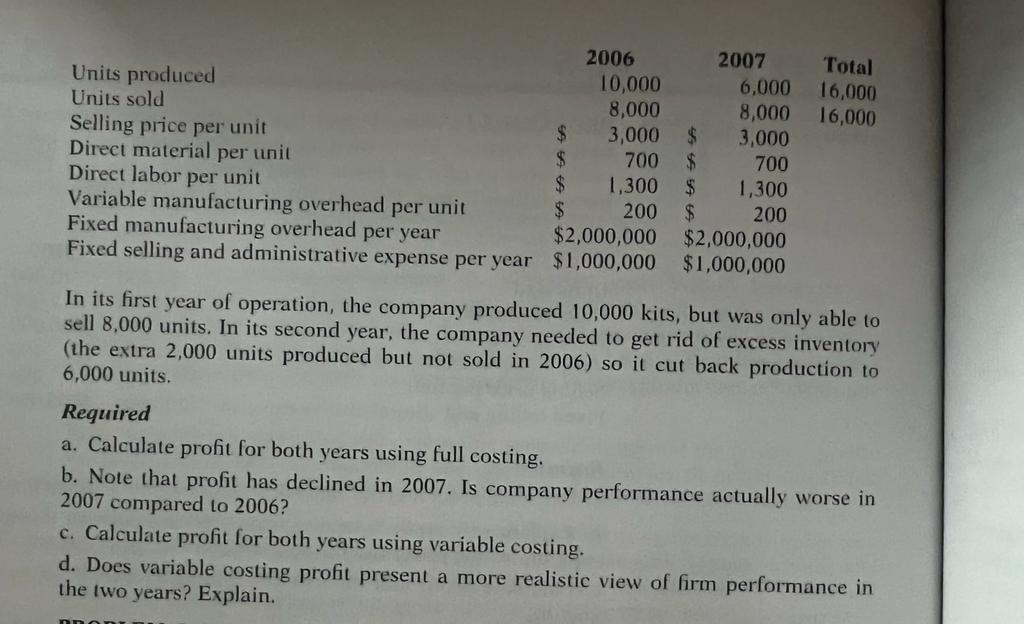

PROBLEM 5-3. Variable and Full Costing: Income Effect of Clearing Excess In- ventory The following information is available for Skipper Pools, a manufacturer of above-ground swimming pool kits: Total 16,000 16,000 2006 2007 Units produced 10,000 6,000 Units sold 8,000 8,000 Selling price per unit $ 3,000 $ 3,000 Direct material per unit $ 700 $ 700 Direct labor per unit $ 1,300 $ 1,300 Variable manufacturing overhead per unit $ 200 $ 200 Fixed manufacturing overhead per year $2,000,000 $2,000,000 Fixed selling and administrative expense per year $1,000,000 $1,000,000 In its first year of operation, the company produced 10,000 kits, but was only able to sell 8,000 units. In its second year, the company needed to get rid of excess inventory (the extra 2,000 units produced but not sold in 2006) so it cut back production to 6,000 units. Required a. Calculate profit for both years using full costing, b. Note that profit has declined in 2007. Is company performance actually worse in 2007 compared to 2006? c. Calculate profit for both years using variable costing. d. Does variable costing profit present a more realistic view of firm performance in the two years? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts