Question: Please help me to write a report! Answer each question as if you were a consultant hired by the company and are presenting to the

Please help me to write a report!

Answer each question as if you were a consultant hired by the company and are presenting to the president.

For each answer explain the terminology and concepts used. For example, in #1 rather than just give the breakeven for each scenario, explain the change in the volume of sales, explain the calculation - this is a professional report from a consultant to an executive committee.

Use outside sources when necessary BUT MAKE SURE YOU CITE THEM!

When giving a recommendation, back it up with numbers.

This particular answer should be an executive committee report that is no more than 4 pages in length.

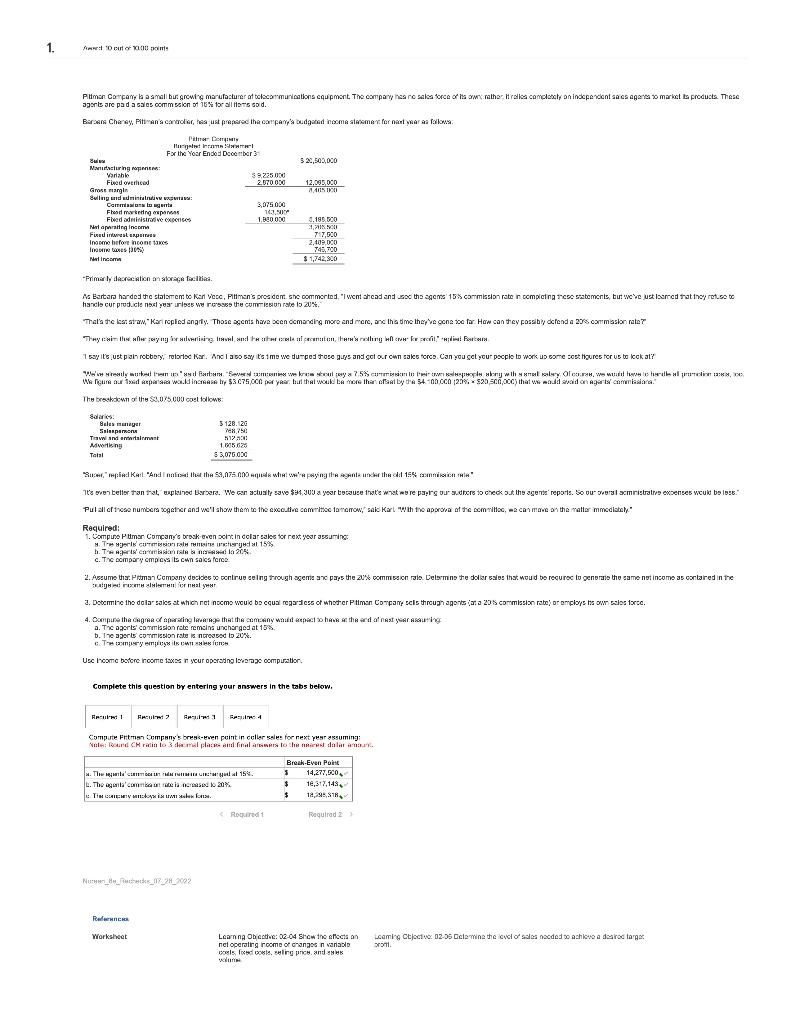

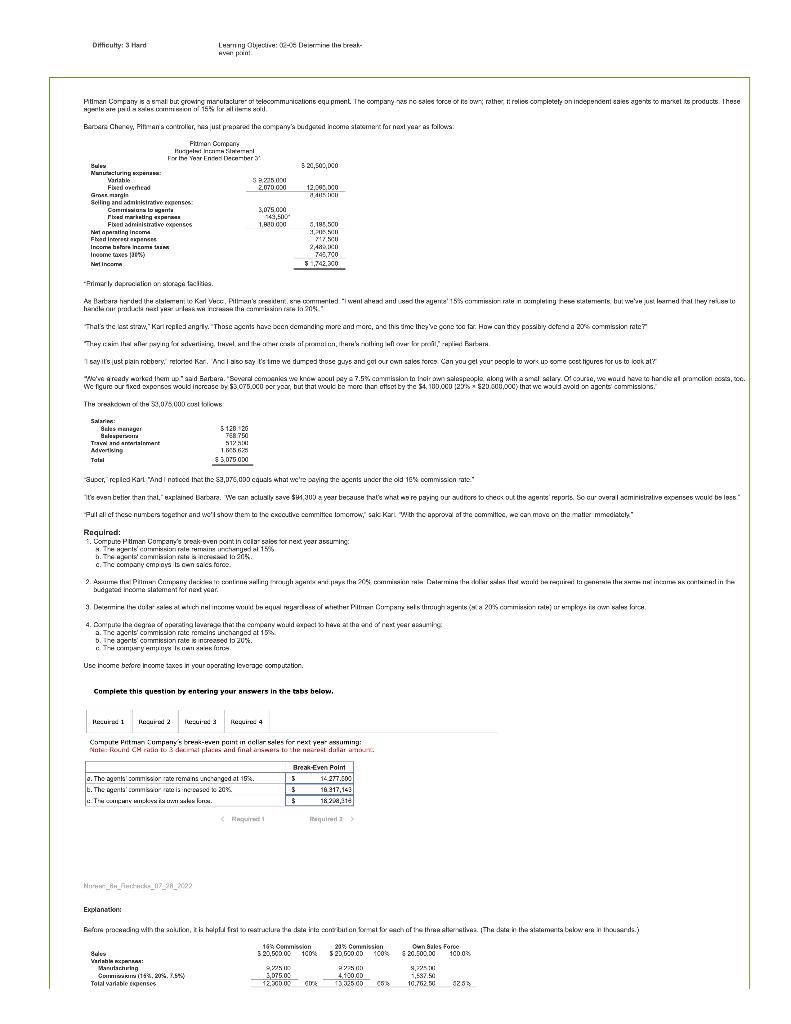

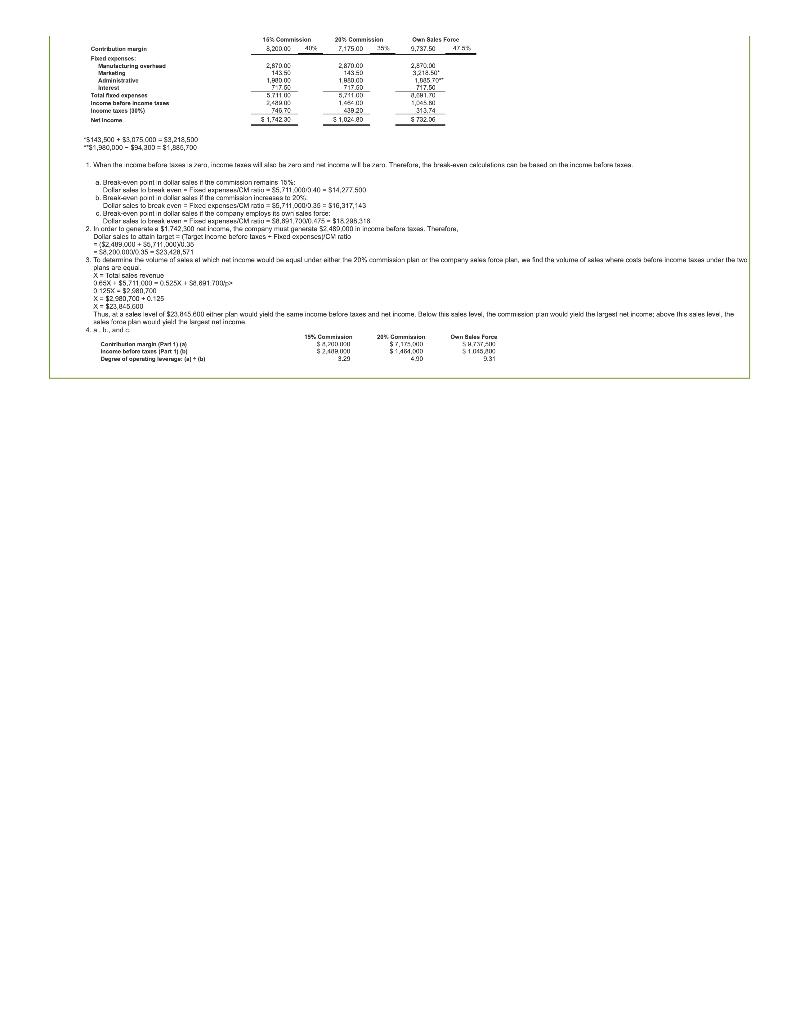

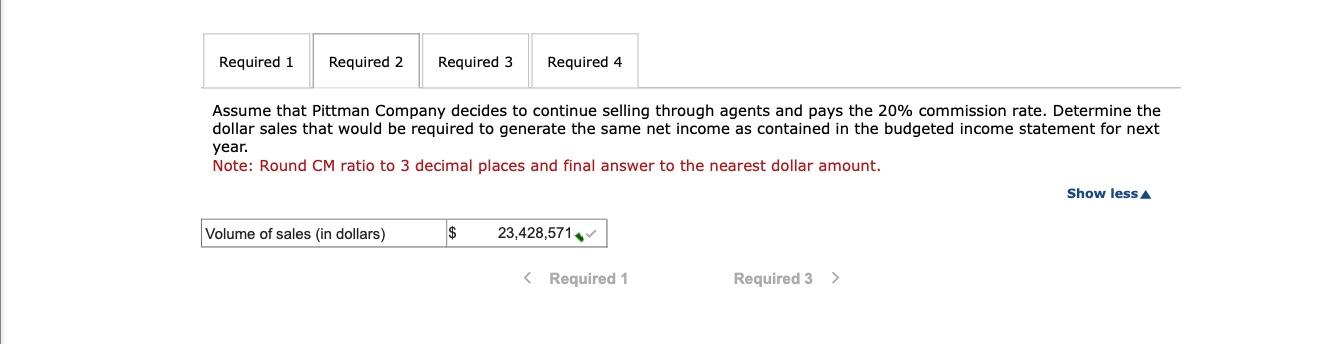

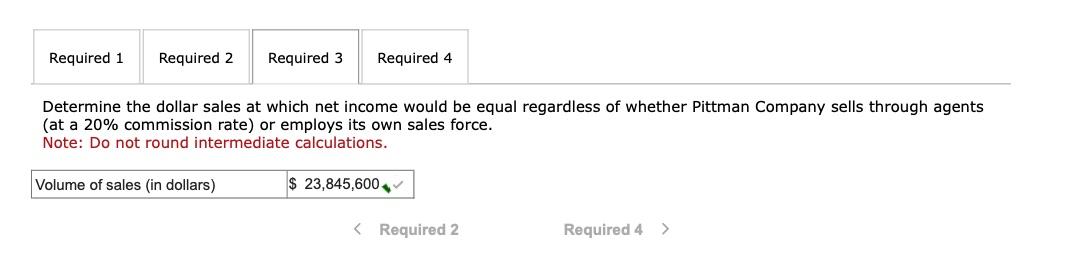

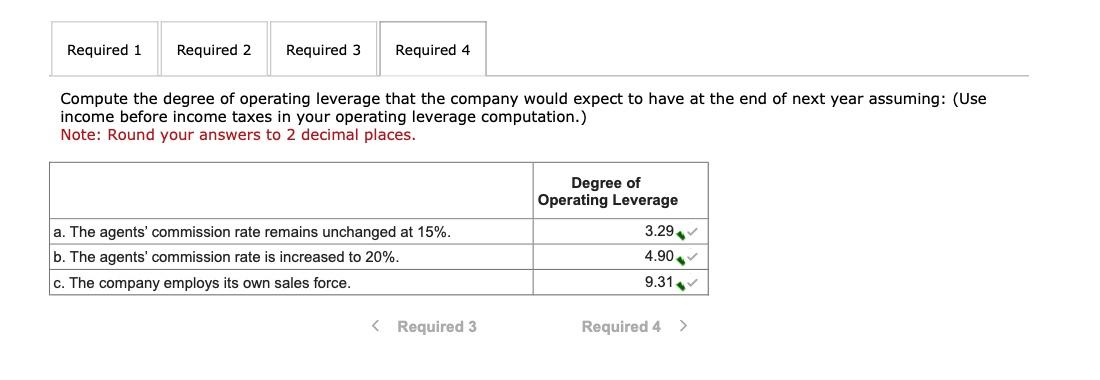

The breakscwil or the Ss, wh, e00 cost followe: Required: a. The aperts' corrtiselon rote remilna uxeharaged at 15s. b. Ine azerts cotmiselon rest is nuresbed ba 2%k. Complete this question by entering your answers in the tobs below. Campure Frtmen Company's breys-even point in celler seles for next pese assuming: Rewenneke Workshwet net operotrg rosme or changes n wariasis Ditticulty; 3 Hard Leymng Otgedjas: Se Let Detien-ite the break- HSMn print. - Frimar ly dequoreatien an sorighe faclbia. The reakdown of the Si, 0,5,009 cusl fol kwe Guscr, replod Kat "d nofocd that the sa, DTE,0DD cqusls what we're oasing the ogents uncer the old 1 Ger ocmmigicn ate: Required: b. The ageris' cammiadon rata a increwsed 1320%. c. The cempary cmp oys ts cwn zaice faroe. budgesod roome alatoment for nent vaar. a. The apcrls' commtelon rabe nemelns unchanaped at 15s. b. Ihe ajerts' commiseion rate 8 nueased is 20%. i. Tre tamiery niniuys Is ben sea ne funs. Uee toome berere noome taves in your operating iverege compusabon. Complete this question br entering your answers in the tobs below, Compire Fittmen Cumpuny s bresc-eaen peitit in eeller seles for rext pey- assuming: Explanstion: a. Uresk-ever pont n dolkr esles t the commigeion remars 15% : c. Ureak-even pont in dolkar esies tt the compony emclope ta bN Ealos forwe: Dollse sales to sthin laraet = 1Tarex Inco me byere lanes - Fhed expenesapesi nato =$8,20000.4035=$23.420.571 plara a squa. x - Tcla soles revenue 365x+$5.711000=0.525x+50.801.7010 3125x32580,700 x=$2cad,7Tco+0.125 x=$23,ec5CO0 Assume that Pittman Company decides to continue selling through agents and pays the 20% commission rate. Determine the dollar sales that would be required to generate the same net income as contained in the budgeted income statement for next year. Note: Round CM ratio to 3 decimal places and final answer to the nearest dollar amount. Determine the dollar sales at which net income would be equal regardless of whether Pittman Company sells through agents (at a 20% commission rate) or employs its own sales force. Note: Do not round intermediate calculations. Compute the degree of operating leverage that the company would expect to have at the end of next year assuming: (Use income before income taxes in your operating leverage computation.) Note: Round your answers to 2 decimal places. The breakscwil or the Ss, wh, e00 cost followe: Required: a. The aperts' corrtiselon rote remilna uxeharaged at 15s. b. Ine azerts cotmiselon rest is nuresbed ba 2%k. Complete this question by entering your answers in the tobs below. Campure Frtmen Company's breys-even point in celler seles for next pese assuming: Rewenneke Workshwet net operotrg rosme or changes n wariasis Ditticulty; 3 Hard Leymng Otgedjas: Se Let Detien-ite the break- HSMn print. - Frimar ly dequoreatien an sorighe faclbia. The reakdown of the Si, 0,5,009 cusl fol kwe Guscr, replod Kat "d nofocd that the sa, DTE,0DD cqusls what we're oasing the ogents uncer the old 1 Ger ocmmigicn ate: Required: b. The ageris' cammiadon rata a increwsed 1320%. c. The cempary cmp oys ts cwn zaice faroe. budgesod roome alatoment for nent vaar. a. The apcrls' commtelon rabe nemelns unchanaped at 15s. b. Ihe ajerts' commiseion rate 8 nueased is 20%. i. Tre tamiery niniuys Is ben sea ne funs. Uee toome berere noome taves in your operating iverege compusabon. Complete this question br entering your answers in the tobs below, Compire Fittmen Cumpuny s bresc-eaen peitit in eeller seles for rext pey- assuming: Explanstion: a. Uresk-ever pont n dolkr esles t the commigeion remars 15% : c. Ureak-even pont in dolkar esies tt the compony emclope ta bN Ealos forwe: Dollse sales to sthin laraet = 1Tarex Inco me byere lanes - Fhed expenesapesi nato =$8,20000.4035=$23.420.571 plara a squa. x - Tcla soles revenue 365x+$5.711000=0.525x+50.801.7010 3125x32580,700 x=$2cad,7Tco+0.125 x=$23,ec5CO0 Assume that Pittman Company decides to continue selling through agents and pays the 20% commission rate. Determine the dollar sales that would be required to generate the same net income as contained in the budgeted income statement for next year. Note: Round CM ratio to 3 decimal places and final answer to the nearest dollar amount. Determine the dollar sales at which net income would be equal regardless of whether Pittman Company sells through agents (at a 20% commission rate) or employs its own sales force. Note: Do not round intermediate calculations. Compute the degree of operating leverage that the company would expect to have at the end of next year assuming: (Use income before income taxes in your operating leverage computation.) Note: Round your answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts