Question: please help me understand how to complete these problems. thank you for taking the time to help me Crane Inc. purchased a patent on January

please help me understand how to complete these problems. thank you for taking the time to help me

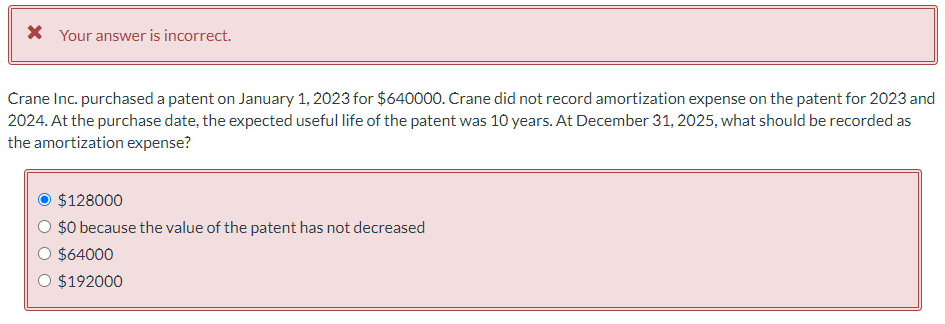

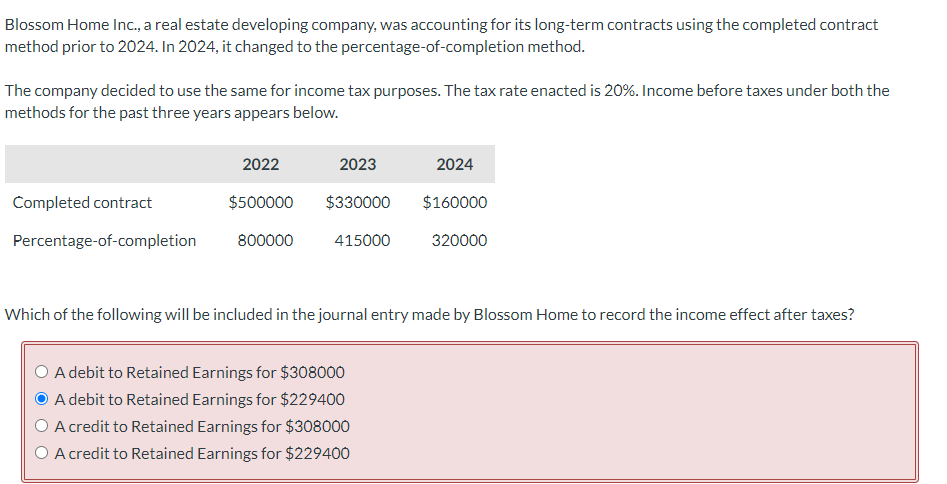

Crane Inc. purchased a patent on January 1, 2023 for $640000. Crane did not record amortization expense on the patent for 2023 and 2024. At the purchase date, the expected useful life of the patent was 10 years. At December 31,2025 , what should be recorded as the amortization expense? $128000 $0 because the value of the patent has not decreased $64000 Blossom Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2024. In 2024, it changed to the percentage-of-completion method. The company decided to use the same for income tax purposes. The tax rate enacted is 20%. Income before taxes under both the methods for the past three years appears below. Which of the following will be included in the journal entry made by Blossom Home to record the income effect after taxes? A debit to Retained Earnings for $308000 A debit to Retained Earnings for $229400 A credit to Retained Earnings for $308000 A credit to Retained Earnings for $229400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts