Question: Please help me understand how to do this E. King, Ltd. produces decorative lamps in several styles and finishes. The company uses a job order

Please help me understand how to do this

Please help me understand how to do this

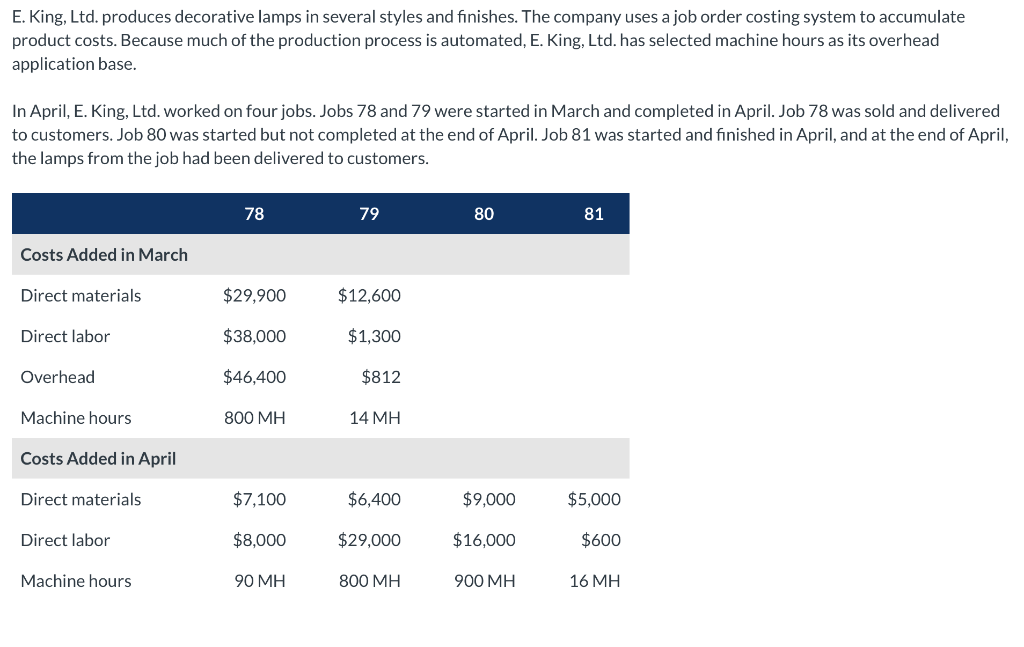

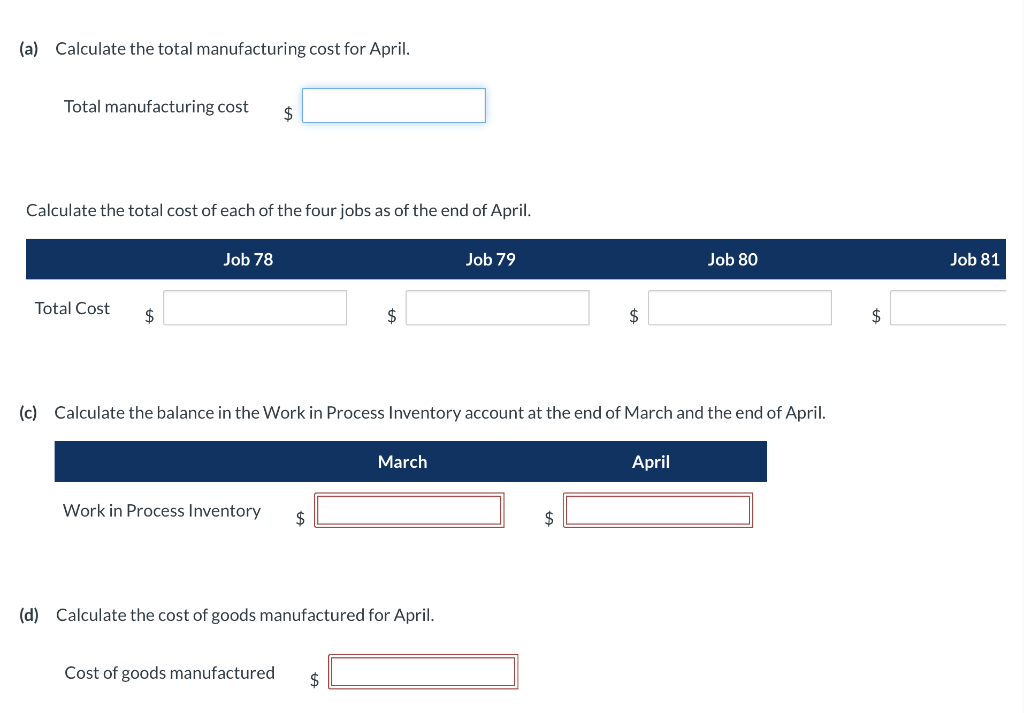

E. King, Ltd. produces decorative lamps in several styles and finishes. The company uses a job order costing system to accumulate product costs. Because much of the production process is automated, E. King, Ltd. has selected machine hours as its overhead application base. In April, E. King, Ltd. worked on four jobs. Jobs 78 and 79 were started in March and completed in April. Job 78 was sold and delivered to customers. Job 80 was started but not completed at the end of April. Job 81 was started and finished in April, and at the end of April, the lamps from the job had been delivered to customers. 78 79 80 81 Costs Added in March Direct materials $29,900 $12,600 Direct labor $38,000 $1,300 Overhead $46,400 $812 Machine hours 800 MH 14 MH Costs Added in April Direct materials $7,100 $6,400 $9,000 $5,000 Direct labor $8,000 $29,000 $16,000 $600 Machine hours 90 MH 800 MH 900 MH 16 MH (a) Calculate the total manufacturing cost for April. Total manufacturing cost $ Calculate the total cost of each of the four jobs as of the end of April. Job 78 Job 79 Job 80 Job 81 Total Cost $ $ $ $ (c) Calculate the balance in the Work in Process Inventory account at the end of March and the end of April. March April Work in Process Inventory $ (d) Calculate the cost of goods manufactured for April. Cost of goods manufactured $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts