Question: Please help me understand question 13 through 16 ILLUSTRATION Given the information on the left, answer the following questions EPS 1 What is the average

Please help me understand question 13 through 16

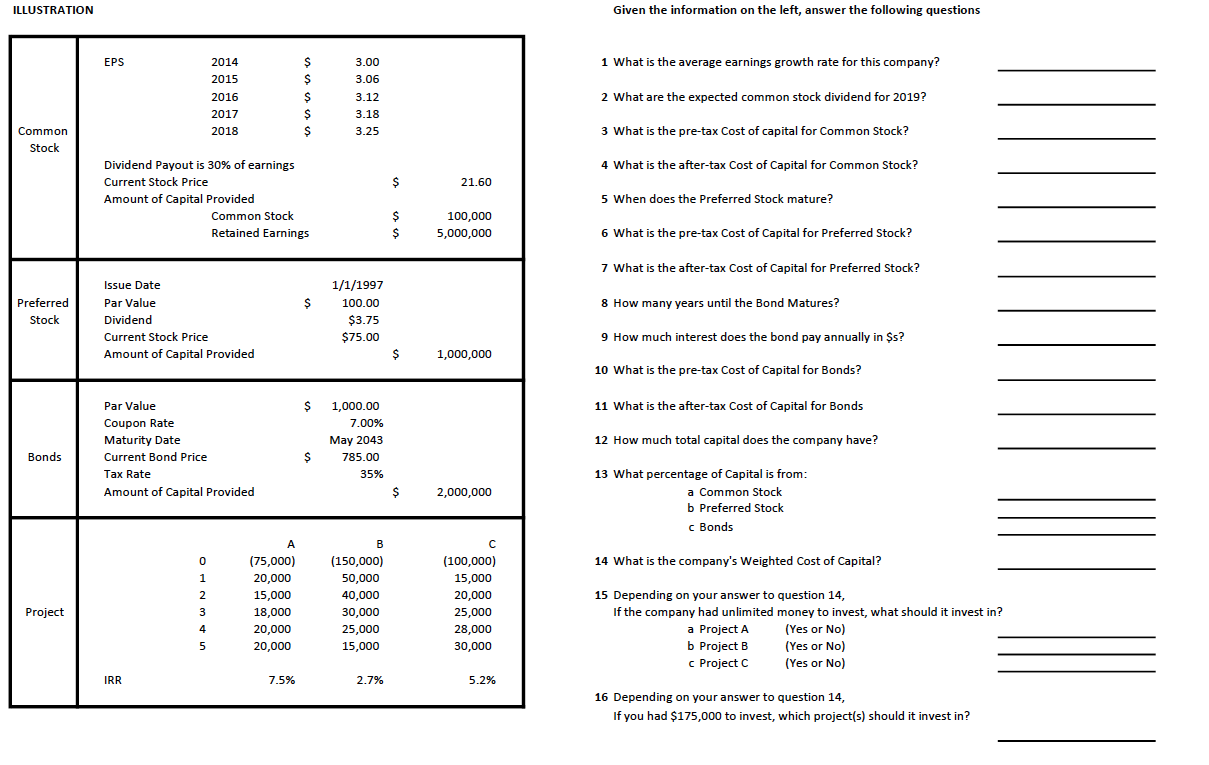

ILLUSTRATION Given the information on the left, answer the following questions EPS 1 What is the average earnings growth rate for this company? 2014 2015 2016 2017 2018 S S $ $ $ 3.00 3.06 3.12 3.18 3.25 2 What are the expected common stock dividend for 2019? Common Stock 3 What is the pre-tax Cost of capital for Common Stock? - 4 What is the after-tax Cost of Capital for Common Stock? $ 21.60 Dividend Payout is 30% of earnings Current Stock Price Amount of Capital Provided Common Stock Retained Earnings 5 When does the Preferred Stock mature? $ $ 100,000 5,000,000 6 What is the pre-tax Cost of Capital for Preferred Stock? 7 What is the after-tax Cost of Capital for Preferred Stock? Preferred $ 8 How many years until the Bond Matures? Issue Date Par Value Dividend Current Stock Price Amount of Capital Provided 1/1/1997 100.00 $3.75 $75.00 Stock 9 How much interest does the bond pay annually in $s? $ 1,000,000 10 What is the pre-tax cost of capital for Bonds? $ 11 What is the after-tax Cost of Capital for Bonds Par Value Coupon Rate Maturity Date Current Bond Price Tax Rate Amount of Capital Provided 1,000.00 7.00% May 2043 785.00 35% 12 How much total capital does the company have? Bonds $ $ 2,000,000 13 What percentage of Capital is from: a Common Stock b Preferred Stock c c Bonds 0 14 What is the company's Weighted Cost of Capital? 1 2 3 A (75,000) 20,000 15,000 18,000 20,000 20,000 B (150,000) 50,000 40,000 30,000 25,000 15,000 (100,000) 15,000 20,000 25,000 28,000 30,000 Project invest in? 4 15 Depending on your answer to question 14, If the company had unlimited money to invest, what should a Project A (Yes or No) b Project B (Yes or No) c Project C (Yes or No) 5 IRR 7.5% 2.7% 5.2% 16 Depending on your answer to question 14, If you had $175,000 to invest, which project(s) should it invest in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts