Question: Please help me understand the answer to this problem. I don't understand why do we debit cash for 692, 085 and not the 750,000? Please

Please help me understand the answer to this problem.

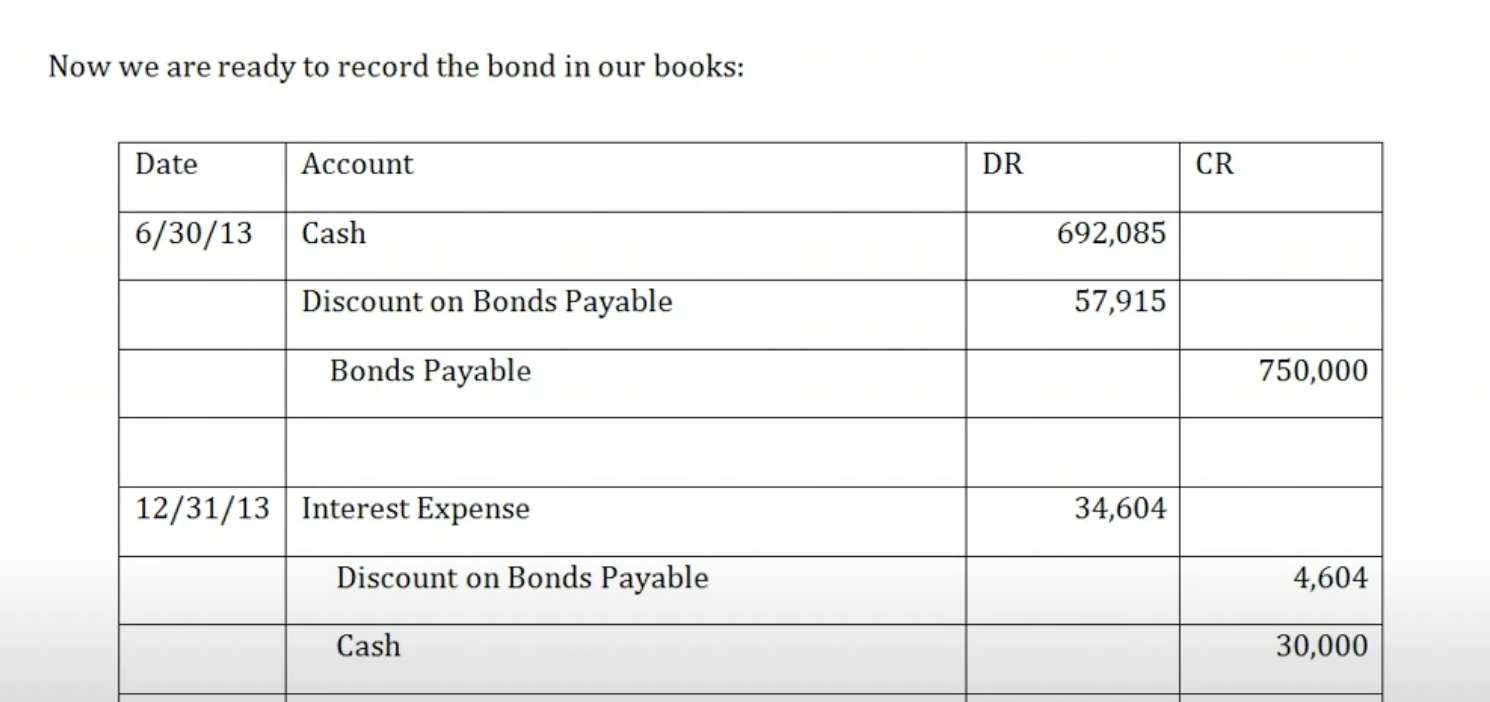

- I don't understand why do we debit cash for 692, 085 and not the 750,000?

- Please explain why do we debit discount on bond payable on June 30 and credit it on Dec 31?

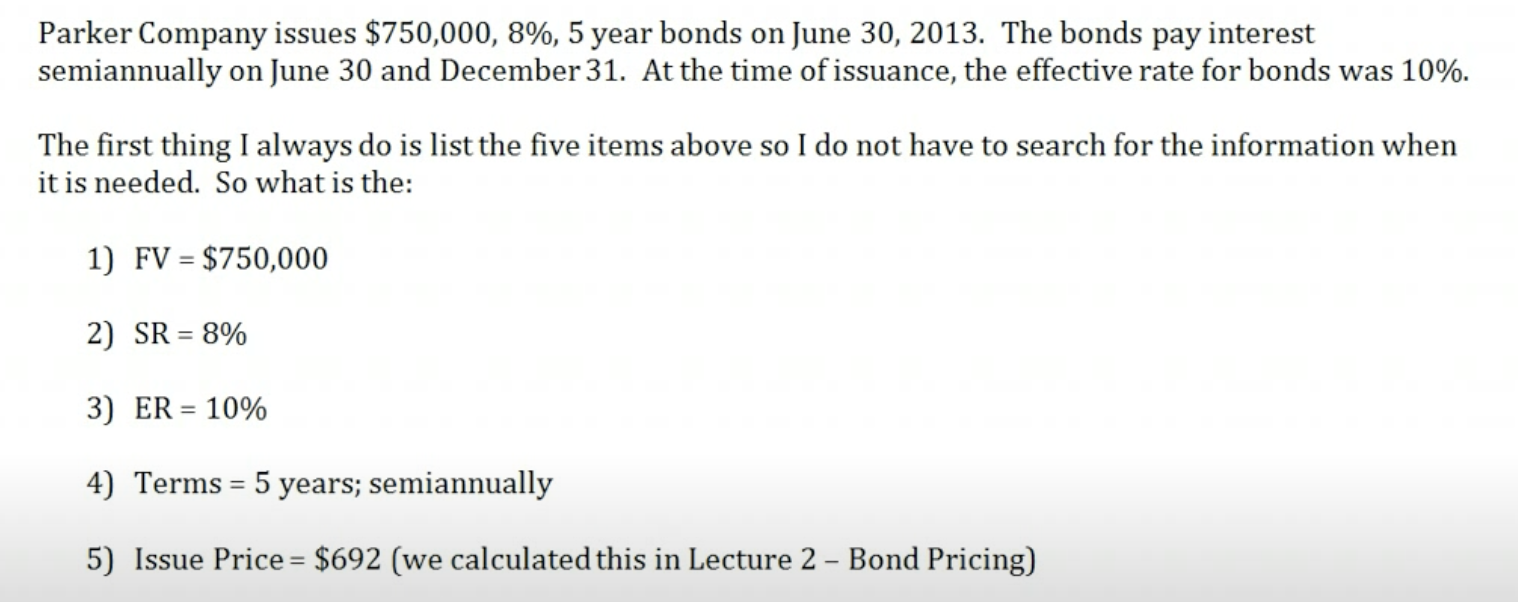

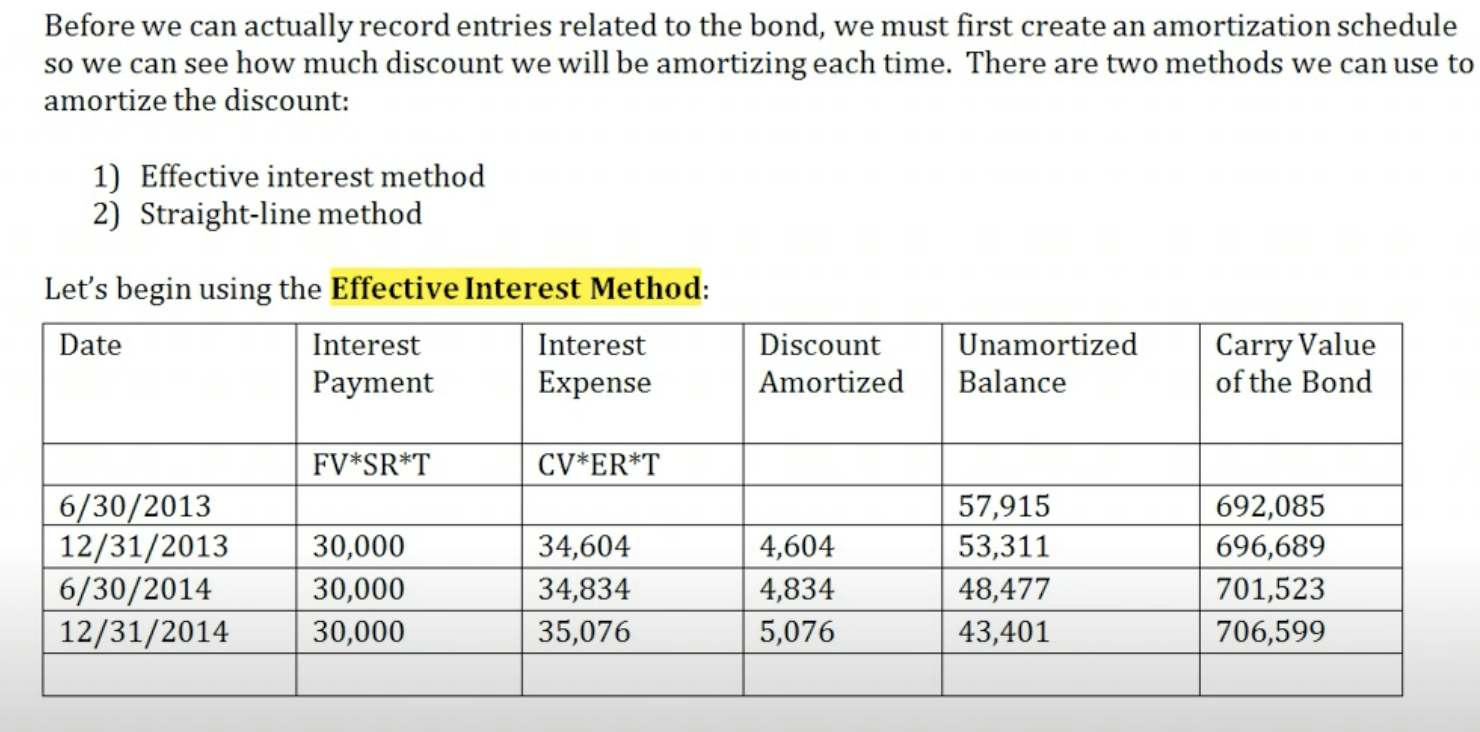

Parker Company issues \\( \\$ 750,000,8 \\%, 5 \\) year bonds on June 30,2013 . The bonds pay interest semiannually on June 30 and December 31 . At the time of issuance, the effective rate for bonds was \10. The first thing I always do is list the five items above so I do not have to search for the information when it is needed. So what is the: 1) \\( \\mathrm{FV}=\\$ 750,000 \\) 2) \mathrmSR=8 3) \mathrmER=10 4) Terms = 5 years; semiannually 5) Issue Price \\( =\\$ 692 \\) (we calculated this in Lecture 2 - Bond Pricing) Now we are ready to record the bond in our books: Before we can actually record entries related to the bond, we must first create an amortization schedule so we can see how much discount we will be amortizing each time. There are two methods we can use to amortize the discount: 1) Effective interest method 2) Straight-line method Let's begin using the Effective Interest Method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts