Question: Please help me understand the concept. I'm not getting it at all. I can reproduce the answer, but I want to know specifically why we

Please help me understand the concept. I'm not getting it at all. I can reproduce the answer, but I want to know specifically why we are making our calculations with each and every account.

Here is the question and the solution:

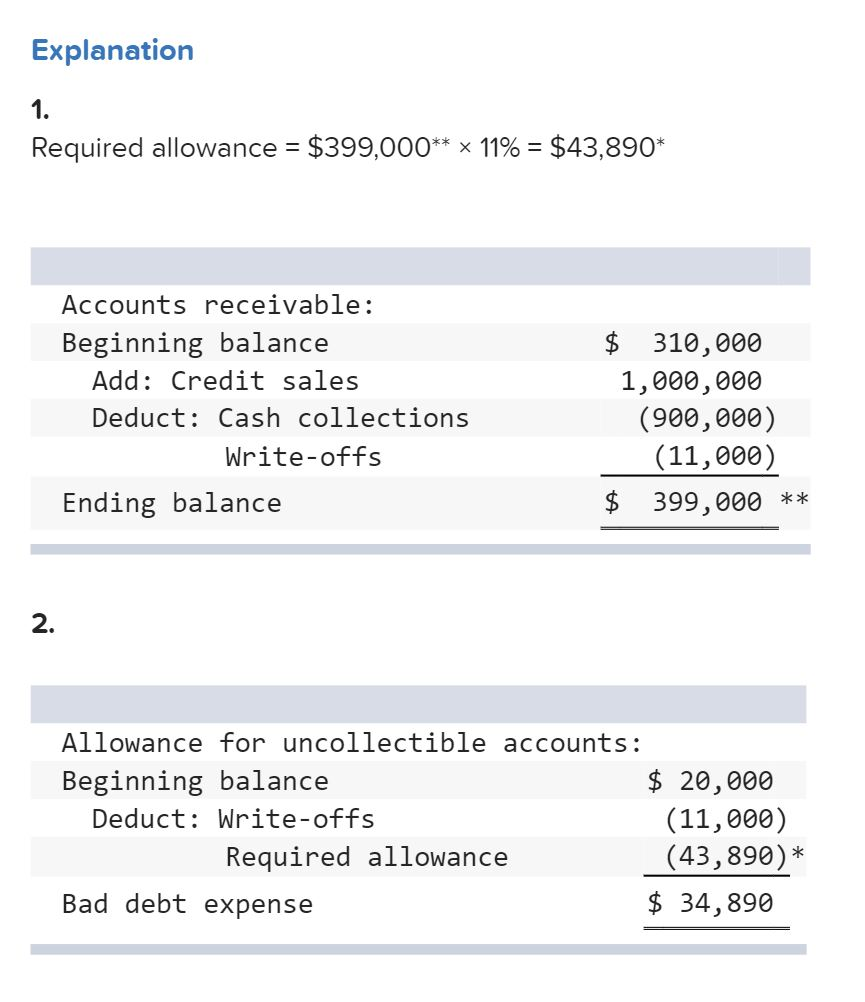

The following information relates to a company's accounts receivable: accounts receivable balance at the beginning of the year, $310,000; allowance for uncollectible accounts at the beginning of the year, $20,000 (credit balance); credit sales during the year, $1,000,000; accounts receivable written off during the year, $11,000; cash collections from customers, $900,000. Assuming the company estimates that future bad debts will equal 11% of the year-end balance in accounts receivable. 1. Calculate the year-end balance in the allowance for uncollectible accounts. 2. Calculate bad debt expense for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts