Question: please help me understand where i went wrong on the reconcilliation as well as completeing the journal entry portions On October 31, 2024, the bank

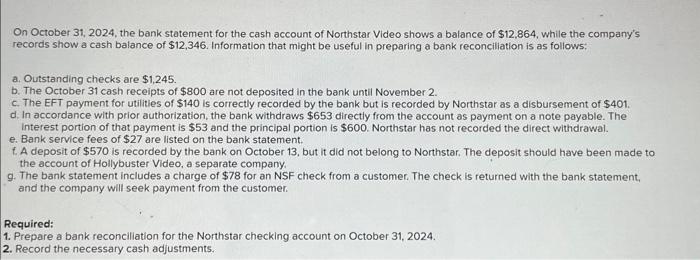

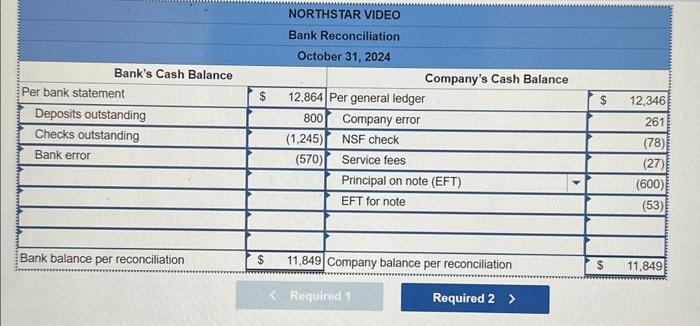

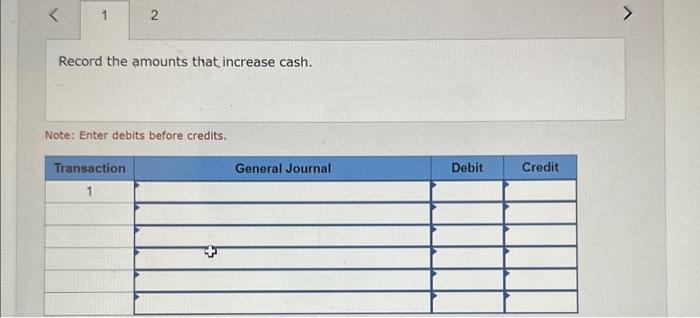

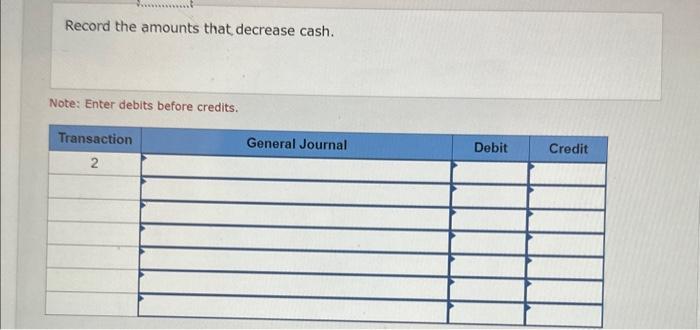

On October 31, 2024, the bank statement for the cash account of Northstar Video shows a balance of $12,864, while the company's records show a cash balance of $12,346. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks are $1,245. b. The October 31 cash receipts of $800 are not deposited in the bank until November 2 . c. The EFT payment for utilities of $140 is correctly recorded by the bank but is recorded by Northstar as a disbursement of $401. d. In accordance with prior authorization, the bank withdraws $653 directly from the account as payment on a note payable. The interest portion of that payment is $53 and the principal portion is $600. Northstar has not recorded the direct withdrawal. e. Bank service fees of $27 are listed on the bank statement. f. A deposit of $570 is recorded by the bank on October 13, but it did not belong to Northstar. The deposit should have been made to the account of Hollybuster Video, a separate company. 9. The bank statement includes a charge of $78 for an NSF check from a customer. The check is returned with the bank statement, and the company will seek payment from the customer. Required: 1. Prepare a bank reconciliation for the Northstar checking account on October 31, 2024. 2. Record the necessary cash adjustments. NORTHSTAR VIDEO Bank Reconciliation October 31,2024 \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Bank's Cash Balance } & \multicolumn{4}{|c|}{ Company's Cash Balance } \\ \hline Per bank statement & $ & 12,864 & Per general ledger & & $ & 12,346 \\ \hline Deposits outstanding & & 800 & Company error & & & 261 \\ \hline Checks outstanding & & (1,245) & NSF check & & & (78) \\ \hline Bank error & & (570) & Service fees & & & (27) \\ \hline & & & Principal on note (EFT) & + & & (600) \\ \hline+ & 7 & & EFT for note & & & (53) \\ \hline 7 & & & & & & \\ \hline & & & & & & \\ \hline Bank balance per reconciliation & $ & 11,849 & Company balance per reconciliation & & $ & 11,849 \\ \hline \end{tabular} Required 2 Record the amounts that increase cash. Note: Enter debits before credits. Record the amounts that decrease cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts