Question: please help me Which project analysis method is the best method? a NPV b. Internal Rate of Return c. Payback Period d. Profitability Index QUESTION

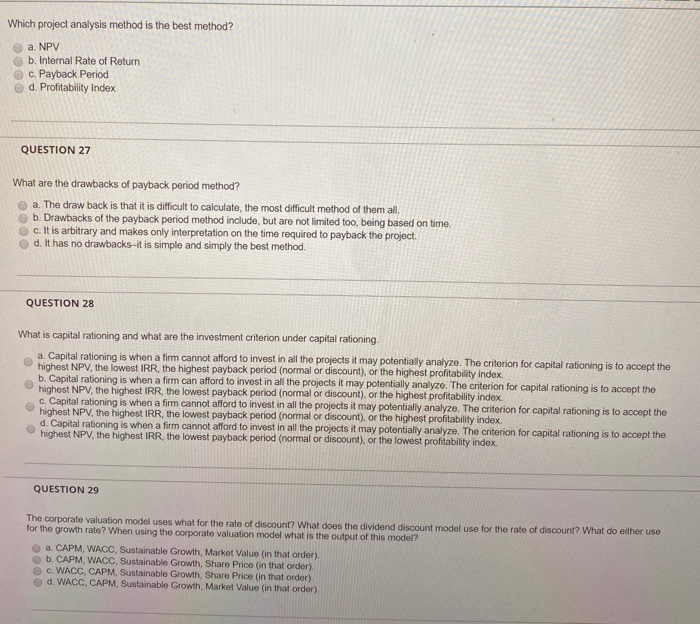

Which project analysis method is the best method? a NPV b. Internal Rate of Return c. Payback Period d. Profitability Index QUESTION 27 What are the drawbacks of payback period method? a. The draw back is that it is difficult to calculate, the most difficult method of them all b. Drawbacks of the payback period method include, but are not limited too, being based on time. c. It is arbitrary and makes only interpretation on the time required to payback the project d. It has no drawbacks-it is simple and simply the best method. QUESTION 28 What is capital rationing and what are the investment criterion under capital rationing a. Capital rationing is when a firm cannot afford to invest in all the projects it may potentially analyze. The criterion for capital rationing is to accept the highost NPV, the lowest IRR, the highest payback period (normal or discount), or the highest profitability index b. Capital rationing is when a firm can afford to invest in all the projects it may potentially analyze. The criterion for capital rationing is to accept the highest NPV, the highest IRR, the lowest payback period (normal or discount), or the highest profitability index. c. Capital rationing is when a firm cannot afford to invest in all the projects it may potentially analyze. The criterion for capital rationing is to accept the highest NPV, the highest IRR, the lowest payback period (normal or discount), or the highest profitability index d. Capital rationing is when a firm cannot afford to invest in all the projects it may potentially analyze. The criterion for capital rationing is to accept the highest NPV, the highest IRR the lowest payback period (normal or discount), or the lowest profitability index QUESTION 29 The corporate valuation model uses what for the rate of discount? What does the dividend discount model use for the rate of discount? What do either uso for the growth rate? When using the corporate valuation model what is the output of this model? a. CAPM, WACC, Sustainable Growth, Market Value (in that order), b. CAPM. WACC, Sustainable Growth, Share Price in that order) G. WACC, CAPM, Sustainable Growth, Share Price in that order) d. WACC, CAPM, Sustainable Growth, Market Value (in that order)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts