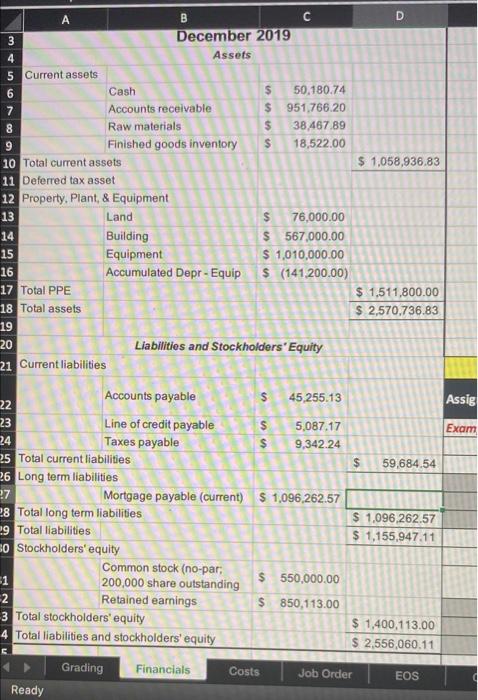

Question: please help me with 1-8 C 00 VOUW B D 3 December 2019 Assets 5 Current assets 6 Cash $ 50,180.74 7 Accounts receivable $

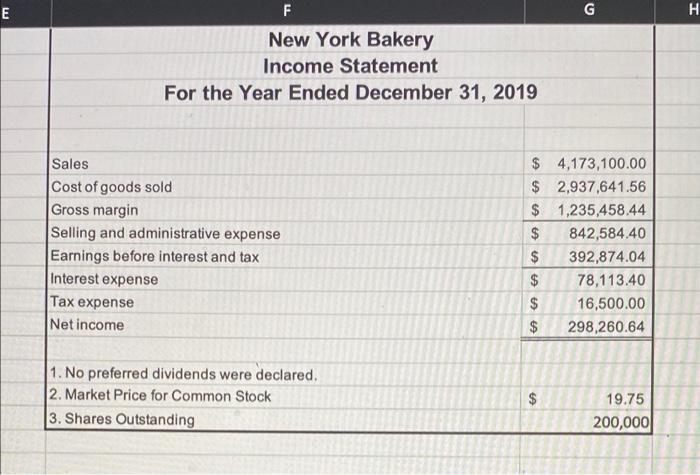

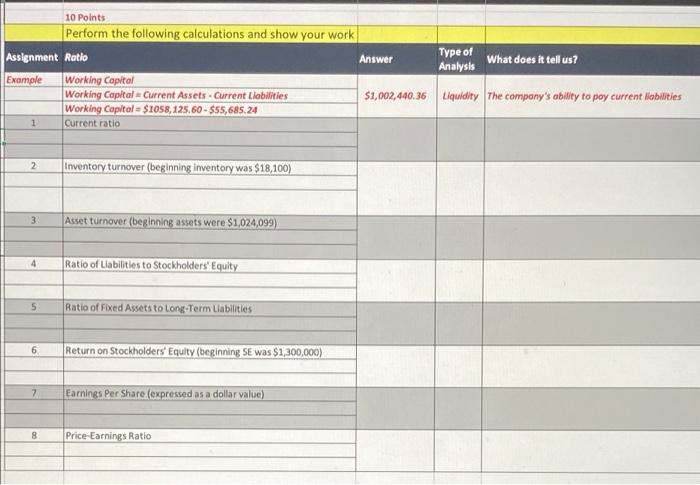

C 00 VOUW B D 3 December 2019 Assets 5 Current assets 6 Cash $ 50,180.74 7 Accounts receivable $ 951,76620 8 Raw materials $ 38.467 89 9 Finished goods inventory $ 18,522.00 10 Total current assets $ 1,058,936.83 11 Deferred tax asset 12 Property. Plant, & Equipment 13 Land $ 76,000.00 14 Building $ 567,000.00 15 Equipment $ 1,010,000.00 16 Accumulated Depr - Equip $ (141,200.00) 17 Total PPE $ 1.511,800.00 18 Total assets $ 2,570,736.83 19 20 Liabilities and Stockholders' Equity 21 Current liabilities Assig Exam Accounts payable $ 45,255.13 22 23 Line of credit payable $ 5,087.17 24 Taxes payable $ 9,342.24 25 Total current liabilities $ 59,684.54 26 Long term liabilities 27 Mortgage payable (current) $ 1,096,262.57 28 Total long term liabilities $ 1,096,262.57 9 Total liabilities $ 1,155,947.11 BO Stockholders' equity Common stock (no-par, 51 $ 200,000 share outstanding 550,000.00 2 Retained earnings $ 850,113.00 3 Total stockholders' equity $ 1,400,113.00 4 Total liabilities and stockholders' equity $ 2,556,060.11 5. Grading Financials Costs Job Order EOS Ready W NE E G H F New York Bakery Income Statement For the Year Ended December 31, 2019 Sales Cost of goods sold Gross margin Selling and administrative expense Earnings before interest and tax Interest expense Tax expense Net income A A A A $ 4,173,100.00 $ 2,937,641.56 $ 1,235,458,44 $ 842,584.40 $ 392,874.04 $ 78,113.40 $ 16,500.00 $ 298,260.64 1. No preferred dividends were declared. 2. Market Price for Common Stock 3. Shares Outstanding $ 19.75 200,000 10 Points Perform the following calculations and show your work Assignment Ratio Type of Answer Analysis What does it tell us? Example Working Capital Working Capital - Current Assets. Current Liabilities $1,002,440.36 Liquidity The company's ability to pay current liabilities Working Capital $1058,125.60 - $55,685.24 1 Current ratio 2 Inventory turnover (beginning inventory was $18,100) 3 Asset turnover (beginning assets were $1,024,099) 4 Ratio of Liabilities to Stockholders' Equity 5 Ratio of Fixed Assets to Long-Term Liabilitles 6 Return on Stockholders' Equity (beginning SE was $1,300,000) 7 Earnings Per Share (expressed as a dollar value) 8 Price-Earnings Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts