Question: Please help me with a case study for accounting(show the calculations and put in a proper order in columns and indicate for what statements is)

Please help me with a case study for accounting(show the calculations and put in a proper order in columns and indicate for what statements is) Thank you

Martinez Corporation, a private entity reporting under ASPE, was incorporated on January 3, 2019. The corporations financial statements for its first year of operations were not examined by a public accountant. You have been engaged to audit the financial statements for the year ended December 31, 2020, and your audit is almost complete. The corporations trial balance is as follows: MARTINEZ CORPORATION Trial Balance December 31, 2020 Debit Credit Cash $ 55,000 Accounts receivable 88,000 Allowance for doubtful accounts $ 1,900 Inventory 59,200 Machinery 81,000 Equipment 37,000 Accumulated depreciation 27,100 Intangible assetspatents 127,800 Leasehold improvements 36,700 Prepaid expenses 12,000 Goodwill 31,000 Intangible assetslicensing agreement No. 1 63,000 Intangible assetslicensing agreement No. 2 53,000 Accounts payable 93,000 Unearned revenue 17,280 Common shares 300,000 Retained earnings, January 1, 2020 170,920 Sales 720,000 Cost of goods sold 475,000 Selling expenses 183,000 Interest expense 28,500 Total $1,330,200 $1,330,200

The following information is for accounts that may still need adjustment:

1. Patents for Martinezs manufacturing process were acquired on January 2, 2020, at a cost of $88,400. An additional $34,000 was spent in July 2020 and $5,400 in December 2020 to improve machinery covered by the patents and was charged to the Intangible AssetsPatents account. Depreciation on fixed assets was properly recorded for 2020 in accordance with Martinezs practice, which is to take a full year of depreciation for property on hand at June 30. No other depreciation or amortization was recorded. Martinez uses the straight-line method for all amortization and amortizes its patents over their legal life, which was 17 years when the patent was granted. Accumulate all amortization expense in one income statement account.

2. At December 31, 2020, management determined that the undiscounted future net cash flows that are expected from the use of the patent would be $84,000, the value in use was $79,000, the resale value of the patent was approximately $59,000, and disposal costs would be $5,000.

3. On January 3, 2019, Martinez purchased licensing agreement no. 1, which management believed had an unlimited useful life. Licences similar to this are frequently bought and sold. Martinez could only clearly identify cash flows from agreement no. 1 for 15 years. After the 15 years, further cash flows are still possible, but are uncertain. The balance in the Licences account includes the agreements purchase price of $59,000 and expenses of $4,000 related to the acquisition. On January 1, 2020, Martinez purchased licensing agreement no. 2, which has a life expectancy of five years. The balance in the Licences account includes its $52,000 purchase price and $6,000 in acquisition expenses, but it has been reduced by a credit of $5,000 for the advance collection of 2021 revenue from the agreement. In late December 2019, an explosion caused a permanent 60% reduction in the expected revenue-producing value of licensing agreement no. 1. In January 2021, a flood caused additional damage that rendered the agreement worthless

3. On January 3, 2019, Martinez purchased licensing agreement no. 1, which management believed had an unlimited useful life. Licences similar to this are frequently bought and sold. Martinez could only clearly identify cash flows from agreement no. 1 for 15 years. After the 15 years, further cash flows are still possible, but are uncertain. The balance in the Licences account includes the agreements purchase price of $59,000 and expenses of $4,000 related to the acquisition. On January 1, 2020, Martinez purchased licensing agreement no. 2, which has a life expectancy of five years. The balance in the Licences account includes its $52,000 purchase price and $6,000 in acquisition expenses, but it has been reduced by a credit of $5,000 for the advance collection of 2021 revenue from the agreement. In late December 2019, an explosion caused a permanent 60% reduction in the expected revenue-producing value of licensing agreement no. 1. In January 2021, a flood caused additional damage that rendered the agreement worthless

4. The balance in the Goodwill account results from legal expenses of $31,000 that were incurred for Martinezs incorporation on January 3, 2019. Management assumes that the $31,000 cost will benefit the entire life of the organization, and believes that these costs should be amortized over a limited life of 30 years. No entry has been made yet.

5. The Leasehold Improvements account includes the following: (i) There is a $15,000 cost of improvements that Martinez made to premises that it leases as a tenant. The improvements were made in January 2019 and have a useful life of 12 years. (ii) Movable assembly-line equipment costing $15,000 was installed in the leased premises in December 2020. (iii) Real estate taxes of $6,700 were paid by Martinez in 2020, but they should have been paid by the landlord under the terms of the lease agreement. Martinez paid its rent in full during 2020. A 10-year non-renewable lease was signed on January 3, 2019, for the leased building that Martinez uses in manufacturing operations. No amortization or depreciation has been recorded on any amounts related to the lease or improvements. 6. Included in selling expenses are the following costs incurred to develop a new product. Martinez hopes to establish the technical, financial, and commercial viability of this project in fiscal 2021. Salaries of two employees who spend approximately 50% of their time on research and development initiatives (this amount represents their full salary) $100,000 Materials consumed 35,000

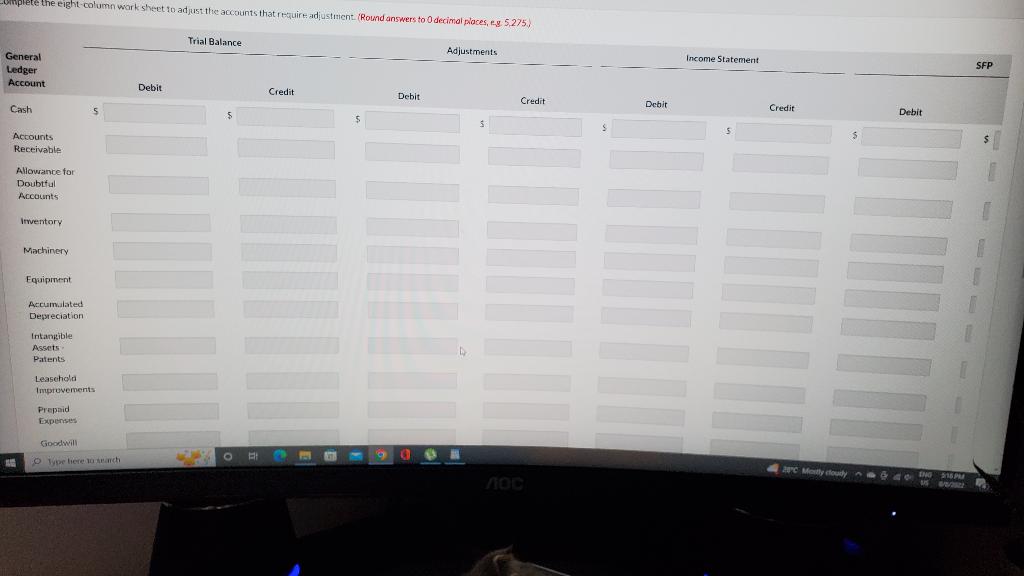

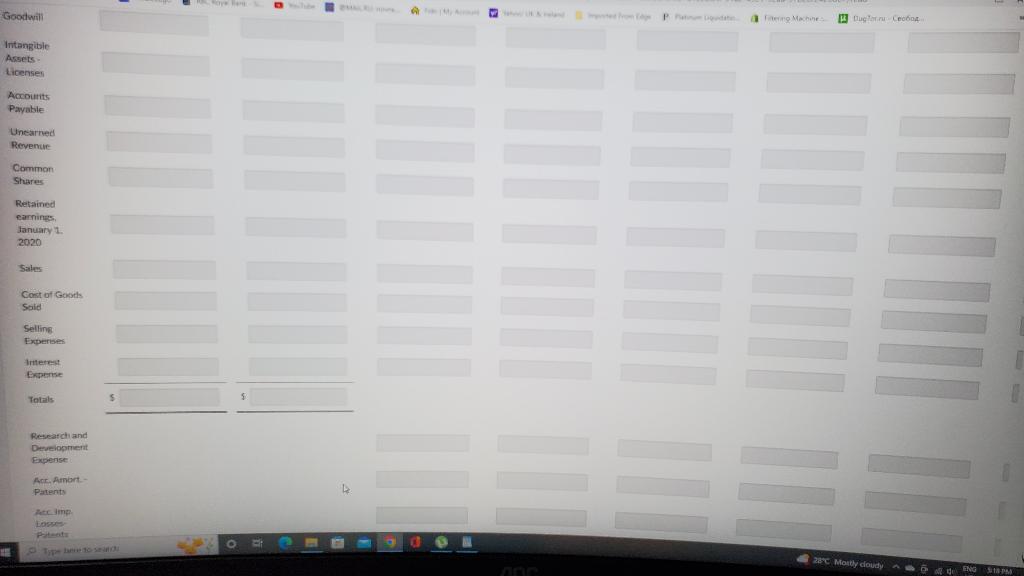

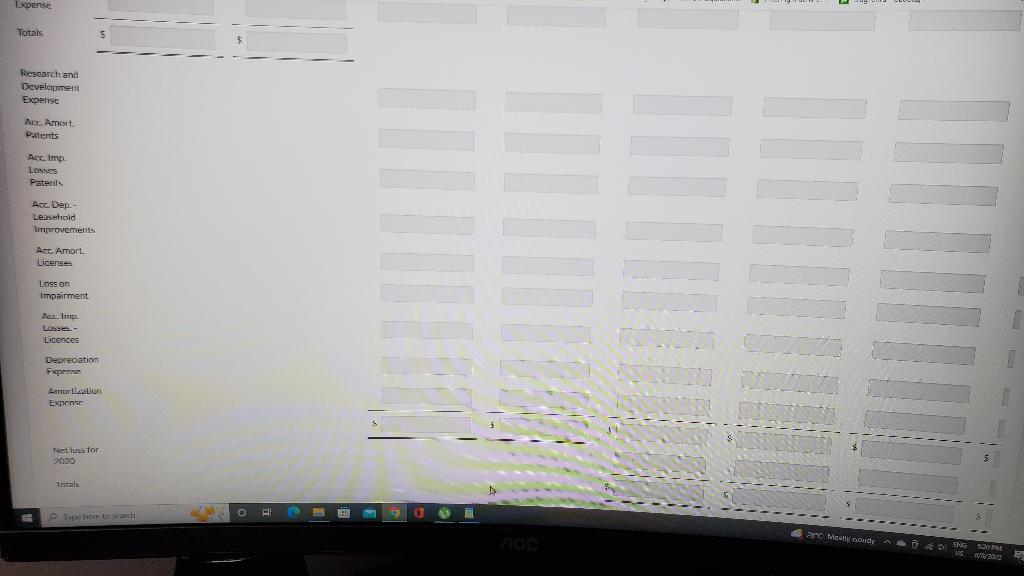

a) Complete the eight-column work sheet to adjust the accounts that require adjustment. (Round answers to 0 decimal places, e.g. 5,275.)

1)Trial Balance Adjustments

2)Income Statement

3)SFP General Ledger Account: Debit Credit Debit Credit Debit Credit Debit Credit Cash $ $ $ $ $ $ $ $

Wrwpiete the eight-column wark sheet in adjust the accounts that resuirt adjustiment. 'Round answers to 0 decimal phaces, ey. 5275 . ITtangitaln Assets - Accounts Accounts Payable Unesarned Revenue Common Shuras Retained earninges, lanuary 1. 2020 Salus Const of Geicits Sald Selling: Exiveribes Wrtterest Expense Picseat chi and Deseiosmerit Expense Ricr. Arnbrt- Paterits Rec imp? Losses: Pitsels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts