Question: please help me with a solution in excel format. many thanks!! Consider the following scenario analysis (6% overall): Scenario Boom Normal Recession Probability 0.40 0.40

please help me with a solution in excel format. many thanks!!

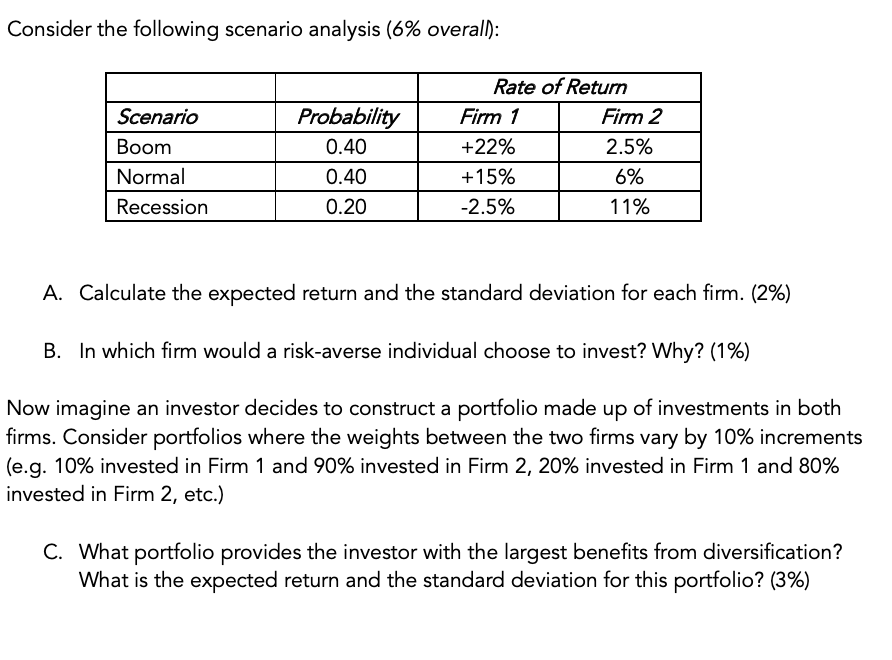

Consider the following scenario analysis (6% overall): Scenario Boom Normal Recession Probability 0.40 0.40 0.20 Rate of Return Firm 1 Firm 2 +22% 2.5% +15% 6% -2.5% 11% A. Calculate the expected return and the standard deviation for each firm. (2%) B. In which firm would a risk-averse individual choose to invest? Why? (1%) Now imagine an investor decides to construct a portfolio made up of investments in both firms. Consider portfolios where the weights between the two firms vary by 10% increments (e.g. 10% invested in Firm 1 and 90% invested in Firm 2, 20% invested in Firm 1 and 80% invested in Firm 2, etc.) C. What portfolio provides the investor with the largest benefits from diversification? What is the expected return and the standard deviation for this portfolio? (3%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts