Question: please help me with accounting..thank you A $120 temporary difference existed for the Orland Company, caused by accelerated tax depreciation on 12/31/17. The difference will

please help me with accounting..thank you

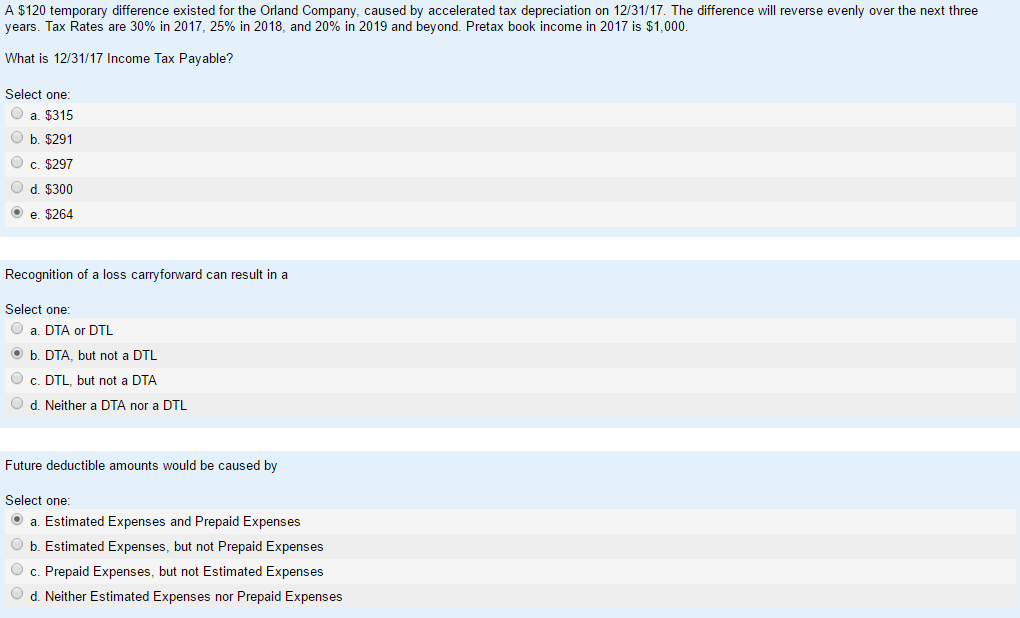

A $120 temporary difference existed for the Orland Company, caused by accelerated tax depreciation on 12/31/17. The difference will reverse evenly over the next three years. Tax Rates are 30% in 2017. 25% in 2018. and 20% in 2019 and beyond. Pretax book income in 2017 is $1,000. What is 12/31/17 Income Tax Payable? Select one: $315 $291 $297 $300 $264 Recognition of a loss carryforward can result in a Select one: DTA or DTL DTA. but not a DTL DTL, but not a DTA Neither a DTA nor a DTL Future deductible amounts would be caused by Select one: Estimated Expenses and Prepaid Expenses Estimated Expenses, but not Prepaid Expenses Prepaid Expenses, but not Estimated Expenses Neither Estimated Expenses nor Prepaid Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts