Question: please help me with all 4 problems asap 17. The new soccer stadium cost $50 (in millions) its expected cash flows are $14 per year

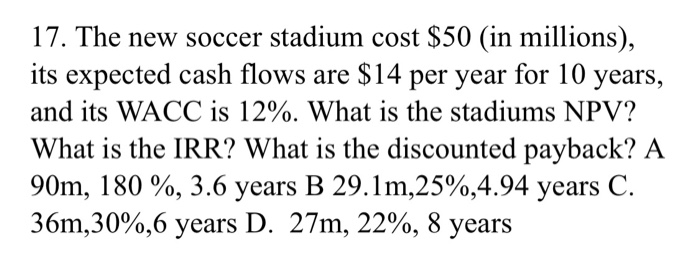

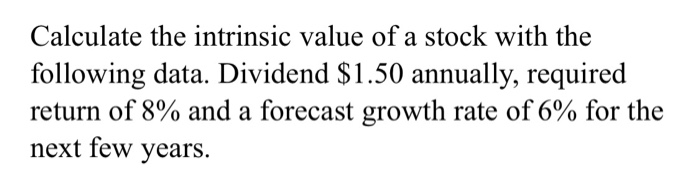

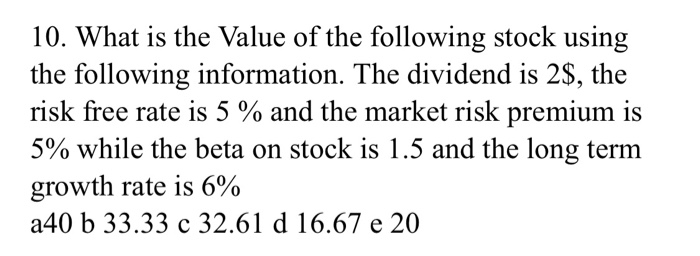

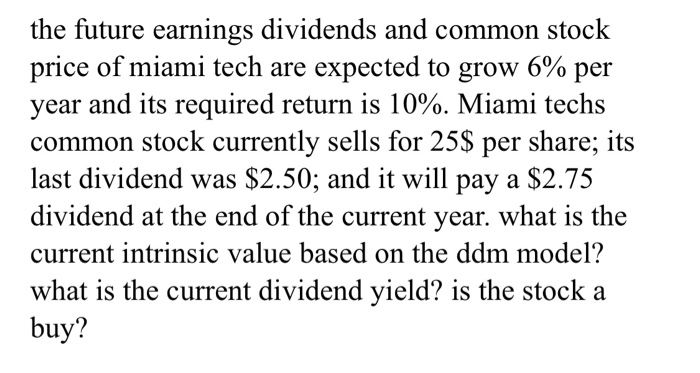

17. The new soccer stadium cost $50 (in millions) its expected cash flows are $14 per year for 10 years and its WACC is 12%. What is the stadiums NPV? What is the IRR? What is the discounted payback? A 90m, 180, 3.6 years B 29.1m,25%,4.94 years C. 36m,30%,6 years D. 27m, 22%, 8 years Calculate the intrinsic value of a stock with the following data. Dividend $1.50 annually, required return of 8% and a forecast growth rate of 6% for the next few years 10. What is the Value of the following stock using the following information. The dividend is 2$, the risk free rate is 5 % and the market risk premium is 5% while the beta on stock is 1.5 and the long term growth rate is 6% a40 b 33.33 c 32.61 d 16.67 e 20 the future earnings dividends and common stock price of miami tech are expected to grow 6% per year and its required return is 10%. Miami techs common stock currently sells for 25$ per share; its last dividend was $2.50; and it will pay a $2.75 dividend at the end of the current year. what is the current intrinsic value based on the ddm model? what is the current dividend yield? is the stock a buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts