Question: Please help me with an explanation on the right steps to come to the right conclusion. Thank you. 5. Calculating tax incidence Suppose that the

Please help me with an explanation on the right steps to come to the right conclusion.

Thank you.

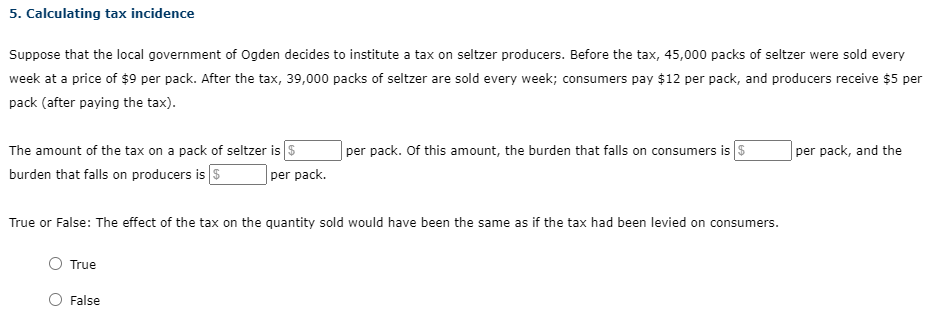

5. Calculating tax incidence Suppose that the local government of Ogden decides to institute a tax on seltzer producers. Before the tax, 45,000 packs of seltzer were sold every week at a price of $9 per pack. After the tax, 39,000 packs of seltzer are sold every week; consumers pay $12 per pack, and producers receive $5 per pack (after paying the tax). The amount of the tax on a pack of seltzer is $ per pack. Of this amount, the burden that falls on consumers is $ per pack, and the burden that falls on producers is $ per pack. True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on consumers. O True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts